Table of Contents:

Intro – Here’s How You Can Save 30-93% on your Bloomberg Costs

The name Bloomberg conjures up images of the Night King himself, but also of the market dominance in the Financial Services industry, of its flagship product, the Bloomberg Terminal. Just whispering the Bloomberg name also sends shivers up the spines of their customers when they think about the exceedingly high costs weighed against the apparently insatiable demand coming from their own traders and the seemingly impossible task of making a dent in the massive cost structure. If you have any doubts about how difficult this can be, just have procurement try to take away one of the iconic dual screen Bloomberg Terminals from a top trader who makes your company millions and millions of dollars by doing deals on his machine and see what happens.

difficult this can be, just have procurement try to take away one of the iconic dual screen Bloomberg Terminals from a top trader who makes your company millions and millions of dollars by doing deals on his machine and see what happens.

However, while the Wight's of Bloomberg will still fight to the end of mother earth to protect their margin, the army of the dead is not as invincible as it once seemed. The Bloomberg empire is crumbling and may very well become one of the most high-profile casualties of the digital transformation era, succumbing to the advance of modern civilization, as victims of their own success.

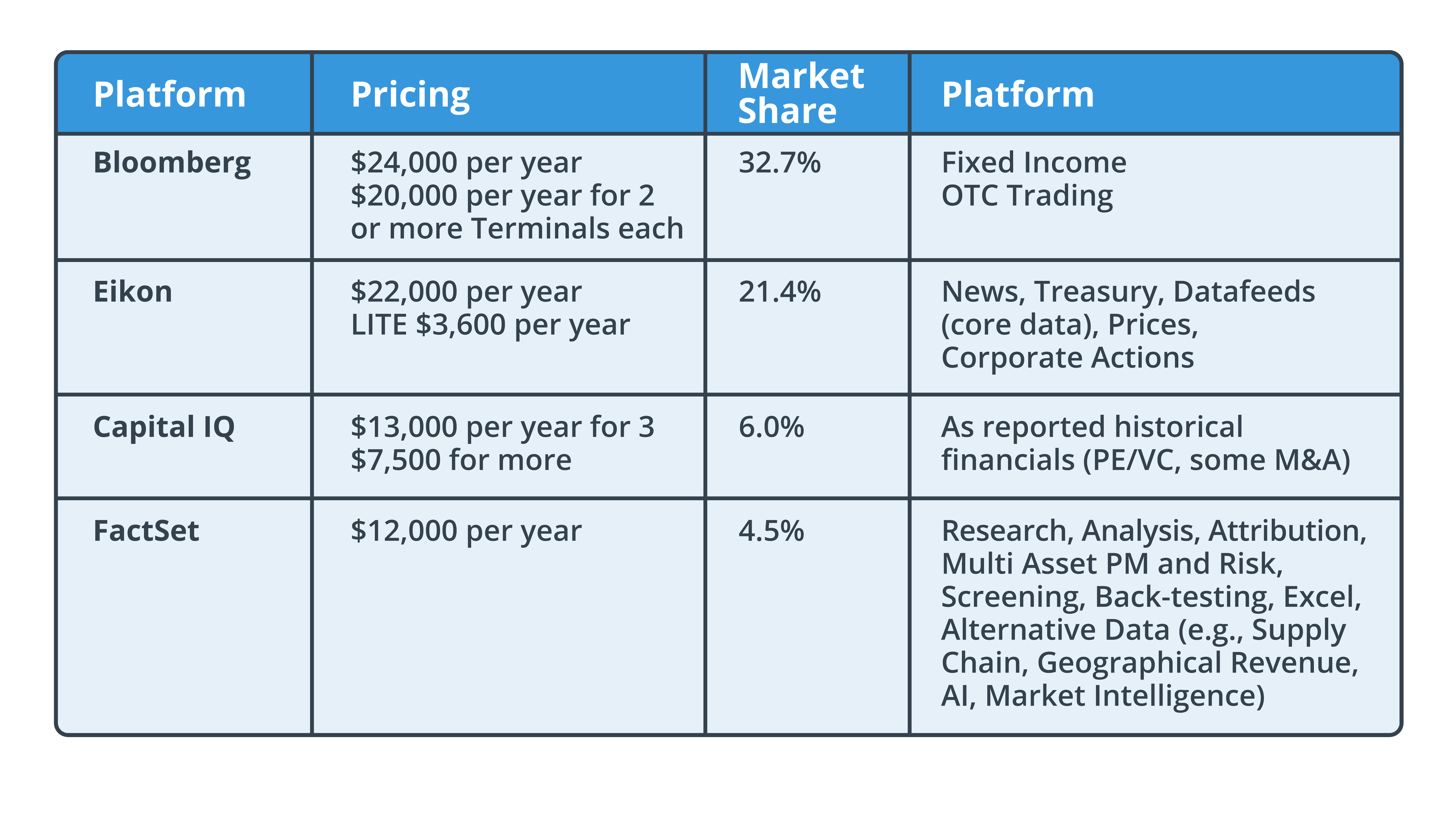

At $24,000 per Terminal, it is easy to see how costs can quickly skyrocket. With a hundred traders or more, customers can easily see costs spiral into the millions or even tens of millions annually.

Bloomberg customers have long tried to negotiate volume discounts and other concessions with little to no success. Bloomberg is famously proud of their ice spear of ‘no discounting’, infamously arrogant and dismissive of customer discontent, and apart from a few special programs (such as Education; where schools that commit to 3 Terminals can get up to 9 additional Terminals at no additional cost), you would certainly need magic dragon-glass to get a discount.

There are those who say winter is coming, and the long dark cold night of Bloomberg dominance will continue for all time, but we say, you know nothing Jon Snow. Winter is almost over.

Read on to find out why.

