A few days ago, a long-time client asked us about our views on some industry analyst firms, and it got me thinking again about who people trust when they need real industry analysis and not just the latest (largely unsolicited) market report, so I decided to write this blog about the Top 5 Technology Research Services Firms clients should use in 2022.

Now, I think I know what you are thinking….you are probably thinking this is a pointless blog because everyone already knows that the Top 3 technology research services firms are Gartner, Forrester, and IDC, right? Well, what if I told you that after much industry consolidation, we took a detailed look at the 39 remaining firms we cover (after 15 firms we used to track have been acquired), and that those supposed top 3 market heavyweights that you believe are the best do not even make it to our Top 5 List! Will you read on to find out why?

Intro

NET(net) is a leading source of industry counter-intelligence, and because we exclusively advocate for the benefit of clients, and do not accept any money or favor from the technology suppliers, we are generally considered to be persona non grata to most of the technology industry cartel – which is fine by us (don’t get it twisted – we are not lamenting here!). There is a certain liberating feeling that comes with our position in the industry, which enables us to speak the plain truth freely, unbeholden to the technology oligarchs and unaffected by their economic and political stranglehold on the advisory community. Unlike the major analyst firms, we also fund 100% of our own market research, and neither rely on supplier funding, nor content contributions.

Further, because we are also not concerned with our social standing, we get to speak truth to power, saying what others refuse to say, and we can therefore tell you this: It is our sincere belief that Gartner, Forrester, and IDC do not perform Market Research on technology suppliers as you may have been led to believe all these years, rather they do paid Marketing Reinforcement for the technology supplier community, giving supplier marketing slicks a dubious feeling of ‘independent’ credibility. Seemingly, no matter how many people understand how this game is played, it continues to be played, and everyone just nods their heads in approval about how this supplier or that supplier is ‘independently’ rated as a leader in their market and goes about their business.

There are numerous examples of how Market Analysts gaslight the entire IT eco-system with supplier advertisements and puff-pieces disguised as so-called hard-hitting Market Research Reports. Please:

- Gartner does it with its Magic Quadrants

- Forrester does it with its Wave

- IDC does it with MarketScape

You don’t have to look very hard to find the major problem with this approach. When buyers are considering who to evaluate, they routinely look at the ‘upper right’ quadrant of the latest magic quadrant, and solicit those suppliers via an RFP, but of course that just plays into the supplier’s hands. Suppose the disruptive supplier that offers the highest value and the lowest cost is not considered to be one of the market leading suppliers by your analyst? Consider that the best supplier for a particular solution isn’t even rated at all? Consider that a superior supplier doesn’t have a bloated marketing budget, rather a focus on technology superiority? It’s easy to see how suppliers who ‘play ball’ with analyst firms can increase their opportunities, and suppliers that don’t, can’t, or won’t, will suffer.

Another problem is due to the balance of trade. The Industry Analyst Cartel gets paid a lot more by the major suppliers than they are paid by you (which is an inherent conflict of interest from the start in our view) and problematically, neither the Analyst nor the Supplier discloses the payment amounts in their market ‘reports’ which also makes them seem clearly tainted, and designed to manipulate opinion, in our view. So, if you are looking to your analyst to give it to you straight about the shortcoming of xyz supplier, and you pay your analyst firm $36k per year, but the supplier pays them $3.6M per year, guess where their loyalties lie?

Scenarios:

- What if a ‘magic quadrant’ ranks Supplier A, first and Supplier B, second – both as leaders.

- Supplier C, third, is located down in the lower left quadrant as a laggard.

- AND you ALSO knew that Supplier A paid Gartner $2M

- Supplier B paid Gartner $1M.

- Supplier C paid Gartner nothing.

Does it change your view about their so-called objective rankings? When you hear from the suppliers who do not pay Gartner (and others), like open-source suppliers, or startups that lack the budget, you will gain from their perspective. They will say it’s a pay-for-play scheme on a slanted playing field that gives the overwhelming advantages to the well-funded suppliers with big marketing budgets, and almost no serious consideration is given to the open source and/or start up crowds.

