Preface

Nearly all clients are seeking greater prosperity in 2024.

- While client organizations are still focused on cost reductions to meet the challenges of their new economic and market realities, the pent-up demands of the business are increasingly calling for innovation, automation, and organizational performance improvement. We foresee a volatile and unpredictable business landscape predicated on geopolitical tensions, economic uncertainty, and continued supply chain disruptions as client organizations continue to diversify their technology supply chains, but digital transformation continues to be an investment area.

- Digital Transformation is the #1 Way to Boost Performance and Savings concurrently. Client organizations that are digitally transforming are: unlocking data insights for better organizational decision-making, automating tasks to streamline efficiencies, and are empowering flexible cloud solutions for more cost-effective scaling. This ultimately drives greater innovation, improved organizational performance, and significant cost savings ranging from 25-30% (depending on industry, scope of transformation, maturity of transformation, and the methodology and execution).

- NET(net) is the #1 IT Cost and Value Optimization Provider. In the last 21 years, NET(net) has shaped over $2 Trillion of investment, captured well over $400 Billion of incremental value for our clients and partners, and has an 85% probability of helping you save between 13-53% on your existing costs. Our performance numbers are simply unmatched.

Introduction

In this blog, we will discuss how client organizations are increasingly investing in Procure to Pay (P2P) solutions with a strong capability for AP Automation solutions including those for invoice and payment processing.

AP Automation, or accounts payable automation, is like having a super-efficient digital assistant that helps your company manage all the tasks related to processing invoices, paying bills, and managing your suppliers. Imagine you have a stack of invoices on your desk, all waiting to be processed and paid. With AP Automation, that digital assistant would read each invoice, check that all the details are correct, and then automatically pay the suppliers. AP Automation can also help you keep track of all your expenses and payments, so you always know exactly where your money is going. It further provides you with a well-organized filing system for all your financial documents. The best part? AP Automation saves you a lot of time and effort, so you and your team can focus on other important things, like coming up with new ideas to help grow your business.

Accounts Payable (AP) automation is rapidly gaining traction as a strategic imperative for enterprises seeking to streamline operations, reduce costs, and enhance overall financial performance. By leveraging AP Automation software, businesses can automate repetitive and time-consuming tasks such as invoice processing, payment approvals, and supplier management. This not only reduces the burden on finance teams but also minimizes the risk of human errors and ensures compliance with financial regulations. Moreover, AP Automation provides real-time visibility into financial data, enabling enterprises to make informed decisions, optimize cash flow, and strengthen supplier relationships. The benefits of AP Automation are undeniable, and forward-thinking enterprises are embracing these technologies to gain a competitive edge and drive further organizational success.

Why Enterprises Are Automating AP

Accounts payable (AP) is a critical function for any enterprise. It involves the management of payments to suppliers, and it can be a time-consuming and error-prone process. As a result, many enterprises are turning to automation to streamline their AP operations.

There are many benefits to automating AP, including:

- Reduced Costs: AP Automation can help enterprises reduce costs by eliminating the need for manual data entry and processing. This can free-up employees to focus on other tasks that add more value to the business.

- Improved Accuracy: AP Automation can help enterprises improve accuracy by eliminating human error. This can lead to fewer late payments, disputes, and chargebacks.

- Increased Efficiency: AP Automation can help enterprises increase efficiency by streamlining the AP process. This can lead to faster payments, improved cash flow, and better customer service.

- Enhanced Control: AP Automation can help enterprises enhance control over their AP operations. This can help to prevent fraud, waste, and abuse.

- Improved Scalability: AP Automation can help enterprises scale their AP operations to meet the demands of growth. This can be especially important for enterprises that are expanding rapidly.

- Improved Cash Flow: AP Automation can help enterprises improve cash flows by automating payments and taking full advantage of payment terms, including early payment discounts.

If you are an enterprise that is considering automating your AP operations, there are a few things you should keep in mind. First, you need to assess your current AP process and identify the areas that are most in need of improvement. Next, you need to select an AP automation solution that is right for your business. Finally, you need to implement the AP automation solution and train your employees on how to use it.

By automating your AP operations, you can reap several benefits, including reduced costs, improved accuracy, increased efficiency, enhanced control, and improved scalability.

