Introduction

Workday was ranked #1 in NET(net)'s Top 10 HCM HRMS Suppliers for 2021 blog. The cloud-based system mostly known as a Human Capital Management (HCM) platform for global workforces is delivered as a Software-as-a-Service (SaaS) and offers the following modules:

- Human resource management

- Business process management

- Reporting and analytics

- Benefits administration

- Compensation management

- Talent management

- Survey framework

- Employee and management self-service

- Program and Project Management

- Payroll and Workforce Management

- Professional Services Automation

- Enterprise Planning

- Higher Ed Student Support

- Spend Management

Many organizations choose Workday because it provides an “all-in-one" modular solution for human capital and finance management. Advocates promote its user-friendly interface and reporting capabilities as two favorite features.

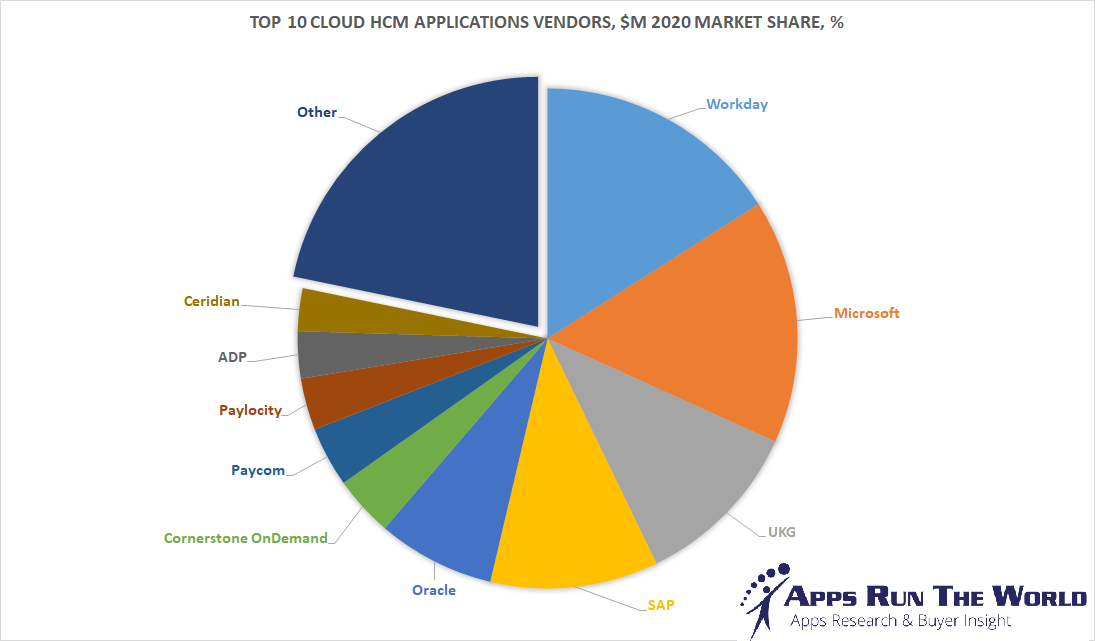

As of the end of 2020, Workday was the HCM market leader with an 8.4% market share, edging out competitors such as Microsoft, Oracle, SAP, UKG and ADP among others.

Workday Pricing

Workday doesn’t publish its list pricing, but the cost basis for HCM Cloud is approximately $300/user/year (absent term commitments & volume discounts).

Workday also prices based on what they call full-service equivalents (FSEs), which is a calculated number, determined to set the licensing level across all modules, regardless of whether or not the usage of a particular module is relevant to the total counts.

How to Save

First step; everyone should price-benchmark their Workday proposal and/or agreement with us. With just a few pieces of information, we can benchmark your deal (in as little as 1 business day) and show you how much you can save.

Other ways to save:

- Term. Committed terms will get you pricing discounts, and most clients opt for a 3-year committed term.

- Volume. Depending on how many FSEs you have, you may be eligible for higher discounts with higher volumes of subscribers. For volumes over 3,000 FSEs, customers can expect to see additional volume discounts, so many clients who are just short of a volume discount tier will choose to pull forward planned future growth at the time of the transaction to benefit from the additional volume discounts.