This business model is largely broken. Gartner (and others) rely on supplier payments to fund (and in some cases conduct) their market research, and routinely publish barely edited supplier marketing documents masquerading as valid research reports; and almost everyone in the industry knows this, yet for some reason inexplicably accepts this practice. In addition to this, many of the industry analyst firms track your activity and sell marketing leads to the very suppliers you are researching. We cover this in more detail in another blog we wrote called: Top 4 (of 100) Technology Review Platforms for 2021.

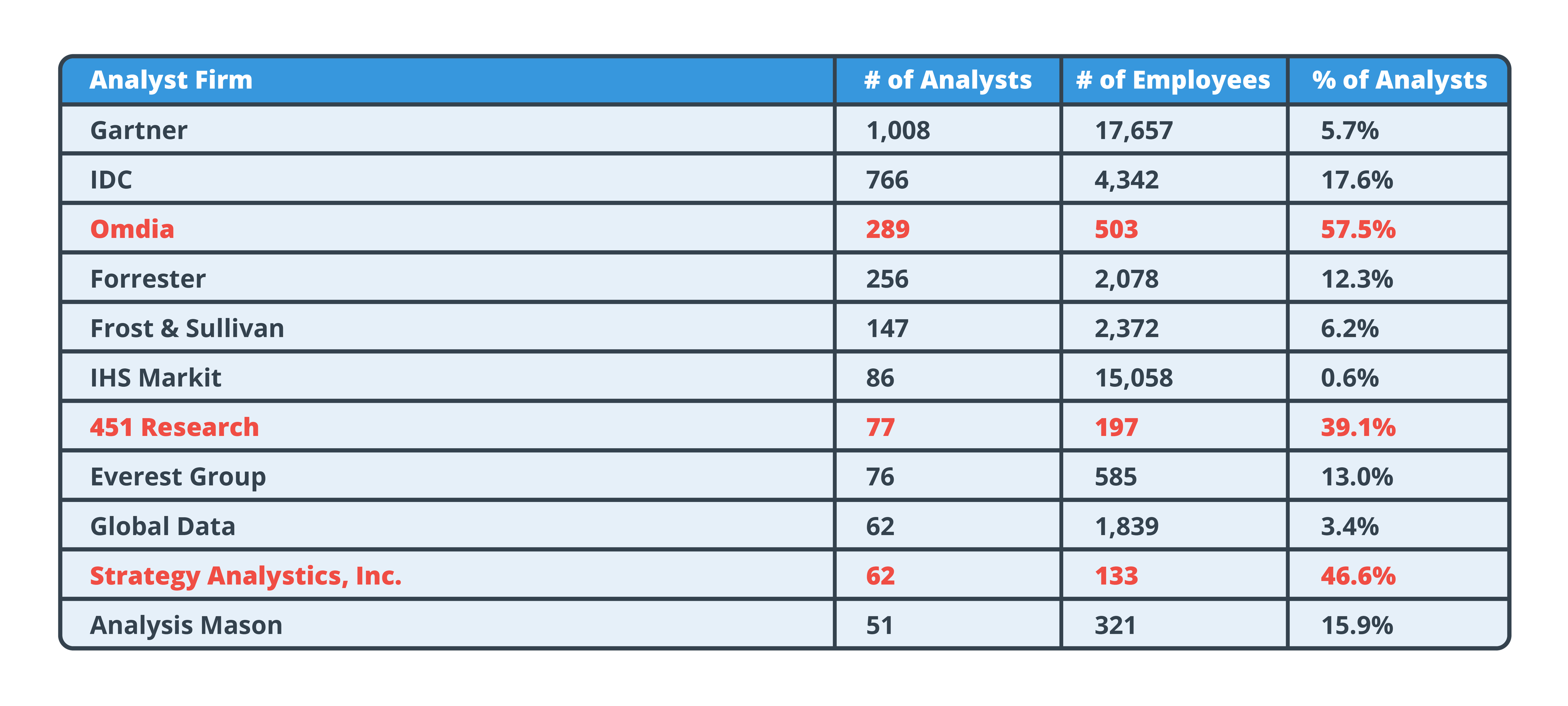

In the chart below, you will see that the sheer number of analysts certainly appears to give Gartner a strong advantage in the comparative analytics, but when you also consider that several hundred of their analysts cover the semiconductor market in China, maybe you will change your tune a bit?

