The fiscal year end is a critical time of year for both suppliers as well as technology buyers, many of whom are in the middle of 2024 budget planning as I type this. Several tech suppliers are wrapping up their fiscal year soon, and will be putting on the full court press to customers and prospects aiming to get as much revenue possible before the book closes on the year.

During times of required action (renewals, new purchases, etc.) or duress (audits, M&As), we feel the pressure to get the deals done, and rarely take a step back to view the tech market as a 'federated'' whole, and how that might be impacting your business decisions. During any of these times, if you’ve felt like you are being pushed in on from all sides – you probably are.

Many of you have probably had regrets in hindsight on past vendor decisions:

- Accepting deals that leave you feeling like there was value given away

- Less than ideal negotiation strategies employed

- Preparations that left the team chasing information

- Timing that made it feel like you were juggling too many projects

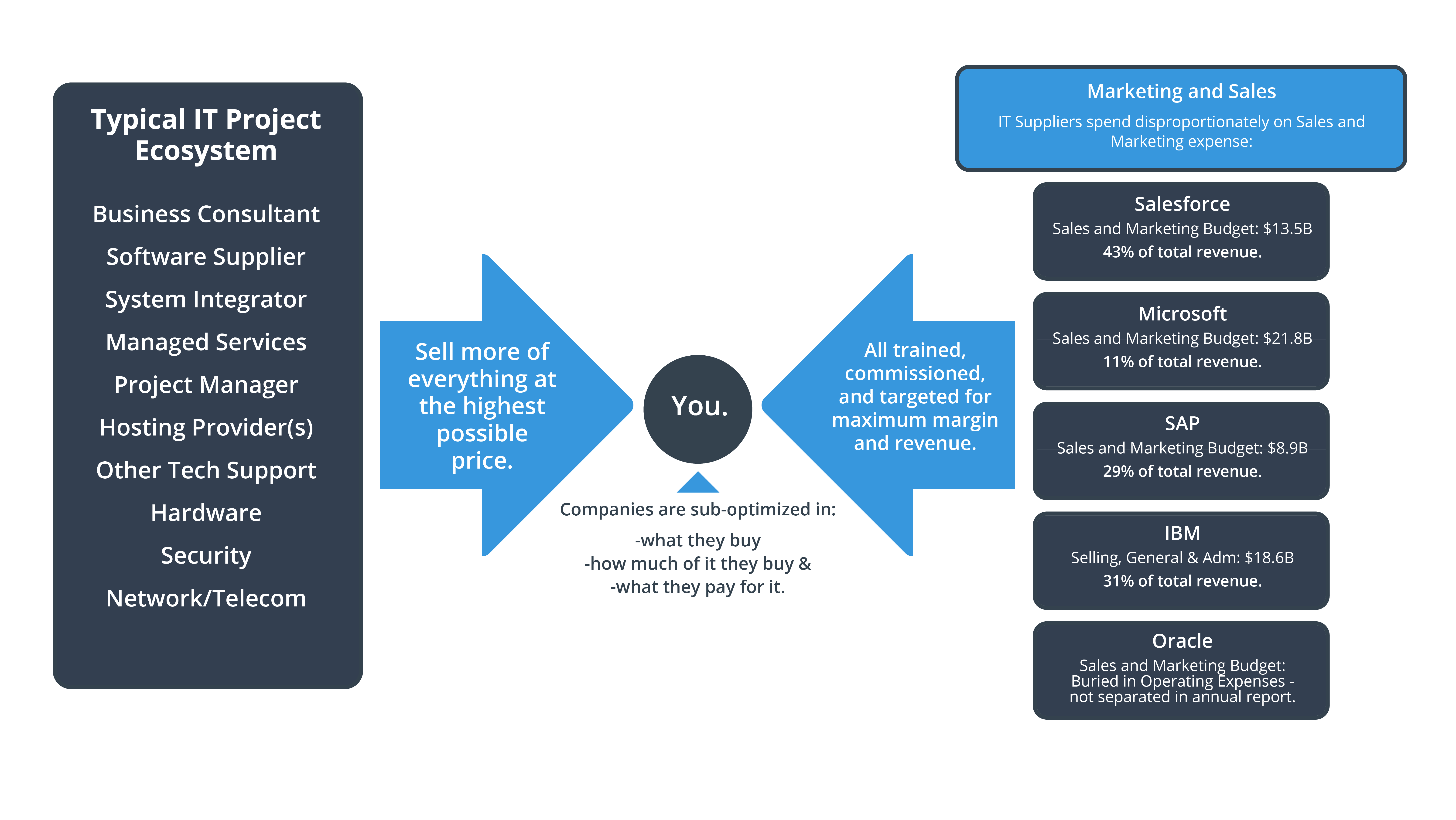

That pressure comes almost exclusively from what we call 'the Un-Official Technology Sales Cartel'. What is the un-official technology sales cartel?