Top 6 AP Automation Suppliers

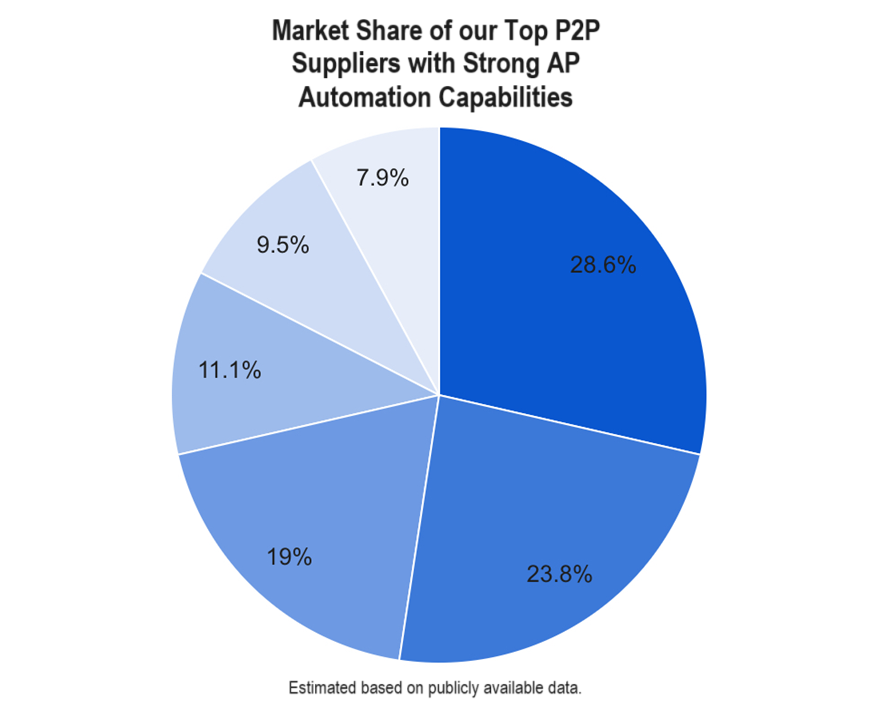

There are a number of different AP automation suppliers in the market, each with its own unique strengths and weaknesses. Here are the top 5 AP automation suppliers, according to market share:

Market Share Leaders

- Coupa: Coupa offers a comprehensive suite of AP Automation tools, including invoice processing, payment processing, and supplier management. Coupa has a market share of 28.6%.

- SAP Ariba: SAP offers a comprehensive suite of AP Automation tools, including invoice processing, payment processing, and supplier management. SAP Ariba has a market share of 23.8%.

- Oracle: Oracle offers a comprehensive suite of AP automation tools, including invoice processing, payment processing, and supplier management. Oracle has a market share of 19%.

Strong Players

- Jaggaer: Jaggaer offers a comprehensive suite of AP automation tools, including invoice processing, payment processing, and supplier management. Jaggaer has a market share of 11.1%.

- Ivalua: Ivalua offers a comprehensive suite of AP automation tools, including invoice processing, payment processing, and supplier management. Ivalua has a market share of 9.5%.

Challengers

- Basware: Basware offers a comprehensive suite of AP Automation tools, including invoice processing, payment processing, and supplier management. Basware has a market share of 7.9%.

These are just a few of the top AP automation suppliers on the market. There are several other suppliers that offer AP automation solutions, so it is important to do your research and compare different solutions before making a decision.

Reliable Sources for Market Share Insights:

- Gartner Magic Quadrant for Procure-to-Pay Suites

- IDC MarketScape: Cloud-Enabled P2P Procurement Platform - Worldwide 2023 Vendor Assessment

- SpendEdge - Procure-to-Pay (P2P) Software Market - Top Vendor Shares by Region (2023)

- Everest Group - PEAK Matrix Report 2023: Procure-to-Pay (P2P) Solutions

Here are the strengths and weaknesses and key differentiators of each of the top 6 AP Automation suppliers:

1. Coupa

Strengths:

- Cloud-native platform: Flexible and scalable cloud-based architecture for easy deployment and updates.

- User-friendly interface: Intuitive and user-friendly interface for smooth adoption and training.