When you look at the percentages of employees who are true analysts, it starts to become clear that the industry ‘Big 3’ must be in some different business other than providing industry insights and market analysis to their customers:

(Click to enlarge. Source: ARInsights)

By objective measures, the three analyst firms that have the most analysts by a percentage of their employee counts are:

- Omdia (57.5%),

- Strategy Analytics, Inc (46.6%), and

- 451 Research (39.1%);

Subsequently, and party as a result, all the above make our Top 5 List.

Summary

In the end, industry analyst firms focus and report on what is essentially considered to be market averages, and they rely on supplier representations for a good portion of that. Much of their market research is supplier funded and designed to create complexity when things can be simplified so that you’ll need an analyst to break it down for you. In sharp contrast, our clients are not at all concerned about industry averages, rather, they are concerned about simplifying things to achieve exceptional outcomes and clients rely on us to provide specific insights designed to meet their most demanding use cases, and engage us to deliver targeted services to help them achieve the most disproportionate and beneficial results – so instead of paying to get general industry information about what is average, why not engage us to help you be more exceptional in the most meaningful ways?

Our Picks for the Top 5 Market Analysts Firms: (Descriptions are provided by the suppliers and are not necessarily reflective of our view).

1: 451 Research

2: Avasant

3: Omdia (prev Ovum)

3: Omdia (prev Ovum)

The Remaining (34) Market Analysts we considered: (Descriptions are provided by the suppliers and are not necessarily reflective of our view).

Aberdeen Research

Aberdeen provides technology sales and marketing teams with an unfair advantage in generating new business. Aberdeen's Engagement Science approach to growing and accelerating your funnel ensures that you are saying the right things to the right people in your target market. Our innovative Lead Essentials product operationalizes your Engagement Science strategy by giving you a constant, fresh stream of accounts and contacts that are in market for what you are selling and the content that is most likely to engage those buyers. Clients of Aberdeen can also implement an Engagement Science strategy on a full-service basis with a wide range of outsourced demand generation programs, content marketing solutions, B2B data management services, and B2B market analysis offerings. Aberdeen's B2B data and content solutions apply to over 90% of the world's IT spend. Our analytical engine is constantly surveying industries ranging from human capital management, enterprise resource planning, business intelligence, and nearly a dozen other categories of technology spend. You can rest easy knowing that Aberdeen can help you target accounts that are in-market for your products and services, say the right things to them, and achieve your deal volume and conversion rate targets whether resources are plentiful or scarce.

Whether you are navigating a digital transformation project or are on the verge of making an investment, we provide the expert, real-time, and actionable guidance you need to make more confident, strategic, and winning business decisions.

Our consulting and research expertise in telecoms, media and technology underpins everything we do to help change our clients’ businesses for the better. Analysys Mason is a global consultancy and research firm specializing in telecoms, media and technology for more than 35 years. Since 1985, Analysys Mason's consulting and analyst teams have played an influential role in key industry milestones, supporting clients in 110+ countries through major shifts in the market. With experts located in offices around the world we provide local perspective on global issues and continue to be at the forefront of industry developments. We are passionate about what we do, and by harnessing our collective knowledge will rise to any challenge to support and deliver tangible benefits to our clients.

Aragon Research is an independent research and advisory firm. We provide business and IT executives with the actionable insights they need to navigate technology's ever-evolving impact on business. Headquartered in Morgan Hill, CA, Aragon Research works with executives at every major level of the business and across industries to give them the tools they need to make more informed technology and strategy decisions.

In today's fast paced and competitive environment, you need an expert on your side, someone that will assist you with strategic decisions, guide you with industry best practices and latest technology solutions. That is the ARC Advisory Group purpose. ARC will make you more competitive through our advisory services, technology evaluation and selection services, our research reports, analyst consultation, and our vision. Regardless of your measure - Operational Performance, Return on Assets, Cost of Ownership, Time to Benefit, or Shareholder Value - ARC will deliver and you will be more competitive.

