BREAKING: The Mainframe is not dead. While smaller companies continue to get off the mainframe, it’s still too soon to write an obituary, as mid-sized businesses grew mainframe consumption from 5 to 15% and large enterprises grew from 15 to 20% in 2021. Recent analyst reports suggest that as much as half of the world’s information is still processed on the mainframe. The mainframe was a $2.3 Billion Industry in 2021, is expected to increase another 8% in 2022, and is projected to grow at a 3.2% CAGR from 2021-2029.

Major hardware, software, and services companies that stand to benefit from this decade of mainframe market growth include Atos, BMC, CA, Cognizant, Dell, DXC, Fujitsu, HCL, Hitachi, Infosys, Kyndryl, IBM, Unisys, Wipro, and others. See related articles:

- Top 10 India-Based IT Services Companies for 2022

- Time to Defuse Your Kyndryl Deal BEFORE it Detonates

Six Major Industries Still Use Mainframes Extensively:

- Banking

- Retail

- Insurance

- Healthcare

- Government

- Travel and Transportation

Mainframes continue to play a pivotal role in client data processing needs in these six major industries but also remain prevalent in the Utilities and Telecom industries as well as any industry that needs high security and/or is transaction-intensive.

Mainframe Resilience in face of Onslaught. Despite record levels of digital transformation initiatives, workload migrations to the cloud, and enterprise modernization efforts, the mainframe market remains enormous, and mainframe dependency in the top industries remains intact with impressive market share and dominance. Cloud providers such as AWS, Azure, and Google all have mainframe migration programs, and customers continue to make headway with digital transformation efforts designed to migrate workloads to the cloud. As a result, while IBM is certainly suffering from a diminishing role in the modern enterprise, mainframes are still gainfully employed at:

- All 10 of the world’s largest insurers

- 92 of the world’s top 100 banks

- 90% of all credit card transactions are processed on mainframes

- 18 of the top 25 retailers

- 70% of the Fortune 500

- 68% of the world’s production IT workloads

IBM z-Series Mainframes (“z” stands for zero-downtime) are currently on version z15, which is based on the z15 chip and was introduced on September 12, 2019. IBM has previously advised that the z16 will come out in ‘early 2022’ based on the Power10 chips with fat cores (meaning 8 threads per core and 15 cores per chip) which became generally available in September 2021. With recent supply chain issues, the exact release date remains unclear. IBM’s z15 mainframe If you are a company that needs to process billions of ultra-secure business-critical transactions, the mainframe is likely still a vital part of your business landscape.

IBM’s latest mainframe (the z15) packs up to 190 configurable cores (up from 170 in the previous generation), can be upgraded to 40TB of memory (that’s 40,000 GB for those of you who are scoring at home), and can survive a massive earthquake without missing a beat. Capable of handling up to 1 trillion secure web transactions per day on a single system, its processing power is equivalent to running 2.4 million containers. Those touting the death of the mainframe will find this easier said than done on a rack of commodity servers. Although plenty of customers are trying as they seek to avoid huge legacy costs and onerous licensing terms, as well as retiring old hardware, and migrating to hybrid cloud environments where they can rely on lower cost and plentiful resources versus a critical shortage of expensive COBOL experts.

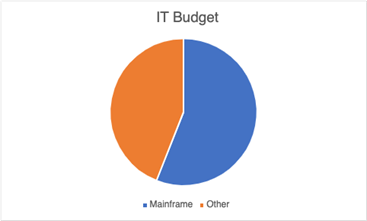

Mainframes are Budget Hogs. For our clients in those 6 major industries with mainframes, they know how all-consuming these monoliths can be with an average of 56% of IT budgets being consumed by mainframes, the systems that support them, the software that runs on them, and the people who program and operate them. The median mainframe programmer salary is $76,282 according to PayScale, which is $11,806 higher than the median salary for computer programmers in general.

When it comes to software, most people can only name a small handful of suppliers and do not realize that there are 576 Independent Software Vendors (ISVs) that have developed software for the mainframe:

- 324 of them still have software that runs in active mainframe environments

- 252 of them have either gone out of business or have since been acquired

March is a big time of the year for ISVs in the Mainframe space, as suppliers such as CA, BMC, and Compuware all have fiscal-year ends in March. This creates some added market activity around this time of the year where many of those renewals come due, which has also created a big month for replacement opportunities for the likes of IBM and others who seek to continue to capture market share by taking it from their competitors.

Executive Summary

The combination of proprietary operating environments and no real alternative systems leads to monopolistic processing control, and the predatory pricing behavior of the mainframe oligarchs generally results in an extremely expensive situation for those customers who seemingly have no way out. However, we can help you escape from the mainframe cost albatross, and it is easier than you think, so take the first step and contact us today!