Background

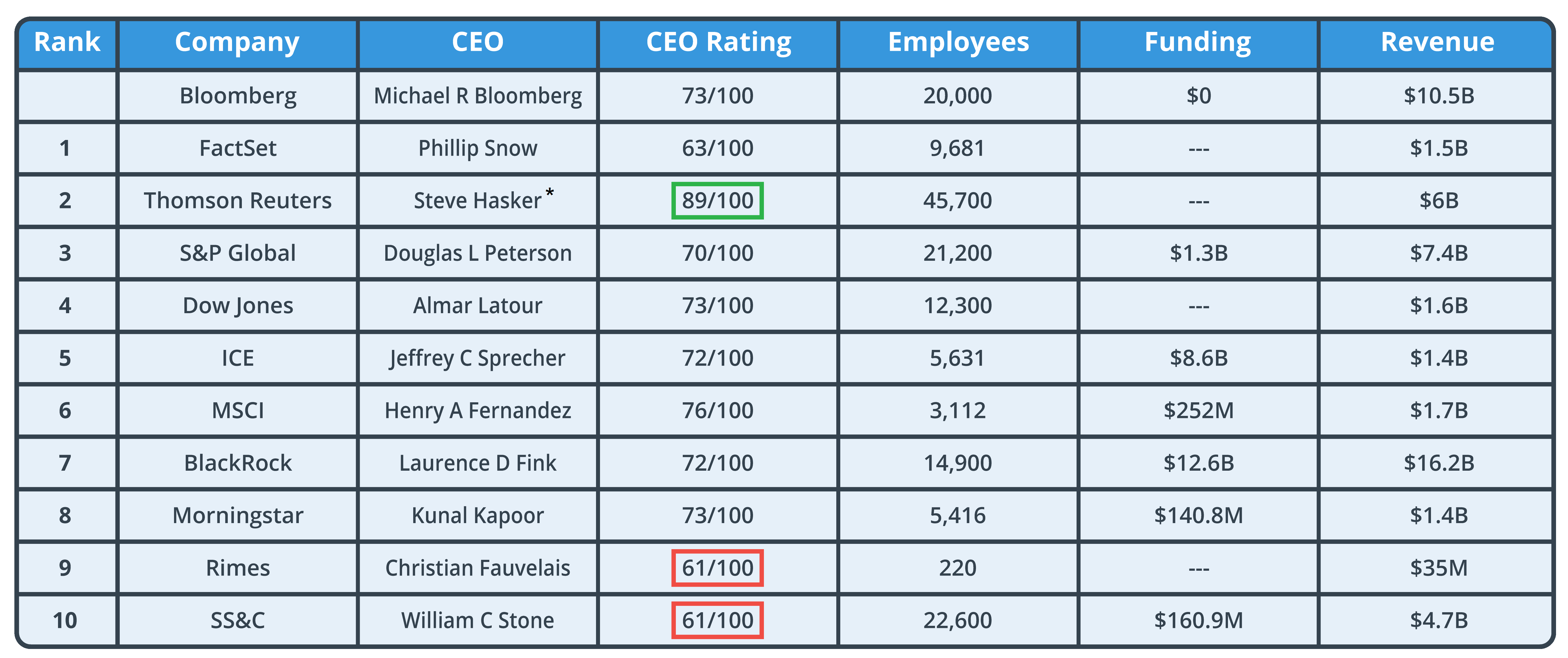

Bloomberg is a privately held financial, software, data, and media company headquartered in Midtown Manhattan, New York City with 167 locations, 20,000 employees, and 325,000 users (mainly traders, analysts, and brokers) on its platform. It was founded by Michael Bloomberg in 1981, with three other partners and a 12% equity stake by Merrill Lynch (Bloomberg’s first customer). With an 88% ownership stake in the company, the 79-year-old Michael Bloomberg has a net worth of roughly $55 Billion and ranks #14 on Forbes list of billionaires, making him one of the richest people in the world.

Bloomberg provides financial software tools and enterprise applications such as an analytics and equity trading platform, related data services, and financial news through its flagship product (the Bloomberg Terminal) via its Bloomberg Professional Service.

Bloomberg is a privately held company, and financials can sometimes be difficult to obtain, but according to a Business Insider report, the company generated more than $10 billion in revenue in 2018.

In addition to a wildly successful financial data services technology company, Bloomberg also has:

- A wire service (Bloomberg News)

- A television network (Bloomberg Television)

- Radio Stations (Bloomberg Radio)

- Two magazines (Bloomberg Businessweek and Bloomberg Markets)

- Subscription-only newsletters, a mobile app, and countless websites

But most of the revenue it produces comes by way of the Professional Service Terminal business. In fact, Investopedia says the Bloomberg Terminal has, in the past, accounted for as much as 90% of its annual revenue. However, a more recent report conducted by analyst Jennifer Milton says that Bloomberg’s Terminal business was 76.6% of all company revenues in 2018.

