SAP customers are facing some difficult and well documented hardships of late, especially those still on the Slow Road to HANA. For many, the migrations have become far more than was originally bargained for. As we have stated in previous articles, SAP’s greatest Cloud success has been in its acquisitions like Ariba, Concur and SuccessFactors. On their own, SAP has struggled. While SAP touts it’s 100% growth in S4/HANA Cloud growth and backlog, for customers, the story is far different as underutilization and adoption woes rule the day for a huge number of them. Given customers are facing these challenges, SAP continues marching forward with new revenue streams to help shore up the core business.

Enter Qualtrics

For a quick historical reminder, SAP announced its acquisition of Qualtrics back in 2018, with then CEO Bill McDermott saying, “SAP and Qualtrics are seizing this opportunity as like-minded innovators.” Is innovation through acquisition, really ‘innovation’? While we ponder that, a timeline:

- 2019

- SAP concludes acquisition of Qualtrics

- 2021

- SAP takes Qualtrics public maintaining a majority stake

- IPO share price was $30/share – which rose quickly to $55/share as of Feb. 5th, 2021

- SAP raises nearly $1.6B USD from IPO

- 2022

- As of this writing, Qualtrics share price is $12.94/share (we’ll round up to $13)

- This represents a drop of 76% from high of $55/share

- At the same time, SAP’s stock as of today is trading at $87.61/share

- This represents a full 1/3 drop off from February 2021 at $132/share (a 45% drop since all time high August 2020 – just two years ago

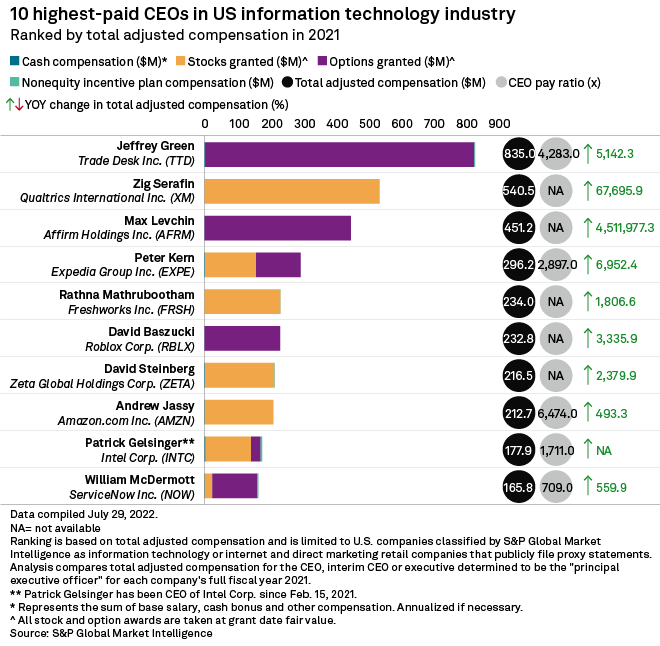

Given that SAP reportedly used Qualtrics IPO to help pay off $1,76B USD of its American segment debt, this precipitous drop in share price and market cap must be troubling in the short term. While Qualtrics reports continued growth, they are still struggling with profit. Q2 2022 reports show net operating loss of $279.2M USD. Interesting to note however, during this same time, Qualtrics CEO Zig seems to be faring pretty well, whose total compensation is more than their quarterly operational loss:

Six of Qualtrics eleven board seats are SAP Executives, so Zig is getting plenty of great advice:

- Scott Russell – Head of SAP Success Unit, member of SAP Executive Board

- Luka Mucic – Qualtrics CFO, and member of SAP Executive Board

- Robin Manherz – SAP EVP and COO Customer Success

- Christian Klein – SAP CEO, and member of SAP Executive Board

- Sindhu Gangadharan – SVP and Managing Director SAP Labs India

- Ritu Bhargava – Chief Product Officer of SAP Experience

Qualtrics is going all in with their Executives and employees as well as noted from SAP’s half year 2022 annual report (page 33): “In the first half of 2022, 19.3 million equity settled Qualtrics RSU (restricted stock unites) were granted to encourage and enable Qualtrics executives and employees to acquire an ownership interest in Qualtrics.”

What does that mean for SAP customers?

As with most things in life and business, always look to what motivates behavior. What we are seeing of late is a propensity of SAP to leverage and prop up (our words) other SAP revenue streams. Like the way Oracle would strong arm their customers to buy Cloud they didn’t yet need to prop up earnings, a similar pattern is unfolding with SAP and Qualtrics.

When taken in the above context, it makes perfect sense if you are SAP to promote and propagate as much Qualtrics revenue possible into your deals, even if you don’t need it. The effort SAP sales teams put into ‘pushing’ other revenue streams into your deal is directly proportional to the stock price of those same entities. If Qualtrics was trading at all time highs, corporate pressure on SAP field teams to ‘work in’ Qualtrics (and others) would be diminished.

Caveat Emptor

That is our advice, buyer beware. While it’s in SAP’s best interest to realize the ‘synergies’ with having Qualtrics under their umbrella, it doesn’t mean it’s right for you. Even if you need Qualtrics or have it on the horizon, don’t be bullied into buying:

- At the wrong time

- In the wrong amount

- For the wrong price

We have seen many of these deals and can help you negotiate the best path forward that will even leave SAP (somewhat) happy. But don’t wait to engage us even if only just to chat. SAP sales teams are trained to get you on a path that seems impossible to diverge from. NET(net) prefers the words of Robert Frost, “Two roads diverged in a wood, and I— I took the one less traveled by, And that has made all the difference.”

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.