Introduction

Kyndryl is the new name for IBM’s managed infrastructure services business (what they refer to as IBM Global Technology Services), which spun out of IBM in November of 2021. Over the last 10+ years, IBM has fallen from a technology titan to a member of the walking dead, so how must Kyndryl feel about itself knowing that it is the discarded most unwanted stepchild of this unholy monster?

Unlike Microsoft, IBM has proven unable to reinvent itself as a cloud company. IBM was very well positioned to become a big benefactor of the cloud revolution, and the explosion of the data center utility model, but IBM continues to suffer from a Diminishing Role in the Modern Enterprise.

Kyndryl purports to design, build, manage, and modernize mission-critical technology systems that ‘the world depends on every day’. Kyndryl’s aim seems to be to provide higher-value data engineering services, curation, and orchestration, while developing services around data integration to drive machine-learning and ultimately automation.

Now free from many of the constraints of IBM, Kyndryl’s new ambition is to leverage its contractual agreements and use its considerable size and force to capture more market and wallet share, potentially putting its current customers, who are either unaware and/or unprepared, in the crosshairs.

This gives you two choices to make:

- Get out in front of this situation, and be proactive about how you control your agreement and investment, and see this as a new opportunity to defuse and reset your relationship.

- Or, let this situation detonate and blow up in your face, and then try to put the charred pieces that remain back together again.

A pressure suit may not be enough to contain the blast. Having the right expertise to defuse the bomb is also extremely important, and we can help you with that. If you’re interested to learn more; read on.

Leadership Team

- CEO Martin Schroeter – is a long time IBMer (since 1992) who was most recently the SVP of Global Markets (since 2017), responsible for Global Sales, and Customer Satisfaction with roll-up responsibilities for marketing, communications, and brand reputation. Mr. Schroeter has held numerous other executive positions at IBM, including serving as its CFO, and being its GM of Global Financing. He also served in posts in Australia and Japan.

- Group President Elly Keinan – who was recently a partner at Israeli-based Pitango Venture Capital, but over the previous 30 years, Mr. Keinan was IBM’s GM of North America, GM of Latin America, and Chairman of IBM Japan.

- Chief Marketing Officer Maria Bartolome Winans – a 25-year IBM veteran who led marketing teams for IBM software and Watson. More recently, she was the CMO for IBM Americas, responsible for demand generation across the US, Canada, and Latin America.

- President Kyndryl United States Matt Milton – who was at IBM for 19 years, most recently as its GM of Financial Services for North America.

- Chief Technology Officer – Antoine Shagoury, the former CIO at State Street and the London Stock Exchange.

- Chief Transformation Officer Nelly Akoth – most recently IBM’s Global Finance Leader.

- Chief Information Officer Michael Bradshaw – who comes from NBCUniversal Media, but was previously with IBM for 23 years, most recently as its VP of IT Infrastructure.

Kyndryl’s Business

Kyndryl’s Employees

To get to its current count of 90,000 workers, Kyndryl took an $800 million charge to make a signification reduction in force (internally referred to as ‘workforce rebalancing’) to “improve the profit and margin profile of the business”.

- US Domestic Workers

- 8%

- International Workers (mostly in these hubs)

- 92%

- India

- Poland

- Brazil

- Japan

- Czech Republic

- Hungary

- 92%

NET(net)’s Perspective of Kyndryl

There is some good news: Kyndryl is somewhat unique in that it starts out life as arguably the world’s largest IT infrastructure provider, with 90,000 employees (who average 10 years of experience), more than 3,000 patents (and another 1,000 in the pipeline), and a presence in 60+ countries across 450+ data centers.