If you do the math on this, Ms. Milton’s analysis appears to bear out. At a claimed user count of 325,000 users at $24,000 per year, that is $7.8 Billion of annual revenue (74.3% of the $10.5 Billion in Revenue).

Giving credit where credit is due, when it first arrived in 1982, the Bloomberg Terminal completely revolutionized Wall Street with its ability to deliver live data with a few keystrokes. Traders eliminated the time and expertise required to access data, perform analysis, and visualize results, which made them able to trade more, faster, and with higher confidence. The Bloomberg Terminal increased Wall Street’s efficiency and efficacy, significantly contributing to decades of growth. The markets responded with higher levels of volume and sophistication, soon developing new instruments like derivatives and more complex markets. It is not an over-statement to say that the Bloomberg Terminal played a key role in the modernization of Wall Street, moving it from a manual industry to an automated industry.

Market Summary:

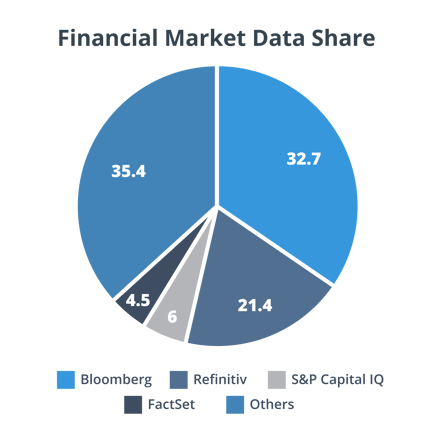

For market data, the Bloomberg Terminal continues to dominate the market with a share of 32.7%, compared to 21.4% from Refinitiv Eikon (formerly Thomson Reuters), 6% from S&P Capital IQ, 4.5% for FactSet, and 35.4% for all others combined.

Other competitors include online database suppliers and integrators and their applications, such as MSCI, Morningstar, RIMES Technologies, and thousands of micro data providers.

sources: ft, finextra.com, wallstreetprep.com

Bloomberg remains the indisputable market leader within equity research and fixed income with buy- side clients. And because the buy-side ultimately pays for everything else in the financial industry, they have a certain amount of power to dictate what everyone else uses for research, analysis, and especially communication.