Founded in 1986, ARC Advisory Group is the leading technology research and advisory firm for industry, infrastructure, and cities. ARC stands apart due to our in-depth coverage of both operational technologies (OT) and engineering technologies (ET) and associated business trends. Our analysts and consultants have the industry knowledge and the first-hand experience to help our clients find the best answers to the complex business issues facing organizations today. We provide our technology supplier clients with strategic market research and help our end user clients develop appropriate adoption strategies and select the best technology solutions for their needs.

Brightwork Research (Shaun Snapp)

Brightwork produces unique research and focuses on getting to the reality of software, ranging from functionality analysis to TCO. It claims to be a ‘real’ research entity that follows research rules, and is not posing as a researching firm, which is what Gartner, Forrester, IDC (and nearly all others) do.

We deliver channels and tech analysis, data and events that ensure your business overachieves.

ABOUT CELENT We are the leading research and advisory firm focused on technology for financial institutions globally. For over 20 years, Celent has helped senior executives make confident decisions around their technology strategies to execute at scale. As the financial services industry rapidly evolves, there is more complexity, with new regulations, startups, technologies, and applications to stay on top of and prioritize. Celent helps you connect this ever-changing puzzle. We offer objective advice and clarity, backed by a database of thousands of solutions and award-winning global best practice use cases. With real-life domain expertise, we also guide you through the maze of emerging tech in the pursuit of value. Our people, data, insights, and relationships form the foundation for you to use Celent to make confident technology decisions in financial services. We are part of the Oliver Wyman Group, a wholly owned operating unit of Marsh & McLennan Companies [NYSE: MMC].

Constellation Research (Ray Wang)

Single reports, full access to our research library with Research Unlimited, or Constellation Credits for flexible engagement with Constellation analysts and access to research.

Deal Architect (Vinnie Mirchandani)

Deal Architect Inc. is a boutique advisory firm and content provider that focuses on IT, energy, health, space and other STEM areas. Our consulting and research are symbiotic – our consulting clients benefit from our research, and our readers benefit from the practical, field feedback from our clients.

As its name suggests, Digital Clarity aims to make digital business clear to its customers, and tackles some of the perplexing questions of the day. Among them are the many questions around the General Data Protection Regulation, the EU directive which is causing so much upheaval in the economy now. It also deals with subjects that are perhaps less widely discussed, such as direct-to-consumer commerce in the manufacturing sector. Understanding digital technologies will be essential if more manufacturers are to reach their end customers directly, without any “middlemen”.

Why is EMA different than other firms? Because our team leverages a unique combination of practical experience, insight into industry best practices, and in-depth knowledge of current and planned vendor solutions to help our clients achieve their goals. Each EMA expert has extensive hands-on experience, so their guidance is based in the real-world – not in theory. These practical skills combine with deep visibility into industry best practices garnered through our consulting engagements and research studies. And – while EMA is vendor-neutral – we regularly brief with top IT vendors, so we know the pros and cons of available solutions and use this knowledge to help IT shops find the tools that are right for them.

Enterprise Applications (Josh Greenbaum)

End-user Organization Services Include:

- Product and technology strategy

- Implementation and deployment strategy

- Training and center of excellence development

- RFP development and review

- Vendor selection and review

We’re a trusted analytics partner that helps global enterprises get the most out of their core processes.

Evalueserve is powered by mind+machine™, a unique combination of human expertise and best-in-class technologies enabling us to design and manage needs-tailored processes for our clients. We generate and harness insights on a large scale, building efficiencies that save resources and help our clients maintain their competitive advantage.

Move forward with clear action. When you need a light-touch engagement designed to give you insights to solve your problem or capitalize on an opportunity – we have your back.

Experts Exchange powers the growth and success of technology professionals worldwide. Solve faster with our database of 4 million+ technology solutions, learn technology skills with researched articles and videos, and build your career with our extensive global network.

Forrester provides proprietary research, consumer and business data, custom advisory and consulting, events, online communities and executive programs globally.

With almost 2,000 employees around the world, Frost & Sullivan is larger than some companies but not as big as the leaders. Its strengths include its fast response to market trends. So, it’s a keen observer of the industrial sector where many changes have been taking place, particularly in relation the industrial internet of things. Frost started out as a company which conducted research into new technologies and provided insights to make sense of them, which it still does. Lately, it’s been interested in the convergence of technologies and how to use it to benefit its clients.