- Strong automation capabilities: Comprehensive automation across the invoice lifecycle for efficiency gains.

Weaknesses:

- Limited industry expertise: Less focus on specific industry needs compared to some competitors.

- Cost: Subscription-based pricing can be expensive for large enterprises with extensive needs.

- Limited customization: Customization options might be limited compared to on-premise solutions.

Differentiation:

- Cloud-native platform, user-friendly interface, and strong automation capabilities.

2. SAP Ariba:

Strengths:

- Global reach and industry expertise: Strong presence in large enterprises across various industries.

- AI-powered automation: Advanced features like AI-powered invoice matching and data extraction.

- Deep integration with SAP ecosystem: Seamless integration with other SAP solutions for end-to-end visibility.

Weaknesses:

- Cost: Higher pricing compared to some competitors.

- Complexity: Can be complex to implement and manage for smaller businesses.

- Limited flexibility: Customization options might be restricted compared to some cloud-native solutions.

Differentiation:

- Deep industry expertise, AI-powered capabilities, and tight integration with the SAP ecosystem.

3. Oracle Procurement Cloud:

Strengths:

- Competitive pricing: More affordable option for mid-size businesses compared to SAP Ariba.

- Seamless integration with Oracle ERP: Tight integration with other Oracle solutions for streamlined workflows.

- Real-time reporting and analytics: Robust reporting and analytics capabilities for better decision-making.

Weaknesses:

- Limited industry expertise: Less industry-specific functionality compared to some competitors.

- Slower innovation: May lag behind pure cloud players in terms of innovation and agility.

- Complexity: On-premise deployments can be complex and require technical expertise.

Differentiation:

- Competitive pricing, tight integration with Oracle ecosystem, and real-time reporting capabilities.

4. Jaggaer:

Strengths:

- Network-based approach: Strong focus on supplier collaboration and community through the "JAGGAER ONE" platform.

- Open and extensible architecture: Easier integration with existing systems and future technologies.

- Industry expertise: Tailored solutions for specific industries like healthcare and manufacturing.

Weaknesses:

- Market share: Smaller market share compared to Coupa and SAP Ariba.

- Learning curve: User reviews sometimes mention a steeper learning curve compared to some competitors.

- Cost: Can be expensive for large enterprises with complex needs.

Differentiation:

- Network-based approach, open architecture, and industry expertise.

5. Ivalua:

Strengths:

- Comprehensive functionality: Wide range of functionalities beyond AP automation, encompassing sourcing, contract management, and spend analytics.

- Strong analyst recognition: Consistently recognized as a leader in Gartner Magic Quadrant for P2P suites.

- Deep spend analytics: Robust spend analytics capabilities for strategic decision-making.

Weaknesses:

- Cost: Higher pricing compared to some competitors, especially for complex functionalities.

- Complexity: Can be complex to implement and manage for smaller businesses.

- Target audience: More focused on large enterprises with complex needs.

Differentiation:

- Comprehensive functionality, strong analyst recognition, and deep spend analytics.

6. Basware:

Strengths:

- Cost-effectiveness: Competitive pricing model, especially for mid-size businesses.

- Ease of use: User-friendly interface and intuitive design for quick adoption.

- Streamlined invoice capture: Efficient data capture and processing capabilities for faster invoice cycles.

Weaknesses:

- Limited functionality: Primarily focused on AP automation with fewer broader P2P features compared to some competitors.

- Market share: Smaller market share compared to Coupa and SAP Ariba.

- Limited industry expertise: Less focus on specific industry needs compared to some competitors.

Differentiation:

- Cost-effectiveness, ease of use, and streamlined invoice capture.

It is important to note that these are just general strengths and weaknesses. The specific strengths and weaknesses of each supplier will vary depending on your specific needs and requirements. Ultimately, the best AP Automation solution for an enterprise will depend on its specific needs and requirements.