This can seem like an insurmountable barrier to entry. However, the greatest strength of Bloomberg (its market dominance) is also its greatest liability in that it only takes a few key institutions to change their approach, and the ubiquity of Bloomberg falls apart. In addition, the complexity of the four decades old mainframe style interface is cringe-worthy when compared against the slick new interfaces of modern tools whose ease-of-use and functionally comparable solutions are available at only the fraction of the price of a Bloomberg Terminal.

Current Market Conditions:

When it comes to pricing, Bloomberg is extremely expensive, and certainly, there are cheaper options available, but advocates claim that Bloomberg has a moat of market advantages such as its market presence and chat feature giving users the ability to instantly connect with any other Terminal user.

It is that market prevalence and fraternal connection to other users that makes having a Bloomberg Terminal not only a status symbol, but also a nearly indispensable luxury to users who need to have immediate access to the institutions and traders that move markets.

Bloomberg’s share of the market has fallen from 57% in 2016 to 33% now; a precipitous decline of 42% in the last four years, indicating the market is changing and moving away from monolithic all-inclusive platforms. This signals a shift towards more specialized providers that offer high value, low costs solutions that are also built on nimble platforms, and offer elegant interfaces.

The weakening of Bloomberg’s dominance comes as smaller rivals push easy to use, modern, and powerful SaaS alternatives that are ‘desk-less’ and do not require a large investment in a physical terminal that is tied to the office – something of particular interest in this changing WFA (work-from- anywhere) world. The Terminals have become less attractive as clients migrate to alternative chat services such as bank-backed Symphony - something Bloomberg recently sought to address by unbundling its own chat service.

The financial market data and analysis story continues to be one of seemingly unending demand for the information and tools necessary to perform the job functions while ensuring regulatory compliance.

Although, markets are quickly changing as technology advancements threaten the very existence of human traders, thus rendering the business case of the Bloomberg Terminal moot.

Bloomberg in Disruption

The financial industry is facing enormous disruption as modernization and transformation efforts abound. Bloomberg is under siege from competitive pressures, government regulations, and revolutionary changes such as how AI is threatening to change the way deals are done.

In the past, the Bloomberg cost containment efforts were somewhat limited to good asset management and centered around optimizing the use of the Terminals across a decentralized organization. Why enter into a new Terminal agreement if there are Terminals idling somewhere else in the organization that can be repurposed?

While such an approach still makes sense, clients have gotten more serious about being disruptive in their thinking about how they go about reducing costs on Bloomberg and have been increasing their investments with specialized providers, steadily chipping away at Bloomberg’s monolith.

As an entrenched market leader with a moat of features to protect its position, Bloomberg has been highly resistant to change that might cannibalize its Terminal business, which has made it extremely vulnerable to market disruption.

Below are just 5 disruptions to Bloomberg’s model...

One: Use Case – One of the key challenges Bloomberg faces is that the Terminal offers several thousand functions for all manner of data and analysis, and only a tiny portion of Bloomberg users utilize more than a ‘small percentage’ of those available functions. As a result, customers feel like they are paying a significant cost for something that is wildly under-utilized.

Two: Competitive Market - The competitive market is robust, feature rich, and highly specialized. Depending on the use case, you may be able to find a solution that costs a lot less and gives you as much or even better value than Bloomberg.Pro Tip: In most cases, there will be another option to source the data and analytics you are getting from Bloomberg from a firm that is solely focused on the space you need. Their tools and information will be every bit as good, or even better and more accurate than what Bloomberg can offer, and it is usually offered at a fraction of the cost. Most customers with Bloomberg Terminals even end up hiring these supplemental firms to complement the analysis they already get from Bloomberg. For example, those interested in oil & gas can use the Bloomberg BMAP function to track natural gas shipments but must pay the full $24,000/year to access the Terminal. Whereas Bluegold Research, on the other hand, offers virtually the same information for $720/year — the clear choice for individuals looking only for access to that specific dataset.

- As always, it depends on what you are looking for. Certainly, there is a wide variety of functionality similar to that of Bloomberg that can be found on other applications.