Gartner delivers technology research to global technology business leaders to make informed decisions on key initiatives. Gartner would probably topmost consultancy lists simply on the basis of brand recognition, the company is so well known. It is said to wield enormous influence on buying decision in tech and in other sectors. Generating $3.3 billion a year with 15,000 employees, the US company says it has more than 12,000 customers or “partner” organizations in more than 100 countries. Technology features heavily in the many conferences it organizes, and regularly publishes analyses of broad tech trends.

GigaOM delivers breaking news and in-depth analysis on the business of technology. We investigate trends, examine emerging business models & profile startups.

Unrivaled Coverage

Our unrivaled coverage helps thousands of companies, financial institutions, professional services firms, and government organizations decode the future of the world’s largest industries.

Tailored Solutions

Our world-class platform provides you with easy access to deep, sector-specific intelligence, real-time news, powerful analytics, and time-saving workflow and collaboration tools.

Another small and nimble tech analyst, HfS highly regarded in the industry and has recently won many plaudits and awards. In recent months it’s been monitoring the developing blockchain, among other technologies such as automation, artificial intelligence, digital business models and smart analytics. HfS also has what looks to be a unique or at least unusual approach in the way it packages its services, through offerings such as “ "As-a-Service Economy" and "OneOffice”, which it has actually trademarked. It also has what it calls a “ThinkTank” model of collaboration and takes particular interest in data products on the future of operations and IT services across industries.

IDC / IDG

IDC (International Data Corporation) is the longest standing, global and independent technology market research and advisory firm in the world. As of 2018, our global team of 1,100 analysts have been providing the strategic insight, guidance, and validation our clients require, going on more than 54 years. IDC is leading the industry in helping our clients digitally transform their organizations to become "Digital Native" organizations. We've been doing this through DATA, data with insight to drive/achieve successful business outcomes. Every year IDC conducts over 350,000 new primary (demand-side) end-user surveys around the globe. This data-driven research in combination with our peer- & market-driven research, offers IT & business leaders the data/insight and validation they require to make the best possible decisions, empowering them to achieve the critical business outcomes these IT and LOB leaders are charged with delivering. IDC is a wholly owned subsidiary of IDG (International Data Group), the world's leading technology media and events company. IDG is the well-renowned events side of our company - They produce globally recognized brands such as: CIO / CIO.com CSO ITworld ComputerWorld NetworkWorld ...and many others you have likely heard of or are familiar with.

Information Handling Services and Markit were two very well-regarded consultancies which agreed a “merger of equals” back in 2016. The combined IHS Markit generated almost $4 billion a year and has about 13,000 employees worldwide. The reason why we’ve placed IHS Markit at the top is that, while it does provide traditional consultancy services, it has a huge range of software on offer, and can build custom applications for clients. Even though the underlying business is full of complexity, its presentation makes accessing its services seem simple and immediately useful.

Cast from the “Tech” capabilities at Informa and UBM, as well as from the recent acquisition of the majority of the IHS Markit Technology research products & solutions portfolio, Informa Tech is a market leading B-to-B information provider with depth and specialism in the Information and Communications (ICT) Technology sector. We're a global business of more than 1.000 colleagues, subject matter experts in the markets we cover and serve, operating in more than 20 markets. Our purpose is to inspire the technology community to design, build and run a better world… and we do this by informing, educating, and connecting those communities via our research, digital media, events and training products and services. We offer an unrivalled reach to decision-makers in the technology marketplace, leveraging over 100 recognized and trusted brands, including AfricaCom, Black Hat, Broadband World Forum, GDC, InformationWeek, Interop, Light Reading, Ovum, and The AI Summit. Every year, we welcome 14.000 subscribers to our research, nearly 4 million unique visitors a month to our digital communities, over 18.200 students to our training programs and 225.000 delegates to our events.

ISG is steeped in technology and is particularly interested in advanced technology such as automation, robotics and autonomous transport systems. Augmented and virtual reality also gets a lot of attention at ISG. In summary, ISG, like all of the consultancies on this list – and the many we have not mentioned – is preoccupied with digital transformation, moving from the old world into the new. What many may be wondering is whether moving to the new world required severing our connections with the old world, or whether the two can be bridged, and if so, which areas of the old economy will remain?