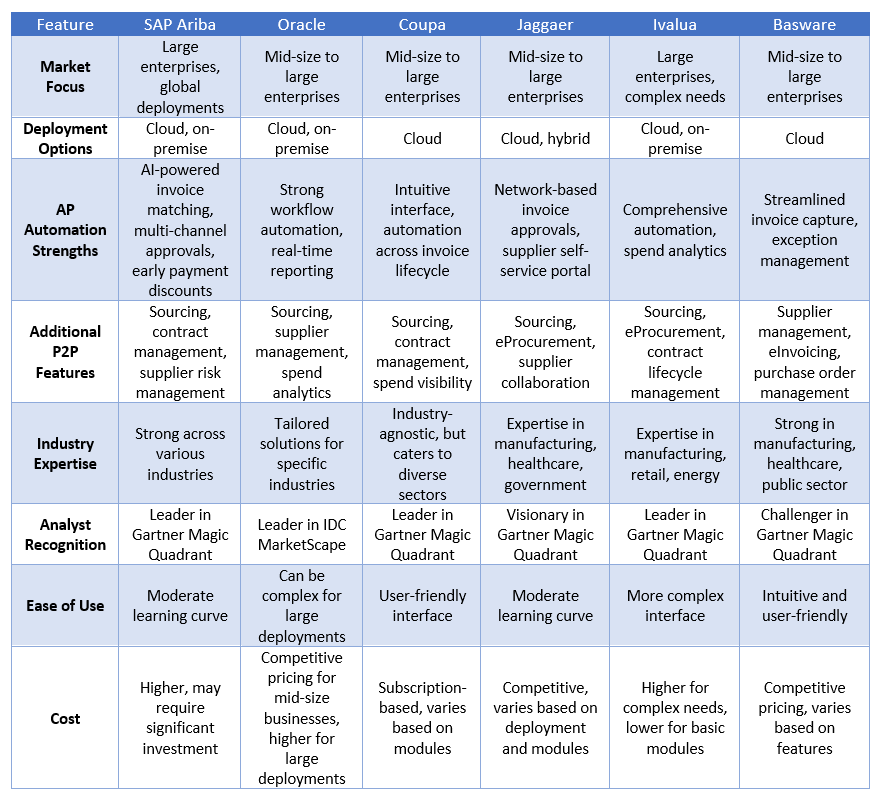

Feature Analysis of the Top 6 AP Automation Capable P2P Suppliers

Here's a comparative analysis of SAP, Ariba, Oracle, Coupa, Jaggaer, Ivalua, and Basware, focusing on key features and AP Automation capabilities:

This is just a general overview of the features and pricing of the top 6 AP Automation suppliers. The specific features and pricing of each supplier will vary depending on your specific needs and requirements.

Client Case Study: Reduce Costs and Boosts Efficiency with P2P Automation

A manufacturer of consumer goods with over 5,000 employees globally, struggled with a manual and paper-based accounts payable (AP) process. This led to inefficiencies, high processing costs, and poor visibility into spending. To address these challenges, this client organization implemented a P2P automation solution with a strong focus on AP automation.

Challenges Faced:

- Manual and paper-based process: Invoices were processed manually, leading to errors, delays, and high touchpoints.

- Limited visibility into spending: Lack of real-time data hindered informed decision-making about procurement and cash flow.

- High processing costs: Manual data entry and approvals contributed to unnecessary operational expenses.

- Slow invoice cycles: Delayed payments impacted supplier relationships and potential early payment discounts.

Solution:

Implementing a cloud-based P2P solution that offered comprehensive AP automation features, including:

- Electronic invoice capture and processing: Automated data extraction and validation for streamlined invoice processing including header and line level details

- Workflow automation: Automated approvals and routing for faster invoice turnaround times.

- Real-time reporting and analytics: Granular insights into spending patterns and supplier performance.

- Early payment discounts: Ability to leverage early payment discounts for improved cash flow.

Business Benefits:

- Reduced processing costs: Client estimates a 30% reduction in AP processing costs due to automation.

- Improved efficiency: Invoice processing time decreased by 50%, freeing up staff for more strategic tasks.

- Enhanced visibility: Real-time data allows for better spend management and decision-making.

- Faster payments: Faster invoice cycles improved supplier relationships and unlocked early payment discounts.

- Increased accuracy: Automated data entry minimized errors and improved data quality.

Additional Details:

- Client chose a cloud-based solution for its scalability, ease of deployment, and lower upfront costs.