- By taking a look at Bloomberg’s Top 10 competitors, you will see that the comparative size of Bloomberg gives them a significant advantage, but you will also see that the revenue production per employee is off the charts at $525,000 – indicating that their solution is wildly (and perhaps unnecessarily) expensive. I am also amazed at the mediocre and even poor CEO ratings.

- Beyond this list, there are some very good alternatives out there all doing their best to disrupt this market such as:

- Symphony – Chat

- Money.net – News & Charting

- Estimate – Crowdsourcing

- Briefing.com – Real Time Data

- Sentieo – Financial & Corporate Research

- Telemet Orion – Market Data

- YCharts – Web-based Research Data Service

- Zack’s - Stock research, Analysis and Recommendations

- And thousands more

- Over the last 6 years, general spending in financial market data continues to climb, but Bloomberg’s market share continues to shrink in part due to the specialization and availability of new market entrants with extremely good solutions at very low costs.

- Bloomberg certainly enjoyed a long and healthy runup during the 80s, 90s, and even early 2000s, cementing their position as the market dominant force.

- However, after the Global Financial Crisis (GFC) of 2008, new regulations emerged that required banks and other financial institutions to: a) Maintain better liquidity b) Spend less on new tooling and c) Cut costs wherever possible.

- Obviously, two of the three regulations have a direct impact on Bloomberg

- During the economic downturn that followed the GFC, major institutions like JP Morgan and Bank of America publicly announced plans to cut some 7,000 Bloomberg Terminals, the equivalent of about $175,000,000 per year from just these two customers.

Four: The BNF Network aka Bloomberg News Fossil – The Bloomberg Terminal was, in effect, a news machine from the very beginning, reporting on price and yield discrepancies in real time, enabling nimble traders to gain first mover market

- Past: In its prime, Bloomberg News was an influential source of information on markets, technology, business, and government around the world, and, buoyed by revenue from its Terminal business, Bloomberg News was expanding. With many reporters focused on financial and business news, and by breaking the news to Bloomberg Terminal subscribers first, it is easy to see why this was a complementary advantage.

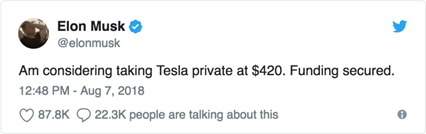

- Present: However, in the modern world, live or breaking news is no longer broken by reporters on Bloomberg Terminals and then on Bloomberg News, rather now on social media sources like Twitter.

- News is now analyzed by big data engines and sophisticated algorithms that scan the news to not only detect market moving conditions, but also to trade on them – instantly; much faster than any human could with or without a terminal. Latest example: ETF launched March 4th 2021, ticker BUZZ, which seeks to “track the performance of the 75 large cap U.S. stocks which exhibit the highest degree of positive investor sentiment and bullish perception based on content aggregated from online sources including social media, news articles, blog posts and other alternative datasets”.

- Therefore, the reason we refer to it as the Bloomberg News Fossil, is because it is prehistoric in that there is no more opportunity to make money on trades that involve the marginal advantage gained by receiving ‘breaking news’ on the Terminal.

- Further, even if there are still ‘old-school’ traders out there who want to trade this way, there are a plethora of other services available.

Five: Bloomberg’s (un) Lucky 11: AIs Role in Trading – The winds of change are blowing, and it is not good news for Bloomberg. Eleven points to consider:

- As noted above, the Role of Artificial Intelligence (AI) is expanding in the financial services arena, especially in the areas of news, data aggregation and trading, Bloomberg strongholds all.

- One example is Nordea Bank, whose CEO replaced 6,000 traders with robots using big data tools and advanced algorithms, which lowered costs, improved performance, and expanded profitability, providing proof that the human trader is in serious jeopardy.

- Artificial intelligence is to traders what fire was to cavemen. According to a recent study by U.K. research firm Coalition, electronic trades account for almost 45 percent of revenues in cash equities trading. And while hedge funds are more reluctant when it comes to automation, many of them use AI-powered analysis to get investment ideas and build portfolios.

- AI is shaping the future of stock trading. Using AI, robo-advisers analyze millions of data points and execute trades at the optimal price, analysts forecast markets with greater accuracy and trading firms efficiently mitigate risk to provide for higher returns.

- When Wall Street statisticians realized they could apply AI to many aspects of finance, including investment trading applications, they could effectively crunch millions upon millions of data points in real time and capture information that current statistical models could not.