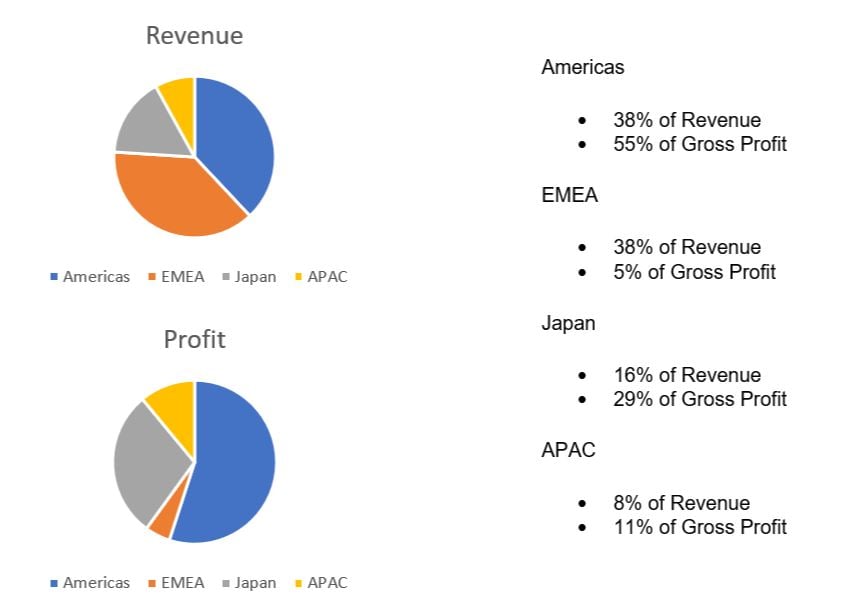

In addition, as a global company with $19 Billion of annual revenue and 4,000 customers (many of whom are committed to long-term contracts), Kyndryl is already deeply embedded with many large corporations and even entire governments, handling most (or all) of their critical IT infrastructure needs, with customers representing some 75 of the fortune 100, and more than half of the Fortune 500.

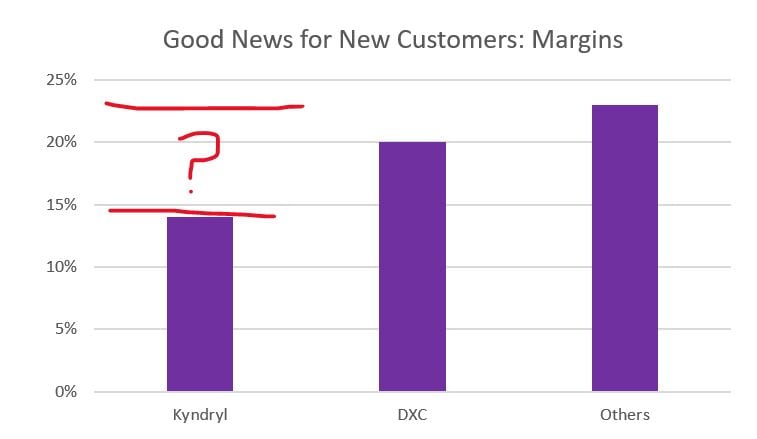

Because Kyndryl also carries a larger depreciation expense than its competitors (15% vs 12% for DXC comparatively), the company is *able* to offer its customers some additional benefit in the form of compressed margins, which could work in its favor if the company is smart about how it wants to pursue new opportunities in the field.