- Mainframe Costs are Exorbitant Compared to Cloud. Mainframes cost as much as 4,500% more to operate than equivalent Cloud solutions. This figure is compounded by a scarcity of development resources and rising licensing and maintenance fees for ancillary mainframe utilities, applications, and databases.

- Getting Off the Mainframe. Most clients do not realize that migrating mainframe batch workloads requires no refactoring. Clients can “lift and shift” COBOL batch processing workloads (along with the JCL) and move them to (for example) an EC2 instance on AWS. This process is easy and can be done with low risk. Clients can also migrate OLTP environments (such as CICS) to the cloud, and while they can scale those instances vertically, they can also direct the user interface to an elastic load balancer with multiple EC2 instances to offer a performance-centric solution that minimizes the risk of any processing bottlenecks. Depending on the nature of transaction volumes and peak loads, clients not only see significant cost savings, but they can also see improved performance and throughput. This methodology also enables clients to easily eliminate those additional instances when not needed during off-peak processing times, saving them huge money in the process. In addition to COBOL and CICS, relational databases such as DB2 also port nicely to RDS - and even hierarchical databases such as IMS/DB can be normalized (with some minor code changes). Even the security protocols of RACF have simple migrations to tools as commonplace as Active Directory.

- Third-Party Products. The best way to save money on CA, BMC, ASG, and others is to get off their products. Comparable products such as job schedulers run in the cloud in the same way they run on a mainframe, but for a tiny fraction of the cost.

- Staying on the Mainframe. Most clients who chose to stay on the mainframe can work to reduce their MIPS footprint to achieve significant savings. Carefully evaluate third-party contracts in this case, which generally do not allow for MIPS reductions during the terms of these agreements, so clients will often plan these moves strategically to coincide with contract expirations.

- MIPS Usage. In conjunction with a cloud migration strategy, where applications and workloads are moved to the cloud, the resulting processing capacity reductions will generally reduce your costs, but not linearly, as certain volume incentives may be lost in the process. Still, it is very much worth the exercise to find out how much you can save.

- How Much Can You Save? We have seen clients with exotic use cases save 80-90% in mainframe operating expense, but 50-60% savings achievement is more common with a standard technology stack. Bottom line, significant savings can be achieved by migrating workloads and applications off your mainframe and onto lower-cost platforms. If you want to learn more about how our large Mainframe clients are transforming into Modern Enterprises that run in the cloud check out our 8-minute video here.

Top 20 Mainframe Software Suppliers

In our objective, evidence-based analysis of the Top 20 Mainframe Software suppliers, we looked first at the number of Supported Products, and in the case where there was a tie, we looked next at the number of Active Products, and in the case of a tie on the number of Active Products, we then looked at the number of Inactive Products. In the case of a tie on all three metrics, we then looked at the operating environments, giving the nod to those who had offerings in more current platforms.

- IBM - World’s largest mainframe computer company based in Armonk, New York. Markets computer hardware, software, outsourcing, and services. Formed in 1911. 24 Acquisitions and 6 Company Consolidations (Access360, Accessible Software, Ascential [Ardent, Mercator, Vality Technology], Candle Corporation [IOSOFT Systems, Netserv, PowerQ], CGI Informatique, CIMS Labs, Consul Risk Management International, CrossAccess Corporation, CSL International, Curam Software, Cyanea Systems, DataMirror, Early, Cloud & Company, Exeros, Guardium, ILOG, Isogon, Lotus Development Corporation, Platform Solutions, Princeton Softech, Softech Solutions, SPSS Inc, Sterling Commerce Inc, Unison Software). 94 Supported Products. 282 Active Products. 252 Inactive Products.

- CA - From humble beginnings selling the mainframe sort program CA Sort, CA has become one of the largest mainframe software vendors in the world. Created by Charles Wang and Russ Artz in 1976, CA today is a multinational company marketing software for many different platforms, as well as its traditional mainframe base. 19 Acquisitions and 32 Company Consolidations (Applied Data Research [Insyte Datacom], Arkay Computer Inc, CAPEX Corporation, CGA [Allen Services Company], Computer and Data Management Services Inc, Cullinet, Cybermation, Innovative Designs, Johnson Systems Inc, Legent [Business Software Technology, CMA Software, Duquesne Systems, Goal Systems {Bennett Software, MVS Software, Tower Systems}, Morino Associates Inc, Spectrum Concepts], MAX Software, On-Line Software International, Pansophic Systems [Christensen Systems, Software Generation Technology Group), Platinum Technology [Altai, AutoSystems Corporation, BMS Computer Systems, Softool Corporation, SQL Tools Inc, TransCentury Data Systems, Trinzic Corporation], Sterling Software [Dylakor Inc, Informatics, Interlink Computer Sciences {Advanced Computer Communications, New Era Systems Services}, Software Module Marketing Inc, Systems Center Inc {Software Developments International}, Texas Instruments Software], Uccel Corporation [Cambridge Systems Group, SKK Inc], Value Software Inc, Wily Technology, zIT Consulting). 34 Supported Products. 183 Active Products. 66 Inactive Products. Acquired by Broadcom in 2018 for US$18 billion.