- Both sell side dealers and buy-side asset managers are increasingly relying on AI applications to price fixed income securities in live trading and automate part of their daily workflows. For example, Greenwich Associates report published in September 2020, estimates approximately 45% of the European bond market is currently traded electronically, compared to 38% a year ago.

- Smart Order Routing (SOR) has been enabling automation in equity asset classes for two decades and is now poised to enhance fixed income trading automation.

- Increases in fixed income electronic trading volumes have driven enhancements in trading desk operations over the previous five years, making the lives of traders easier in today’s natively digital world. Trading workflow enhancements that automate trading tasks, such as pricing automation and SOR to different electronic trading venues, have lagged. This has largely been due to the difficulty to aggregate disparate data streams coming from multiple-venues and data-sources in real-time, which is necessary for algorithms to perform automated trading tasks with precision.

- SOR AI algorithms bridge the gap between the data aggregation layer and electronic venues, resulting in a simplified trading process.

- If the future of the human trader is in jeopardy, and the process of aggregating data for human review is intermediated, then how much more is the risk of losing the social network that drives Bloomberg’s virtual monopoly?

- In today’s modern world, trading decisions are increasingly left to highly sophisticated software agents that are expertly tuned to discover marginal advantages that can be exploited in real time. As trading tools get better and better, and the algorithms get smarter and smarter, they will eventually all but replace the institutional investor, eliminating the need for Bloomberg Terminals in the process.

I will mention 5 watershed events over the years that our clients often mention when we talk to them about their Bloomberg relationship.

1. Private Chats?

Bloomberg’s brand took a beating when it was determined that Bloomberg News employees were reading the transcripts of Bloomberg users’ chats to gain insights that could be deemed as newsworthy. This was a significant violation of trust that called into question whether Bloomberg was a private and secure industry platform for critical deal communication, or a spying tool that could be used to generate news that would be boost the reputation and earnings of the Bloomberg news desk.

2. The Spiked China Story

Another Bloomberg scandal involved the company killing a story about the accumulation of wealth by corrupt Chinese government officials. Bloomberg leadership extinguished the story due to concerns of retaliation that would put a moratorium on Bloomberg Terminal sales in China, and perhaps get Bloomberg News expelled from the country – neither outcome acceptable to management. This of course outraged the employees involved and prompted the resignation of the News editor who resigned in protest due to the poor handling of the story. This raised serious concerns from subscribers about the company’s willingness to bury legitimate news stories and potentially hurt market makers if the outcomes of those stories would interfere with the commercial interests of the Bloomberg empire.

There may have been good cause for concern as a previous unflattering story prompted China to order state institutions not to subscribe to Bloomberg Terminals.

3. Toxic Culture

Court records reveal that at least 17 women have taken legal action against Bloomberg for fostering a frat-like sexist culture that degrades women.

Many unsavory comments have been attributed to Mr. Bloomberg himself, and some of those were commemorated in a ‘gift book’ he received from colleagues. Of particular interest was some apparent instruction to female sales representatives, that stated, “Make the customer think he’s getting laid when he’s actually getting f*cked”. The second part of that quote unfortunately resonates with many of Bloomberg’s customers.

According to New York attorney Bonnie Josephs, who represents former employees who are or were litigants, “The atmosphere was toxic and harassing” at Bloomberg.

4. Silencing Critics

Bloomberg also has a reputation of taking extraordinary measures in trying to silence critics. We all remember Elizabeth Warren’s takedown of Bloomberg’s use of NDAs to silence women who were claiming sexual harassment and/or a hostile work environment, but others have come forward as well. Former Bloomberg reporter Mike Fincher, part of the award-winning team that investigated the accumulation of wealth by China’s ruling class was suspended, and later fired, after speaking out on the killing of the China story and (like the rest of the reporters involved), remains forever bound by an NDA, not able to speak on the topic. Bloomberg did not stop there, however, they also sought to keep the *spouse* of one of the reporters quiet too.

"They assumed that because I was the wife of their employee, I was the wife," Author and Journalist Leta Hong Fincher told NPR. "I was just an appendage of their employee. I was not a human."

5. Political Activism

- Finally, it was revealed that Bloomberg would also engage in what many consider to be political activism when it announced that it would not be doing any investigative reporting on Michael Bloomberg (or any of his Democrat rivals) during the presidential primary but would continue to do negative stories on Donald Trump.

