Most clients today use a complicated procedure for processing supplier payments to ensure the process is not only accurate and complete, but also:

- comports with the terms of the commercial agreement

- performs in compliance with the conditions of the contractual agreement

- is done with authenticated trading partners

- isn’t fraudulent or illicit in any way

- is fully auditable

An Example of This Authentication Process:

- A Purchase Requisition is made, signifying the internal demand for the seller’s products and services.

- The terms of a Commercial Arrangement are agreed to, including product, service, and pricing information.

- A Contractual Agreement is made outlining any restrictive conditions relating to the use, timing, delivery, quality, and satisfaction with the solution.

- A Purchase Order is submitted as the official confirmation of an order from a supplier. The document generally includes the products and services, date, description, quantity, price, payment information, invoice address, and a purchase order number.

- A Contract Reconciliation is then generally performed to ensure the Purchase Order comports to the terms of the commercial arrangement and is compliant with the conditions of the contractual agreement before sending the Purchase order to the Supplier.

- The supplier then sends the buyer an Invoice for the purchase, which includes the same information as the purchase order, plus an invoice number, supplier contact information, any credits or discounts, special terms for things such as early payments, payment schedule information, other details such as taxes, and a final total amount due to the supplier.

- Proof of Delivery of the products and services is then provided to the client. If any issues are found, such as inaccurate quantities, wrong prices, damaged goods, or more, payment is not sent to the supplier until the issue is resolved.

- Before a Payment is made, Accounts Payables (AP) reviews the quantities, prices, and terms to ensure that what is ordered (via the Purchase Order) matches what they are being charged (via the Invoice) and there is a proof of Delivery with no objections.

- The Payment Receipt is provided by the supplier and validated by the client. It generally contains the same information as the Invoice, and details what was provided in the order, plus it includes the method and details of the payment.

The goal of this authentication process is to highlight any discrepancies in order to save the company from overspending or paying for products and services it didn’t receive as well as to protect the company from any vulnerability it might otherwise face by not taking the proper steps to ensure compliance with its own internal best practices.

Preface

Invoice processing, and invoice fraud by proxy, are the biggest threats to client money out there today. Just look at Facebook and Google who were victims of $100M payment scam this year.

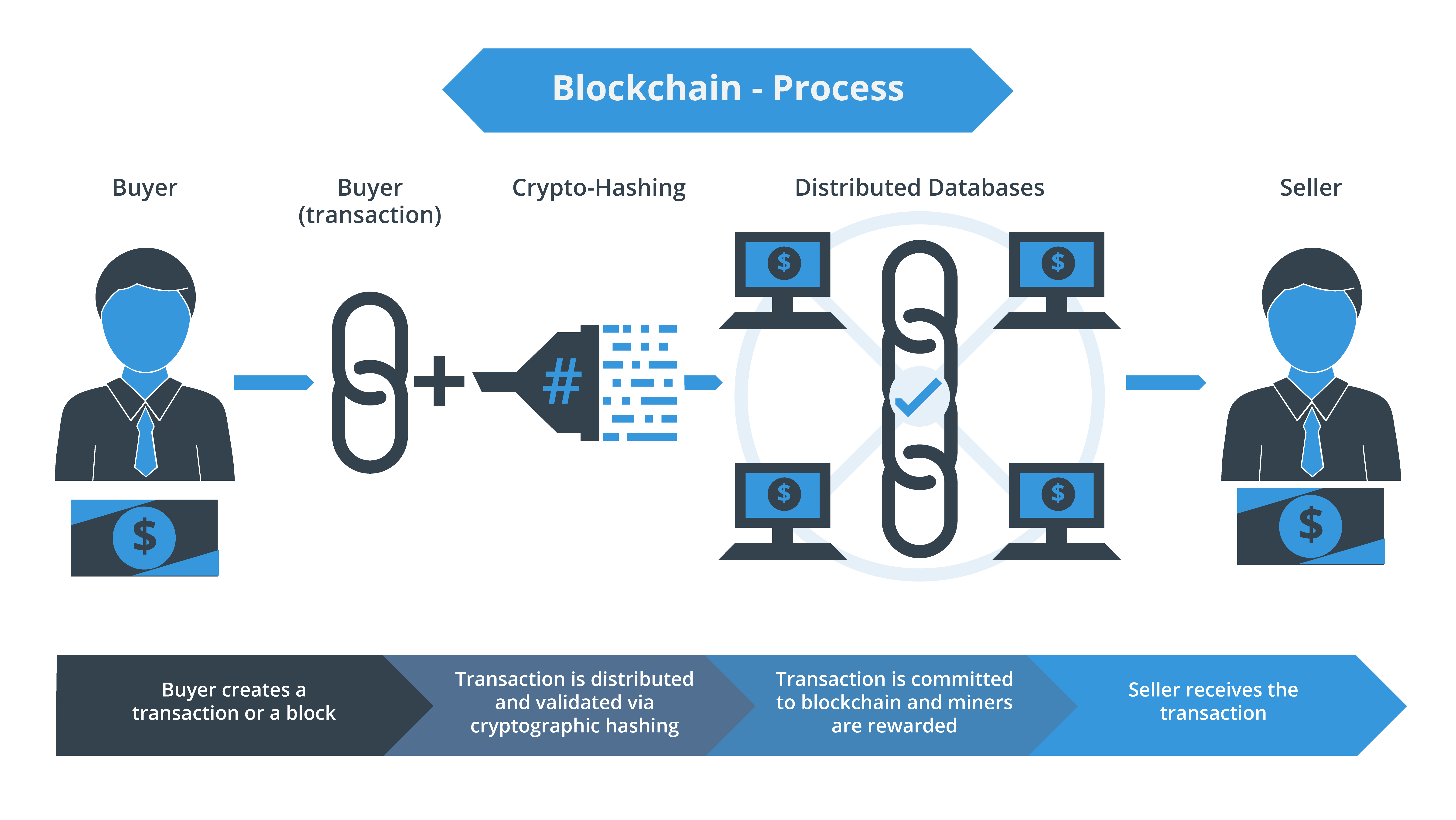

The Blockchain difference:

Blockchain Automates Trust

Trust is the cornerstone of every business relationship. On a fundamental level you need to believe that the other person is who they say they are, and they need to believe the same of you.

