The Un-Official (sales) Technology Cartel is Alive and Well

The fiscal year end is a critical time of year for both suppliers as well as technology buyers, many of whom are in the middle of 2024 budget planning as I type this. Several tech suppliers are wrapping up their fiscal year soon, and will be putting on the full court press to customers and prospects aiming to get as much revenue possible before the book closes on the year. During times of required action (renewals, new purchases, etc.) or duress (audits, M&As), we feel the pressure to get the deals done, and rarely take a step back to view the tech market as a 'federated'' whole, and how that might be impacting your business decisions. ...

Read More

Using IT Savings to Boost Productivity, Lower Costs and Mitigate Recession Risk

As discussed in some of our previous blogs, market indicators continued to show signs that a recessionary environment was on the horizon. Today, it became official wherein the U.S. recorded its second straight quarter GDP retraction. Preceding this news, were some unfortunate earnings reports coming from Fortune 100 companies (Walmart missed expectations on lowered forecasts). Firms are carrying unanticipated levels of inventory and are having to heavily discount to get rid of it, which are all harbingers of low growth, lower revenue and tighter margins. From our blog titled, “CEOs: #1 Action to Protect Your Organization from The Looming ...

Read More

NET(net) in the Private Equity Industry

Preface In 2007, NET(net) developed a program for Private Equity firms to improve the operational efficiencies of their portfolio companies by reducing IT costs with no diminution of business value. As our Private Equity partners went through the global financial crisis in 2008, they modified their approach to the capital markets, extending their holding horizons, and looked to make up the difference in missed returns with improved value (predicated on the operational efficiencies they created). No category performed as well as IT spend, and no partner performed as well as NET(net). In 2022, we see a similar situation as many of our clients ...

Read More

Like a Bad Hangover, Did You Wake Up in 2022 Budgeting Season and Wonder Where Your Money was Spent?

Like a party no one wanted to go to, the COVID pandemic dragged many IT Executives into (over) spending on technology that was not planned for. In the frenetic pace to ‘keep the lights on’, expenditures were made without the scrutiny they may have normally received pre-COVID. Supporting all the work from anywhere (WFA) initiatives including conferencing, PCs, and remote access software and hardware were all added to the mission critical initiatives already underway, like digital transformation and cloud migrations siphoning money away from those other priorities. As you start planning for your 2022 budgets, you may just now be realizing and ...

Read More

Top 10 HCM HRMS Suppliers for 2021

Introduction: The WFA (Work from Anywhere) dynamic has challenged the traditional mission of HCM professionals. With these changes come new and unique ways that HCM and HRMS providers should be engaged and negotiated with. As you read through our top 10 providers, some strategic imperatives to keep in mind: Innovation: Shifts to WFA models require rapid, nimble, innovation focused providers. Keep this in mind when researching your renewal and or new agreements. Ensure the agreement’s terms and conditions meet YOUR expectations and projected business requirements – not the providers sales and margin goals. Return of the niche providers: HCM ...

Read More

Top 4 (of 100) Technology Review Platforms for 2021

Clients often ask how we can stay on top of the market due to its constantly changing nature, and our answer is simple. We are constantly researching and analyzing the market in real-time, availing ourselves of a variety of resources. First among those is our own FMI (Federated Market Intelligence) gathered from thousands of executed deals since 2002. It’s a luxury to have that kind of data to inform Client strategy and optimization. However, we do also frequently vet our own understanding of the market by using a variety of resources, including the major Technology Review Platforms. If you can imagine, there are literally hundreds of ...

Read More

Financial Services Series: Four Ways to Find Savings and Reduce Opex Now

The IT landscape in Financial Services is changing rapidly. Regardless if they want to be industry leaders, fast followers of reactors, the ever-spreading cost base for Financial Services Companies leaves less budget available for capital investments in new technology, driving a vicious cycle of increased operating cost. In the drive to enact transformational change, Financial Services Companies should seek out the benefit from low hanging fruit to reduce current Opex. According to a PwC Global FinTech survey, 81% of CEOs are concerned about the speed of technology change, which is more than any other industry sector. Thousands of startups ...

Read More

SolarWinds Breach: Three Lessons You Need to Heed

What do the Pentagon, the U.S. State Department, The White House, the NSA, all five branches of the US military, the top ten U.S. telecommunications companies, and four hundred twenty-five of the Fortune 500 all have in common? Given the title of this article, you already have a clue, which is that they are all SolarWinds customers. Those are just some of the higher profile organizations, but in all there are 300k SolarWinds customers around the world, with about 18k identified as impacted. The impact of this breach is so far and deep, the actual repercussions will not be fully understood for years potentially. However, we don’t have to wait ...

Read More

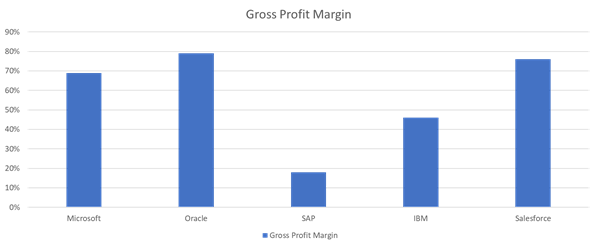

Supplier Profits and 5 Year End Sales Tactics They Use Against You

The end of year mania is underway as sales professionals from some of the largest tech companies on the planet try to capture and fill their Q4 quota. When such a substantial portion of a sales rep’s income rests on their ability to separate company dollars from your budget, it’s no wonder we often witness such unbridled aggression this time of year. It can be personally traumatic for salespeople as they sit in their weekly (sometimes daily) sales meetings with their respective teams, while management tears apart their sales opportunities and deals often in front of their peers with questions like: What is the status of deal x/update on ...

Read More

Look that Gift Horse in the Mouth

Things are moving fast in these challenging times as both individuals and companies struggle to keep up with changing demands and plan for an uncertain financial future. In response, we are already starting to see many clients (a) put most major technology spending projects on hold and (b) look closely at supplier contracts (almost none of which contemplate a reality such as the one we are facing today). As a result of a confluence of these and other factors, we are seeing an unprecedented level of activity in renegotiating technology supplier contracts, including but not limited to: The force majeure clause in most agreements Government ...

Read More