- Employees were gob smacked. Editor-in-Chief John Micklethwait said, “There is no point in trying to claim that covering this presidential campaign will be easy for a newsroom that has built up its reputation for independence in part by not writing about ourselves.”

- The former editor of Bloomberg Businessweek labeled the decision “staggering” and said that journalists at Bloomberg News “deserve a hell of a lot better than this.”

- Customers viewed the move as one that exposed Bloomberg to be a political organization, rather than an impartial and dispassionate conveyor of the news.

- All these events further eroded the trust Bloomberg once enjoyed with its customers and has made clients weary of continuing to invest with Bloomberg.

As a result of these and other factors, clients have gotten serious about reducing costs on Bloomberg and have been increasing their investments with alternative and specialized providers, steadily chipping away at the monolith of the Bloomberg Terminal, and hence, its dominance.

The Failure to Innovate

Competitors, firms with greater specialization, and even startups all recognize that the financial world has changed, and in response, are innovating to create flexible solutions that create greater value. Even the slowest governments around the world are making efforts to foster upstarts and incubate FinTechs as they introduce new solutions that offer greater value for less cost. Bloomberg, on the other hand, has not made a significant change to the Terminal since inception in 1982, and instead, relies wholeheartedly on its market dominance to maintain its leadership position.

Their over-reliance on the Terminal has handcuffed Bloomberg’s ability to innovate, as it would have a detrimental and cannibalizing effect on its Professional Services. By maniacally focusing on the Terminal as the center of all things Bloomberg, they have tied themselves to a sinking ship. For example, customers for years had asked for access to the chat platform ‘Instant Bloomberg’, but it was not until Symphony (a company trying to become a viable financial services industry / social media alternative to Bloomberg) took direct aim at their instant messaging capabilities while generating a growing market presence, that Bloomberg finally caved to competitive pressures to unbundle chat as a separately available subscription.

As modern firms further enable the industry with crowdsourcing, machine-learning, artificial- intelligence, sophisticated algorithms, embedded analytics engines, and modern data visualization layers, it will be difficult for Bloomberg to keep pace, as its desire to protect its massive Terminal base becomes the albatross around its neck.

Even as the culture of finance has become more technologically advanced, more open and collaborative, more integrated with the rest of the world, and less insular as an industry, Bloomberg remains stubbornly committed to a monolithic legacy architecture that embraces tyranny rather than liberation.

For decades, the Bloomberg Terminal was the primary source of market data, making it the 800-pound gorilla of the financial markets. However, today, with the advancement of technology and the rise of specialization, there are modern, superior, and much less costly options available at every stage of the process from data production to sentiment analysis, to analytics and visualization, to investment testing, to trading and more.

Instant Bloomberg (IB)

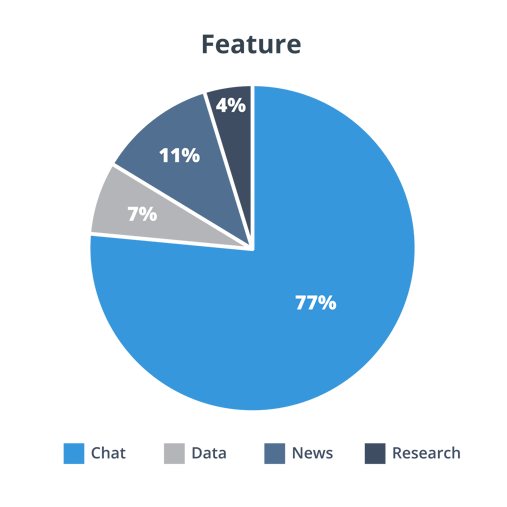

Bloomberg’s Chat Function – called Instant Bloomberg (IB) – is commonly seen as the world’s first (and most expensive) social network and is the primary reason why users insist they must have a Bloomberg Terminal; and it is not even close.

Chat is the overwhelming driver of the Terminal:

For now, financial instruments are still traded by humans through conversation (more on that in a bit), and Bloomberg’s chat function facilitates the lion’s share of that log file. It is estimated that users of Instant Bloomberg (IB) exchange hundreds of millions of messages across tens of millions of conversations every single day.