In most IT projects, there are at least three stakeholder pillars involved with enterprise technology transactions that surround and envelop the buyer team:

- Suppliers (Verizon, Oracle, Microsoft, SAP, IBM, AWS, Salesforce and hundreds more).

- Third Parties: Vars, Integrators, Resellers, Consultants, and more.

- You (the buyer).

On one side: The Suppliers

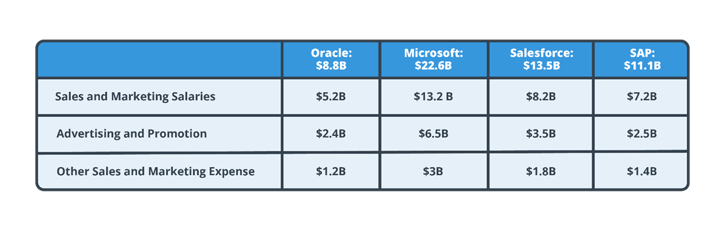

Suppliers spend a LOT of money annually to capture and keep your attention (below are in Billions):

Consider the following…

The technology industry is one of the biggest spenders on sales and marketing, with global spending expected to reach $1.3 trillion in 2023, according to Statista. This represents a significant increase from the $1 trillion spent in 2022 and is a testament to the importance of sales and marketing in the tech industry. All that investment is geared toward influencing (in some cases coercing – audits anyone?) revenue from customers that typically have limited time, budget, and resources.

Participants in the cartel are aware of this and use all those resources to ensure they capture their share of the pie.

That financial backing is also used to apply maximum pressure in all the areas that generate FUD (fear, uncertainty, and doubt) amongst their current and potential customers. Some of the key areas where sellers have a distinct advantage over buyers:

- Asymmetric information: Suppliers have more information about their products and services than buyers do. This can put buyers at a severe disadvantage in negotiations – not knowing what you don’t know can be a career killer.

- Complex contracts: Technology contracts can be very complex and difficult to understand, which is often intended. How many iterations has Microsoft had in their EA agreements? Thousands? This can make it difficult for buyers to know how they can expect agreements to unfold after being executed and what surprises are in store for them when unforeseen circumstances arise (i.e., M&As, divestitures, business downturn/upturn, new projects, etc.).

- Lack of leverage: Buyers often lack leverage in negotiations with suppliers. This is because technology suppliers are large and powerful companies with a lot of bargaining power. As referenced earlier in the article, suppliers are spending billions on sales and marketing with the specific goal of influencing your buying – regardless of your preferences. The number one goal of almost every sales rep training program at vendor firms is to become their customer’s ‘Trusted Advisor’, then incentivize them heavily to make it happen.

- Time pressure: Buyers are often under a lot of time pressure to sign agreements for various reasons. This can make it difficult for them to negotiate effectively. In some instances, buyers can claim this leverage back for renewals and some new purchases when salespeople are more desperate to close deals, but more often than not, time is not on the buyers’ side.

- Vendor lock-in: Once thought of as the domain of perpetual licensing that cloud would free them from, this is perhaps stronger now than it ever was. Suppliers know how to bundle their way into your forever budget. It was already difficult and expensive to switch to a different provider due to complexity and integration of existing solutions, but in many ways the pain has only been exacerbated, leading to higher prices and less accountability for service and support.

The other side: Third Party Integrators, Consultants and Resellers

There is no definitive answer to the question of how many third-party integrators and technology consultants there are because the industry is constantly evolving and there is no single central database that tracks all the players at any given moment. However, based on various estimates, it is believed that there are millions of third-party integrators and technology consultants around the world.