NelsonHall is the leading global analyst firm dedicated to helping organizations understand the 'art of the possible' in IT and business services. Our IT services (ITS) research helps organizations understand, adopt, and optimize adaptive approaches to IT services that underpin and enable digital transformation within the enterprise. And our business process services (BPS) research helps organizations understand, adopt, and optimize the next generation of digital models for business processes. Founded in 1998, and with analysts in the U.S., U.K., and Continental Europe, NelsonHall provides buy-side organizations with detailed, critical information on markets and vendors that helps them make fast and highly informed sourcing decisions. And for vendors, NelsonHall provides deep knowledge of market dynamics and user requirements to help them hone their go-to-market strategies. NelsonHall's research is based on rigorous, all-original research, and is widely respected for the quality, depth and insight of its analysis. We work closely with our clients to create a value-based relationship founded on our unrivalled knowledge of ITS and BPS markets, acting as a trusted

Nucleus Research is the only provider of case-based technology research. We deliver the insight, benchmarks, and facts that allow our clients to make the right technology decisions, every day. Our research approach builds on in-depth assessments of actual deployments allowing our analysts to provide technology advice built on real-world outcomes.

100% independent of enterprise resource planning [ERP] software vendor affiliation, Panorama offers a phased and integrated approach to strategy alignment and execution, enabling each client to achieve their unique vision. We offer the flexibility of either a top-down strategic approach, or a bottom-up tactical approach to our clients’ projects, depending on each client’s unique business transformation objectives.

Parks Associates has been established since 1986, but it has seen strong growth in the past couple of years. One of the reasons for this growth is its concentration on digital technologies for the home – whether its smart televisions, smart speakers, smart doorbells, or any other smart home device or appliance. Some tech observers say that household items will become more and more “intelligent”, in that they will integrate more chips and sensors, and, inevitably, they will collect more data – about the machine itself as well as its environment. This places Parks in the position of monitoring a massive and growing market.

Peer Insights (Gartner)

Get free access to the insight and real-world experience of more than 23,000 peers at enterprises like yours. Reviews are rigorously vetted by Gartner, the world's leading research and advisory company — no vendor bias, no hidden agendas, just the real voices of enterprise users. Explore alternatives and lessons learned at every stage of the buying process through in-depth reviews and ratings.

Altimeter helps leaders thrive by providing research and advisory on how to leverage disruptive technologies. Our analysts take a holistic, yet pragmatic approach to understanding the intersection of technology and the human side of business.

Solutions Review brings all of the technology news, opinion, best practices and industry events together in one place. Every day our editors scan the Web looking for the most relevant content about Endpoint Security and Protection Platforms and posts it here.

Technology Business Research

Supporting Growth & Transformational Decisions with Business Data & Insight. We advise global IT, telecom and professional services companies, informing their business decisions to enable their growth and success.

Acquired (15) Analyst Firms (no longer covered)

- AMR Research

- Acquired by Gartner in 2009

- Burton Group

- Acquired by Gartner in 2009

- Feedback Now

- Acquired by Forrester in 2018

- Fletcher Research

- Acquired by Forrester in 1999

- FORIT

- Acquired by Forrester in 2000

- Giga Information Group

- Acquired by Forrester in 2003

- GlimpzIt

- Acquired by Forrester in 2018

- Jupiter Research

- Acquired by Forrester in 2008

- Machina Research

- Acquired by Gartner in 2016

- META Group

- Acquired by Gartner in 2005

- Senex

- Acquired by Gartner in 2014

- Sirius Decisions

- Acquired by Forrester in 2018

- Springboard Research

- Acquired by Forrester in 2011

- Strategic Oxygen

- Acquired by Forrester in 2009

- Yankee Group

- Acquired by 451 Research in 2013

Wrap-up

So, how do you think we did on this list? Do you agree with our Top 5? Do you agree that Gartner, Forrester and IDC are pay-for-play firms that are too cozy with the supplier community to be trusted for objective analysis? Is there anyone in our Top 5 who you don’t think deserves to be there? Are there any great, objective firms out there that we missed that you think should be in our Top 5? We would love to hear from you so Sound Off!

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.