- Solution had a single metric for ease of management and providing cost predictability

- Having an AP Automation solution linked to P2P solution will allow for better cost allocation internally and linking to Purchase order references.

- The implementation process was smooth, with minimal disruption to daily operations.

- User training was provided to ensure employees could effectively utilize the new system.

- Regular monitoring and data analysis helped Client measure the impact of the solution and identify further optimization opportunities.

Lessons Learned:

- Investing in P2P automation can significantly improve efficiency, reduce costs, and enhance visibility into spending.

- Choosing the right solution with strong AP automation capabilities is crucial for success.

- User training and change management are essential for ensuring user adoption and maximizing the benefits.

- Continuous monitoring and data analysis are key to optimizing the solution and achieving long-term value.

- Contracts Terms can facilitate customer journey and support fluctuating volumes over contract term.

- Providers have different SLA tiering and depending on Size of Business and criticality to the business Client should find their relevant SLA Tier.

Conclusion:

By implementing a P2P solution with a focus on AP automation, this client organization successfully addressed its challenges and achieved significant business benefits. This case study demonstrates the potential of P2P automation to transform procurement processes, improve organizational performance, and create a competitive advantage.

Market Research Sources on AP Automation

Gartner: A leading research and advisory firm offering in-depth reports and insights on AP automation trends, vendors, and market forecasts.- Link: https://www.gartner.com/en/documents/4003684

- Specific Article: "Predicts 2023: Accounts Payable Automation" https://www.gartner.com/reviews/market/accounts-payable-invoice-automation-solutions/vendor/rillion/product/ap-automation/alternatives

- Link: https://www.forrester.com/

- Specific Article: "The Forrester Wave™: Procure-to-Pay Suites, Q3 2022"https://www.coupa.com/resources/analyst-reports/Forrester/2022/SVM

- Link: https://www.aberdeen.com/

- Specific Article: "Accounts Payable Automation: The Path to Frictionless Finance" https://www.aberdeen.com/blogposts/managing-your-supply-chain-with-ap-automation/

- Link: https://www.paystream.co.uk/contact/

- Specific Article: "AP Automation Maturity Model: Assessing Your Progress" https://instreamllc.com/wp-content/uploads/2019/10/InStream-AP-Automation-Info-Sheet-RevB.pdf

- Link: https://spendmatters.com/

- Specific Article: "AP Automation Vendor Comparison: Coupa vs. Basware vs. Tradeshift" https://spendmatters.com/2022/12/07/coupa-vs-basware-ap-automation-head-to-head-technology-evaluation-and-comparison/

- Link: https://www.pymnts.com/about/

- Specific Article: "How AP Automation Is Streamlining B2B Payments" (https://www.pymnts.com/study/solving-accounts-payables-frictions-with-automation-technology/

- Link: https://www.techvalidate.com/vendor-research

- Specific Search: Search for reviews of your chosen vendors (e.g., "SAP Ariba reviews")

- Examples: Supply & Demand Chain Executive, CFO Magazine, Journal of Accountancy

Webinars and Events: Attend industry webinars and conferences to hear from experts and gain insights into the latest AP automation trends.

- Examples: ProcureTech Virtual Summit, Institute of Finance & Management (IFM) AP & Automation Summit

Remember, these are just a few starting points. It's important to tailor your research to your specific needs and interests.

Conclusion

Enterprises are increasingly choosing to tech-enable their AP operations to reduce costs, improve accuracy, increase efficiency, enhance control, and improve scalability. By automating AP, enterprises can free up employees to focus on other tasks that add more value to the business.

If you are an enterprise that is considering automating your AP operations, NET(net) can help you minimize cost and value and maximize the realization of value and benefit. We have a team of experienced professionals who can help you assess your current AP process, select the right AP automation solution for your business, and implement the solution successfully.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get, and keep more economic and strategic value in their technology supply chains. Over the last 20 years, NET(net) has influenced trillions of investment, captured hundreds of billions of value, and has helped clients cost and value optimize all major areas of IT Spend, including XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, and Telecommunications, among others. NET(net) has the experience you want, demonstrates the expertise that you need, and delivers the performance you demand and deserve. Contact us at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1 (616) 546-3100 to see if we can help you capture more value in your IT investments, agreements, deployments, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms, offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.