In this age of phishing, malware, and general cyber security attacks, this seemingly simple principle becomes complicated. Login details are stolen and used with criminal intent; high-level executives are being impersonated by hackers who then persuade other parties to release vital funds. The sheer scale, variety, maturity, and sophistication of cybercrime is growing every day.

Blockchain provides a means of automating trust. By using permanently retained historical data to authenticate everyone involved in a deal, each side can be assured of the other parties’ trustworthiness: the client and the seller alike, are always who they say they are.

And because prices cannot be modified, invoices will effectively be rendered obsolete.

Blockchain Will Replace the Supplier Invoice

One of the near certainties with Blockchain is that it will almost assuredly replace the supplier invoice (if you let it).

Blockchain is a disruptive technology. Add to that the complementary nature of cryptocurrencies, and we see a boom in the supplier payment market that will disrupt the way we do business and transform how we pay suppliers. The elimination of the Invoice is very clearly one of the most practical ways we will experience this disruption.

Blockchain essentially removes banks from a client / supplier transaction. As a result, it brings significant changes to the way a client and a supplier do business. As a result, large parts of the transactional processes that have been in place for years will no longer be needed. The invoice is one of these parts; perhaps the most important part that will disappear.

With Blockchain there will be no need for an invoice anymore because, if you represent a Purchase Order as a block on the Blockchain, then that is an immutable object. It’s unchangeable. When a supplier approves a purchase order, they are immediately committed to that cost, and only that cost. They could never issue an invoice that differed in the amount of money from the recorded purchase order.

When a purchase order is fulfilled and the payment is made to the supplier, it will be the money that’s in that purchase order. The payment could be made in cryptocurrency as well and there are specific use cases where that may be appropriate. The cost savings will be huge in terms of:

- administrative spend

- time currently spent issuing and processing invoices

- timely payments to suppliers

As a means of reducing costs, improving efficiency, controlling fraud, and boosting transparency, Blockchain has tangible, real-world benefits for procurement functions — whatever the market or business they work within.

Not Everyone is Convinced...

Let’s go through some of the common reason’s skeptics think Blockchain is not all it promises to be:

“Blockchain is Hackable”

So is your bank software, or Apple Pay or Paypal or anything else you might consider using. Blockchain is very secure using a cipher suite of key exchange network algorithms, a transport layer security protocol, and bulk encryption algorithms as well as a message authentication code. Don’t throw the baby out with the bathwater.

“Blockchain is Too Transparent”

Your credit card has your name, card number, expiration date, and security code on the back of it, yet you freely give it to hotel clerks, cashiers, waiters, rental counter attendants, and other people all the time. Let’s not forget about paper checks still in use which often has a name, address and phone number along with your account numbers.

“It’s not Centralized”Banks have been trying to come up with distributed ledger technology since the 70s, but they were hindered because they refused to be outside the transaction.

“You can still lose things!“Of course, you can. You can lose your wallet or your checkbook or your credit card, too.

Blockchain is Fast

Finance functions will benefit from the speed and efficiency of Blockchain technology. For one thing, it’s fully digital: by taking the more time-consuming elements of a conventional transaction out of the equation, you immediately save time and resources that would have been spent on these tasks. Shared access databases mean that it’s no longer necessary to manually scan invoices — dramatically accelerating the reconciliation process as all parties can view the same transaction.

Blockchain effectively cuts out the middlemen. By removing all intermediaries, it makes the processing of payments and transactions much faster: purchase order data can be exchanged on the blockchain at a far speedier pace than current levels will allow.

Blockchain Creates Strong Audit Trails

Blockchain technology stores every detail of every transaction at every level. This will — as mentioned above — facilitate increased fraud control, and it will also offer transparency into issues of legality such as money laundering and the use of child labor among other issues.

And though it’s a digital technology, Blockchain will also assist with the tracking and recording of physical items. As they are transported across local and international borders, they can be identified at each location — creating a strong and fully documented audit trail. This allows you to manage and optimize these supply routes with maximum efficiency — ensuring that no space is wasted and no customer disappointed.

Blockchain will Disrupt Business and Transform Payment Processing

It’s clear that Blockchain will have a significant effect on our clients - particularly with procurement and finance professionals, and especially when considering making supplier payments. There are certainly concrete advantages of being able to (i) authenticate trading partners, (ii) streamline business processes, (iii) secure financial payments, and (iv) automate workloads. However, there are likely other benefits to consider as well, such as significant out-of-pocket cost savings when considering international payments, currency conversions, foreign transaction and other bank fees, credit card transaction processing fees, limiting or restrictive or punitive regulatory requirements, and a host of other concerns.

If you would like to maximize the economic and strategic value of your supply chain, consider using Blockchain for payments with all suppliers to maximize value, and consider using cryptocurrency with international trading partners to minimize cost and risk.

About NET(net)

Celebrating 17 years, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002.

NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.