- Right-Sizing. To chase improved discounts, customers often consider making a higher level of commitment for planned future users. While this can sometimes result in a significant over-payment that goes under-utilized in future years, aligning the deployment to the current level of consumption with incentive pricing to add on additional users as they are needed is often a better solution that saves money now and doesn’t cost more in the future.

- Right-Licensing (Full-Time vs. Part-Time). The process to determine the user demographics is extremely important with Workday, as the FSEs are calculated based on an algorithm that uses a percentage of value for the user type. In a simplified example, Full-Time workers might be counted as 100% towards the FSE count, but Part-Time workers might be valued at 25% towards the FSE count, so a customer with 6,000 Full-Time and 4,000 Part-Time workers would be able to license 7,000 FSEs instead of 10,000, which offers some 30% Savings.

- Custom User-Classes. Some clients have been able to create custom user classes that more closely reflect the demographics of their workforce, and in those cases where there is limited use, customized algorithms can be negotiated to agree to various rates that enable workers to be covered at a partial cost. The opportunity here for savings can be substantial, so this is an excellent area to focus on if you have a dynamic workforce with genuine limited use business cases.

- Market. Customers should always consider the competitive market to be sure they are getting optimized economic treatment. It doesn’t take a lot of effort to see that Oracle Cloud HCM is priced at $4/user/month, which is only one-third of Workday’s 1-year price (absent further term and volume discounts).

Terms and Conditions Alerts

- Future Price Holds. Future purchases on all titles, versions, editions, and quantities should be able to be made at the same discounts. Once an organizational commitment has been made to Workday, future negotiating leverage is dramatically reduced, so it’s important to ensure that future purchases are given the same treatment with pricing discounts, otherwise each new purchase will result in a new negotiation where Workday has a considerable advantage.

- Price Locks. Once your annual costs are known, be sure to lock in your fees for the term of your agreement, so that they do not increase annually. Workday routinely charges a 7-10% annual increase without this protection (and sometimes even with it), so contract compliance and financial management is also important with Workday.

- Caps on Renewals. Once the existing term expires, Workday is known to significantly increase costs (sometimes by 20% or more), so be sure your agreement gives you the added protection of a rate cap on the possible increase for your next renewal.

Implementation

Systems Integrators (SIs). In addition to the subscription charges and platform costs for Workday, customers are also responsible for the implementation and integration work. In addition to Workday itself, many leading consulting firms offer SI services for Workday. Leading SIs include IBM, Deloitte, Accenture, PwC, and KPMG (among many others). These agreements are also critical to negotiate as they often result in significant delays, huge cost overruns, and failure to achieve important objectives. Depending on your specific situation, you may benefit from one of several different implementation pricing models, but all agreements should include transparent timelines and cost estimates based on reasonable assumptions about tasks, resources, rates, and responsibilities. In addition, contractual instruments should be tuned to include all the appropriate documents to minimize potential disputes. Various terms and conditions should be reviewed and negotiated to ensure customers have the proper protections to minimize the impact of change orders, added costs, delayed value, and the loss of functionality. Negotiations with SIs is as much art as it is science, so we strongly encourage all clients to seek professional assistance in structuring their SI agreements.

Supplier Performance Management

Demand Management. Clients often buy products they don’t need in amounts they don’t have with aspirations of future deployment and consumption, but many failed deployments can be linked back to the inability to accurately predict deployment ease and adoption. For this reason, we strongly suggest that clients evaluate and manage any proposed bill of materials changes.

Summary

To be successful in negotiating Workday deals, you need a deep understanding of the HCM market. Leveraging experienced resources can help you determine how your HCM strategy can yield the best organizational results in the context of various supplier capabilities and models. In addition, you need subject matter and optimization experts with the right blend of technical, commercial, and contractual knowledge of Workday to help you negotiate the best deal possible.

NET(net) has the information you need, offers the experience you want, and delivers the performance you deserve to help you minimize cost and risk and maximize the realization of value and benefit.

Call to Action

Workday’s January’s Fiscal Year-End is fast approaching, making this the best time to capture value, so Act Now.

Contact us today to learn more about how we can help you save 32-60% on all your SaaS investments, including those with Workday or Sign up now for a Savings Cloud subscription on Workday, and we will help you minimize costs and risks, and maximize the realization of value and benefit.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.