Kyndryl Margin as Compared to Market

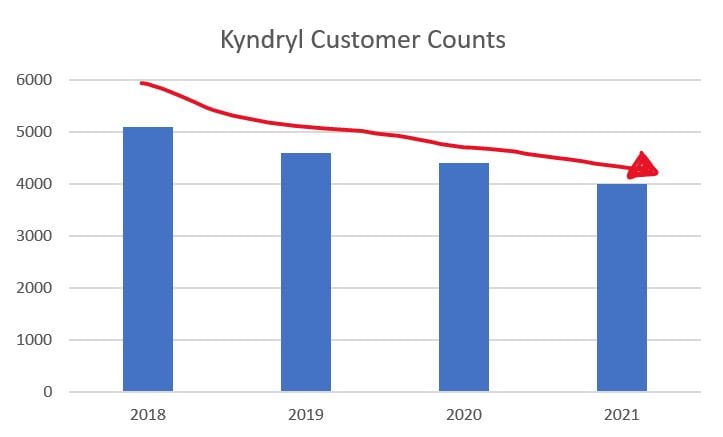

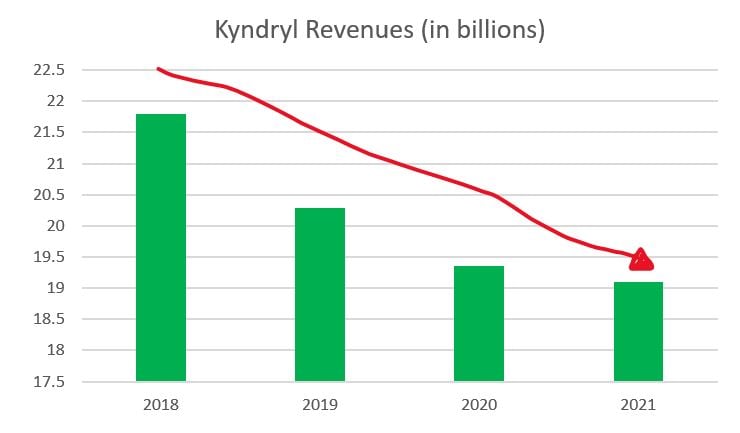

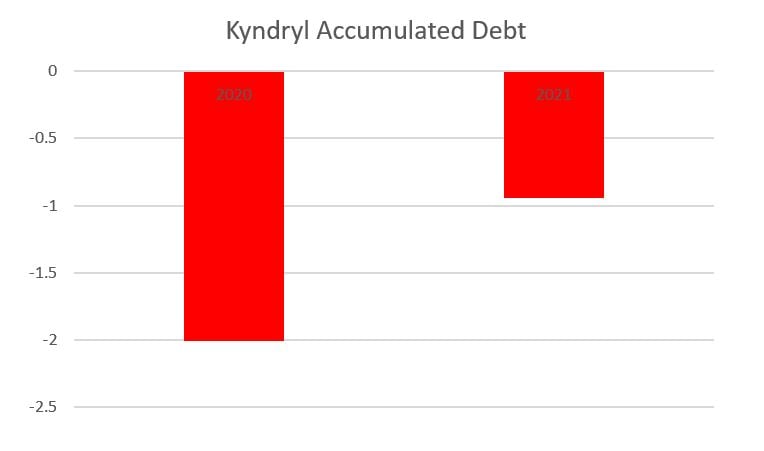

And there is some bad news: Kyndryl is also a bit unique that it starts out life already struggling with 4 years of customer defections and revenue declines, and $3 Billion worth of accumulated debt over the last 2 years (although they do also have $2 Billion in cash).

Kyndryl Customer Declines:

Kyndryl Revenue Declines

Kyndryl Accumulated Debt over the last 2 years:

Kyndryl Accumulated Debt over the last 2 years:

Kyndryl’s Competition

Kyndryl faces stiff competition from many organizations, including:

- Atos

- Cognizant

- DXC Technology

- Fujitsu

- Infosys

- Rackspace

- Tata Consultancy Services (TCS)

- Unisys

- Wipro

Kyndryl Composition

Kyndryl offers six (6) practice areas of focus:

- Cloud

- Digital Workplace

- Security & Resiliency

- Network & Edge

- Core Enterprise & zCloud

- Applications, Data, and Artificial Intelligence (AI)

Kyndryl also offers advanced advisory and professional:

- Advanced Advisory Services

- Digital

- Technology Adoption

- Professional Services

- Implementation Services

- Integration Services

How to Save

There are many things you can do to save big on your Kyndryl agreement. Here are the three most important things you can do:

- Benchmark. Everyone should Price-Benchmark their proposal, agreement, and/or renewal. NET(net) can benchmark your deal and show you how much you can save.

- Contract Review. Many IT Outsourcing (ITO) contracts have ‘change-of-control’ provisions that give customers options up to and including (i) opting out of the contractual term and/or other commitments, (ii) opening up new negotiations based on changing market conditions, or (iii) triggering actual pre-negotiated conditions in the commercial arrangement that apply to specific price concessions, (iv) Rightsizing or resolutioning for services where Kyndryl is chronically underperforming. In any case, we recommend a benchmark as the first step to help you determine the specific opportunity you have.

- Engage us to help you (Re)Negotiate. NET(net) has considerable experience negotiating some of the world’s largest IBM agreements, and has helped clients save billions on IBM. Kyndryl deals are intricate and extremely complex, with many moving parts, and if just one of the important elements is neglected, it can lead to catastrophic results. However, your Kyndryl deal may offer you a unique opportunity to reset what has otherwise been seen as an antiquated deal and a decaying relationship, but in order to capture value, you must move now.

Summary

Whether you realize it or not, value is traded in every single supplier interaction and exchange. You are either capturing value, or you are surrendering value, and the level and nature of your relationship, the timing of your actions, the frequency of your communications, the length of your e-mails, and the sequencing of your steps has every bit as much to do with your performance as does the content of your messages.

The client organization must speak with a unified voice, which must be sponsored by the appropriate executives, supported by the applicable department leaders, and channeled through the appropriate supplier-facing resources.

To further enhance performance, we always recommend professional commercial representation to heighten the effectiveness of these critical business dealings to ensure clients maximize value as there is no substitute for experience, expertise, and a track record of proven performance.

With clients in virtually every industry and every geography around the world, NET(net) is the world leader in IT cost and value optimization, capturing hundreds of billions of dollars of negotiated Savings.

NET(net) has the information you need, offers the experience you want, and can deliver the performance you deserve to minimize cost and risk, and maximize the realization of value and benefit across your entire IT value chain.

Call to Action

- Do you want to learn more?

- Contact us today to learn more about how we can help you

- Are you ready to start?

- Sign up now for a Savings Cloud subscription, and we will get started right away helping you minimize costs and risks, and maximize the realization of value and benefit.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.