For example, a 2022 report by Gartner estimated that there are over 2 million third-party integrators and technology consultants worldwide. This number is expected to grow to over 3 million by 2025.

Put those numbers in the context of your own projects:

- According to a recent survey by the Technology Services Industry Association (TSIA), the average IT project involves 10-15 third-party technology companies (hardware, software, cloud computing, consulting, and support services).

- The average corporation has between 89 and 250 technology vendors, according to a recent survey by Bomgar.

Companies in industries such as technology and finance are more likely to have an even larger number of technology vendors than their counterparts in other industries.

In the Middle: YOU

With the economic uncertainty, a lot of companies have been or are in the middle of cutting costs or at the very least, freezing them. Some of the first things to go on notice:

- Hiring/Staffing cuts/Reorgs

- Discretionary spending

- Service reductions

Are you thinking, “yeah, and I didn’t have a lot to work with before all the above were frozen or cut?”

But perhaps you are one of the lucky professionals that are in a recession-proof market and or have a team of resources at your disposal. Even in those circumstances, when stacked up against the sheer numbers, experience, and training of the ‘sales cartel’, it’s no wonder that most companies overpay by 30% plus for IT. And that’s before they realize they are sub-optimized in what they bought, the quantity they bought it in, and the term they signed up for.

You may also be thinking that since you spend millions of dollars with a given supplier, it’s assumed you get the very best pricing, terms, and services available. In those cases, surely you receive the very best of everything, real VIP treatment!?

You would be wrong. In fact, most of the biggest spending firms on technology pay the most. They are assured by suppliers that they are getting the best based on their size and importance, but typically it’s not the case. These are suppliers’ ‘cash cow’ customers that provide great margins and run rate along with six to seven figure commissions for salespeople.

“Yes, but I benchmarked my spend to similar companies!” Benchmarking your spend against companies that are also overpaying is no benchmark at all, but backward-looking data that does not reflect the market and the bespoke terms you should be getting based on your circumstances.

It’s the difference between following the market and making the market. Savvy buyers make the pricing and set the bar. Everyone else pays for the savvy few who can negotiate on their terms.

Hire a Lawyer

Just kidding, don’t hire a lawyer (unless you really need one of course). But you should hire an expert to help navigate your strategic agreements. Think of it this way, if you found yourself in a legal situation and needed to defend yourself in court, where you will have to interact with judges, prosecutors, juries, file briefs, interview witnesses, etc., would you do it yourself? Or would you bring in someone who is trained, has experience, and a track record of winning in that environment?

With an expert who has negotiated thousands of technology agreements, you gain leverage over the cartel that’s bringing pressure (unintended or otherwise) to your project and business. Just some of the other benefits:

- Expertise: You can gain through osmosis and learn from their expertise in negotiating technology contracts. They (we) understand the complex terms and conditions of these contracts and can help you avoid unfavorable terms.

- Objectivity: You get unbiased advice, and firms like NET(net) are not beholden to any particular technology vendor and will work in the best interests of you. We only win when you do.

- Leverage: We can help give you leverage in negotiations. Suppliers know that buyers are serious about negotiating when they are represented by a team of experts – this can often shortcut the path to real savings and favorable terms.

- Peace of mind: Think of it like an insurance policy - engaging a firm like ours to help negotiate strategic agreements can give you peace of mind and instill confidence that your interests are being protected and you are getting the best possible deal.

- Experience: Where you or your team may have negotiated one Oracle deal in the last three years, why not work with someone that’s done hundreds?

- Cost and price: Most C-levels when presented with a model that says for every dollar you spend with NET(net), you will get $4 to $6 back, says where do I sign. That’s a great ROI while also ensuring you are buying the right things, in the right quantity, at the right price.

The list could go on, but you get the idea. Your call to action? Act. NET(net) does not engage unless we can deliver meaningful improvement(s) to your business. Anything else is a waste of your time, which is your most valuable commodity.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get, and keep more economic and strategic value in their technology supply chains. Over the last 20 years, NET(net) has influenced trillions of investment, captured hundreds of billions of value, and has helped clients cost and value optimize XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend. NET(net) has the experience you want, the expertise you need, and delivers the performance you demand and deserve. Contact us at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1 (616) 546-3100 to see if we can help you capture more value in your IT investments, agreements, deployments, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms, offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.