Even though there are viable alternatives to Instant Bloomberg (IB), competitors have struggled to gain traction primarily because of the pervasive use of IB, but also because the tool comes with embedded security and compliance features that enable the tracking and contracting of transaction arrangements in a way that makes it as easy as sending instant messages.

This has kept Bloomberg in a market dominant position. However, this market dominance has also backfired on them.

In 2013, a scandal involving Bloomberg News bureau employees reading transcripts of Bloomberg clients’ chats resulted in Goldman Sachs and J.P. Morgan seeing an opportunity to make industry communications more private, secure, verifiable, and transparent. That resulted in the purchase of Perzo, and a development effort to turn it into an open-sourced financial messaging app called Symphony, designed to compete head on with Instant Bloomberg (IB) at a very low $15/user/month as opposed to the $2000/user/month of the Bloomberg Terminal.

In addition to Goldman Sachs and J.P. Morgan, Symphony had strong backing from the likes of BlackRock, Citadel, and Maverick Capital, among others, making this a highly credible industry alternative; something the market had to take seriously.

Taking direct aim at Instant Bloomberg (IB), Symphony did quite well, quickly onboarding hundreds of customers and hundreds of thousands of new users.

Because Symphony was such a success, and new market entrants Echofin and Slack were also making inroads to Wall Street, chat alternatives became viewed by Bloomberg as a serious threat to its Terminal business, and to stimy competitive gains and encourage users to stay in the Bloomberg ecosystem, it decided to unbundle its chat feature and compete directly at an even lower price point.

In today’s world, Bloomberg customers (with at least one Terminal) can subscribe to its chat service for $10/user/month – a 99.5% reduction in cost from the $2000 monthly Terminal cost otherwise required if your user insists on having Instant Bloomberg (IB) Chat but don’t use any of the other features (or can live with alternative providers).

Arrogance

As much as traders (especially those on the buy side) love Bloomberg, customers who must pay the bills hate Bloomberg. In virtually every client interaction we have had where Bloomberg is a topic of conversation, our clients tell story after story of how awful the Bloomberg salespeople are, and how they would do just about anything to reduce costs on Bloomberg – except, you know, asking their traders to give up their Terminals.

Probably the most vehement complaint we hear is how the average Bloomberg user only ever uses a few of the thousands of features yet is forced to pay the full price to have access to that large repository of data and analysis because there is only one subscription level. Further, if only there were limited use subscriptions that were appropriately aligned to the consumption patterns of the job codes of their user demographics (and appropriately priced), there could be a good, long-lasting, and thriving partnership.

However, Bloomberg has rejected all such efforts to create such an environment where costs and value would be more aligned to user consumption and is often dismissive about these complaints to the great frustration of their customers. As market options continue to expand, financial institutions are capitalizing on the opportunity to align need and consumption by unofficially unbundling the Bloomberg monolith, which has the added benefit of dramatically reducing costs. For specialized users, Bloomberg’s data is already often subsidized by more focused supplements, causing customers to rethink the need for the terminal in the first place.

Today, the arrogance of the market leadership with equities and bonds investing (the main use cases for the Bloomberg Terminal) is costing Bloomberg its future, as customers are moving away from Bloomberg in virtually every other area. Once the market dominance slides, it is only a matter of time before cheaper, better, and more innovative options take over. So, if Bloomberg does not change its ways, drop its attitude, and develop some meaningful options for its customers, it will only have itself to blame for its ultimate demise.

Help

Would you like our help?

Sophisticated and specialized software-as-a-service (SaaS) options and open-source dashboards have made it possible for any trader to build a Bloomberg Terminal-like financial research portal for a fraction of the cost.

Rather than pay $24,000/year for one package with thousands of functions, the vast majority of which you will never use, you can build your own dashboard with the exact functions you need for an order of magnitude less (or even free with our help).

Yes, it is all possible:

- You can have the analysis you want.

- You can get the market data you need.

- And you can get the price you deserve (which for some, may be zero).

The savings opportunity is incredible, but this is about more than saving money, it is also about transforming to an environment where solutions can be tailored to fit your precise needs, and aligned with your user demographics, giving them tools they need at the price you want.

We are here to help. Our process for Bloomberg cost optimization promises to show you how you can get everything you need and save anywhere from 30-93% with no diminution of business value.

Contact Us for more details.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.