The end of year mania is underway as sales professionals from some of the largest tech companies on the planet try to capture and fill their Q4 quota. When such a substantial portion of a sales rep’s income rests on their ability to separate company dollars from your budget, it’s no wonder we often witness such unbridled aggression this time of year. It can be personally traumatic for salespeople as they sit in their weekly (sometimes daily) sales meetings with their respective teams, while management tears apart their sales opportunities and deals often in front of their peers with questions like:

- What is the status of deal x/update on probability to close this quarter?

- Who is the decision maker/what is your relationship currently?

- Do they have budget/what are the objections?

- What leverage have we employed/increased pricing, access to new products, audits, etc.?

- Do we have a personal relationship anywhere in the organization?

- Have we made our best offer/discount/add-on services, etc.?

You get the idea. Most technology buyers reading this will recognize these questions as eventually they are the target of the ensuing barrage of calls and emails that are directly related to the above. What is surprising however, is the frequency with which these strategies work to sell more ‘stuff’ at the end of the year. Is it because we feel sorry for these poor, struggling teams of sales professionals and find ourselves sympathetic and generous as the holidays approach? Probably not.

More likely however, is the fact that organizations like Salesforce, IBM, Oracle, SAP, and many more spend hundreds of millions on sales training and marketing that are all designed to make you feel a certain way about their products and the people selling them. A quick look at the numbers show this quite clearly:

- Microsoft 2020 Revenue: $143B USD, Profit: $44.2B USD

- Oracle 2020 Revenue: $48BB USD, Profit: $14.6B USD

- SAP 2019 Revenue: $33.4B USD, Profit: $7.6B USD

- IBM 2019 Revenue: $77.1B USD, Profit: $9.4B USD

- Salesforce 2019 Revenue: $13.2B USD, Profit: $1.1B

(note: above represents GAAP net profit)

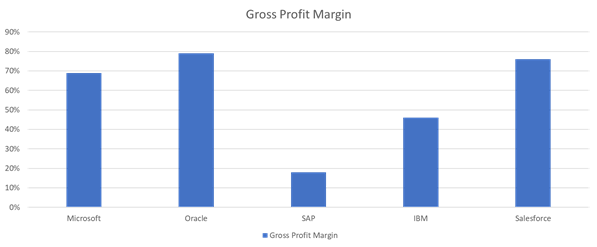

In case you were wondering about gross profit margin, most of the companies above are starting out from a good place: (source: https://ycharts.com)

According to a report by the New York University, Stern School of Business, out of 95 market segments Software (Systems and Applications) was amongst the top 10 in gross profit margin. When factoring out Banks and Financial Investment segments, this group has the 2nd highest gross profit margin of any industry.

What does this financial snapshot mean for you? What it demonstrates in part to us, is that most industries are overpaying technology companies. As the fiscal year ends for many of these firms, now is the time they will pad their profits and bottom lines, most often at your expense but dressed up as some great deal for you.

Below are some of the most time-honored ways that tech suppliers will try to leverage year-end sales strategies to drive their own bottom line:

1: Buying Deadlines

You’ve likely heard it before, “Buy now, and the increased discount is available until the end of the quarter. After that, the discounts are half.”

Your response to this should be….nothing. When this type of ultimatum is put in front of you, we suggest you ignore it and pursue a strategy that aligns with optimizing your deployment and budget. The message back to the supplier should be very simple – that you pursue relationships that are aligned with the long-term interests of our objectives. Deadlines that are meant to pressure your company into snap decisions have nothing to do with the interests of the company, but rather the supplier’s end of year pipeline.

You can most certainly turn the tables on these deadlines and take advantage of proposals to be sure, but you must remember that any offer is always in the best interest of the supplier – not your company.

2: Blank Checks for Future Spend

“Listen, we know you’re going to buy more technology next year, so go ahead and spend your left-over budget dollars with us now, and we will hold it as a credit, which will enable us to fill in the products at a later time once we have all the details.”

This can sound appealing, but beware the pitfalls:

- Lock in – often these lead to lock in on products and services you may or may not actually need or use

- Inflation of future values – they can make your future credits worth less than it is today in real dollars

- Change – technology roadmaps, staff, budgets and so much more can change which renders today’s decision and huge mistake next year

This scenario simply gives too much leverage to the supplier in most cases to be worth it.

3: Pricing Too Good to be True

“You will never see discounts and pricing this good again.”

Remember all those revenue numbers we discussed at the beginning? Suppliers always find a way to make it back from you:

- Raising implementation charges

- Higher service and support costs

- Added miscellaneous fees

- ‘Erroneous’ billing

- Holding back options within products or services

We often find that these ‘once in a lifetime’ deals are stuffed with unneeded things, are restrictive in their use covenants, and/or end up causing more problems long term. In super rare cases, where a purchase is already fully thought out and cost justified, and the client is planning on making the purchase anyway at the previously proposed price, the ‘waiting game’ can add some value if you are lucky enough to find yourself in this situation, but that is a rarity.

4: Audits, Audits, Audits

“Sorry to see that our audit has uncovered so many unlicensed users. The penalty is substantial, but we are willing to work with you in consideration for incremental product purchases (usually cloud related).”

You only need to google for stories of supplier software audits launched whose sole purpose is to gain sales leverage. Oracle has made it a science in using audits to leverage clients into new purchases to avoid paying penalties. If your own business isn’t driving you into the arms of the supplier, they will look for ways to drag you.

There are several strategies that can be employed before, during and after audits to mitigate your risk and exposure. NET(net) has successfully worked with clients to turn audit events into a win for all parties, without mortgaging their future IT roadmap.

5: Increased Sales Incentives for Sales Reps

“Any cloud deals that close in Q4 will be recognized at twice the actual revenue (or words to that effect) and contribute to quota retirement.”

That is music to the ears of any sales professional. While there is tremendous pressure for them to close deals by year end, offering a carrot along with the stick has proven very successful over the years. If you can double your commission payments by closing new cloud deals, do you think they really have your best interest in mind? Or are they (salespeople) motivated to close business wherever they can? In addition, you must remember that there are hundreds of sales training courses and techniques that salespeople have taken part in, which is 100% geared toward using all levers available to close a deal: business, personal and emotional.

Lastly, please remember that technology companies spend millions training salespeople to master these techniques on a recurring basis and are paid handsomely to succeed. Take a quick example from Miller-Heiman, a global sales training firm’s own web page:

“Benefits of SPIN® Selling Training Courses:

- Uncover Buyer Urgency - Tailor conversations to expose buyer pain points, igniting a sense of urgency that causes customers to take action.

- Tackle Buyer Skepticism - Hone the skills you need to address and overcome buyers' hesitations or concerns during the sales process.

- Increase the Value of the Sale - Explore unrecognized needs, developing customer buy-in to highlight and grow the value of your solutions.

- Accelerate the Sales Cycle - By encouraging customers to actively engage in each stage of the sale, you’ll mitigate lengthy sales cycles.”

These five fiscal year-end strategies in the context of supplier profits should give any technology buyer pause and spend additional due diligence before entering into any agreement in Q4. Since our founding in 2002, NET(net) has seen every technique used by technology suppliers and knows how to work with them. Contact us if you find yourself in any of the above situations, or just need some advice on how to optimize your technology agreements, investments and relationships.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.