- Allen Systems Group (ASG) - Naples, Florida-based company. Founded in 1986 by Arthur Allen. First product marketed was the IDMS monitoring product ShopMon, now ASG Pre-Alert. Acquired by Rocket Software in 2021. 14 Acquisitions (Diversified Software Systems, Emprise Technologies, Entact Information Security, Firesign Computer Company, Impact Software Technologies, Landmark Systems, Manager Software Products, Mobius Management Systems, Network Software Associates, PERFMAN, Sisro, Soamai Software, TRILOGExpert, Viasoft). 19 Supported Products. 64 Active Products. 3 Inactive Products. Acquired by Rocket Software in 2021.

- BMC - Houston, Texas-based multinational software company. Founded in 1980. The name BMC is from the surname of the three founders: Scott Boulette, John Moores, and Dan Cloer. From the 1990s, has acquired many other computer software firms, the largest being Boole and Babbage in 1998. Today, BMC is one of the largest mainframe software companies worldwide. Total revenues in 2012 were $2.2 billion. 7 Acquisitions and 2 Company Consolidations (BGS Systems, Boole and Babbage [Empact], CDB Software, I/O Concepts, Integrity Solutions, MQSoftware [Reconda International], New Dimension Software). 17 Supported Products. 96 Active Products. 57 Inactive Products.

- Rocket Software - Boston, Massachusetts-based software company formed in 1990. Initially focused on DB2 software for IBM mainframes. Within five years, Rocket sold these products to IBM. Rocket continues to develop and market software for IBM mainframes but has expanded to other platforms. Rocket has also undergone a series of acquisitions to expand its market. 7 Acquisitions and 3 Company Consolidations (ASTRAC, Computer Corporation of America, Mainstar Software Corporation, SEAGULL Software [BlueZone, Farabi Technology, SofTouch Systems], Sirius Software, Zephyr Development Corporation). 10 Supported Products. 76 Active Products. 57 Inactive Products.

- Precisely - New Jersey-based company founded in 1968. Made famous for their Syncsort (now Elevate MFSort) sorting software that, at the time, outperformed all other mainframe sorting solutions. Syncsort has been released on other platforms including UNIX and Windows. Acquired software and data business of Pitney Bowes in 2019. Renamed to Precisely in May 2020. 6 Acquisitions and 2 Consolidated Companies (Circle Computer Group, Cogito, EView Technology, Metron, Pitney Bowes [Emtex, Group1], William Data Systems). 10 Supported Products. 15 Active Products. 0 Inactive Products.

- Beta Systems - Berlin, Germany-based software company. Formed in 1983 by Alfred H. Tauchnitz, William P. Schmidt, and James Henderson. 4 Acquisitions and 1 Consolidated Company (Harbor Systems Management, Pecan Software, Software Innovation, Systor Security Solutions [Shumann Security Solutions]). 8 Supported Products. 15 Active Products. 5 Inactive Products.

- Software AG - Darmstadt, Germany-based software development company formed in 1969. First product, ADABAS, was released in 1971. In 2011, total revenue was around €1.1 billion, with more than 5,500 employees. 3 Acquisitions (Sabratec, Webmethods, Zementis). 5 Supported Products. 44 Active Products. 2 Inactive Products.

- Levi, Ray & Shoup - Springfield, Illinois-based software company formed in 1979 by Richard Levi, Roger Ray, and Bob Shoup as a computer consulting company. LRS released its first product VPS (which routed JES output to VTAM/SNA connected printers) in 1981. 2 Supported Products. 20 Active Products. 0 Inactive Products.

- MacKinney Systems - Springfield, Missouri-based software development company formed in 1980 specializing in v/VSE, z/OS, and CICS software. 1 Supported Product. 49 Active Products. 5 Inactive Products.

- CSI International - Williamsport, Ohio-based mainframe software company formed in 1995. Original product was a TCP/IP product for z/VSE. Markets z/OS and z/VSE software. 1 Acquisition (B.I. Moyle and Associates). 1 Supported Product. 30 Active Products. 0 Inactive Products.

- Innovation Data Processing - Little Falls, New Jersey-based software company founded in 1972. Known for the mainframe data movement product Fast Dump Restore (FDR) which was a utility to backup and restore disks and datasets first released in 1972. 1 Supported Product. 24 Active Products. 0 Inactive Products. Innovation Data Processing was acquired by Compuware in 2020, and Compuware was acquired by BMC later that same year.

- Compuware - Detroit, Michigan-based multinational software corporation. Formed in 1973 by Peter Karmanos, Thomas Thewes, and Allen Cutting. First software product was Abend-Aid (mainframe debugging tool), was released in 1977. 4 Acquisitions (ISPW BenchMark Technologies, MVS Solutions, Programart, Standardware). 1 Supported Product. 17 Active Products. 1 Inactive Product. Acquired by BMC in 2020.

- UNICOM Systems - Los Angeles, California-based information technology company providing software, hardware, services, education, and outsourcing. Formed by Corry Hong in 1981. First product developed, AUTOMON/CICS, was announced in 1985. 2 Acquisitions and 1 Consolidated Company (Illustro Systems International, Macro4 [INSYNCH]). 0 Supported Products. 38 Active Products. 3 Inactive Products.

- SDS - Spring Lake Park, Minnesota-based software development company formed in 1982. Specializes in z/OS, z/VM, and z/VSE software. 0 Supported Products. 30 Active Products. 1 Inactive Product.

- GSF Software - US Based software development and consulting company, formed by Gilbert Saint-Flour in the 1990s. 0 Supported Products. 30 Active Products. 0 Inactive Products.

- Relational Architects International - Hoboken, New Jersey-based software development company founded in 1987 specializing in z/OS and DB2 software. 0 Supported Products. 20 Active Products. 0 Inactive Products.

- Software Engineering of America - New York-based software development company formed by Salvatore Simeone in 1982. Specializes in mainframe and IBM System I (AS/400) solutions. 0 Supported Products. 20 Active Products. 0 Inactive Products.

- ASPG - Naples, Florida-based software development company founded in 1986. 0 Supported Products. 18 Active Products. 0 Inactive Products.

- CDB Software - Houston, Texas-based software development company specializing in software for DB2 on z/OS. Formed in 1985 by Richard Barry. Several of its products were previously acquired by Candle Corporation in 1990 including DB2 DB/DASD and DB2 DB/EXPLAIN. Candle had previously acquired IOSOFT Systems, Netserv and PowerQ, and was of course itself acquired by IBM in 2004, at which time it had 3000 customers in 50 countries, including 83% of the Fortune 100. 0 Supported Products. 16 Active Products. 0 Inactive Products. Assets acquired by BMC in 2015.

Next 22 Mainframe Software Suppliers - Depending on your environment (whether z/OS, z/VM, or z/VSE), you may also want to review agreements, investments, and relationships with the following companies to see if there are opportunities to reduce cost, improve value, and/or consolidate suppliers:

- 21st Century Software

- Applied Computing Technology

- Attachmate

- Aviva Solutions

- B.O.S. Software Service

- Barnard Software

- CLEO Communications

- CQ Communication Software

- Data 21

- Esker

- Lattwein

- MPI Tech

- Phoenix Software

- Redvers Consulting

- Select Business Solutions

- Semantic Designs

- Serengeti Systems

- Software Product Research

- Software Pursuits

- Syspertec Communication

- TPS

- Velocity Software

Final Word

We took a deep dive into the Mainframe Independent Software Vendor space, evaluating 576 suppliers (324 of which are still active, and 252 of which have either gone out of business or have been acquired), and narrowed down our selection criteria to get the top 20 suppliers who have 622 products that still run on the mainframe today. These top 20 firms have acquired 90 companies and consolidated 47 more with even 5 of the top 20 having been acquired in their own right. While it's certainly a legacy platform, the mainframe landscape remains huge and complicated, so before you even think about going it alone, give us a call and we'll show you how we can help. Since 2016, our clients have had an 85% probability of getting between 30-65% savings on their mainframe costs. We can show you how you can do the same.

Call to Action

With clients in virtually every industry and every geography around the world, NET(net) is the world leader in IT cost and value optimization, capturing hundreds of billions of dollars of negotiated Savings.

NET(net) has the information you need, offers the experience you want, and can deliver the performance you deserve to minimize cost and risk, and maximize the realization of value and benefit across your entire IT value chain.

- Do you want to learn more? Contact us today to learn more about how we can help you

- Are you ready to start? Sign up now for a Savings Cloud subscription, and we will get started right away helping you minimize costs and risks, and maximize the realization of value and benefit.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.