Teradata Surviving on Mysticism and Tyranny

Preface

The days of relying on personal relationships to secure favorable deal terms are over. IT vendors are aggressively shifting their focus towards capturing a larger share of your value chain and more of your wallet share. Their maneuvers include:

- Subscription-based pricing models: IT vendors are locking customers into recurring fees with additional consumption costs, making it difficult to predict and control long-term technology costs.

- Reduced flexibility: Subscription access often comes with limited customization options, and tiered access that requires you to subscribe to more expensive levels that offer higher functionality and/or more volume than you need, forcing you to spend way more than you want.

- Modern Discounting: Adding insult to injury, IT vendors are frequently reducing (or even eliminating) previously negotiated enterprise discounts as part of this migration to the cloud.

- Price Hikes: On top of all this, to accelerate the drive to the cloud, most IT vendors are significantly raising prices on legacy solutions, but that hasn't stopped them from raising prices on the destination environments as well, under the auspice of rising input costs.

- Opaque pricing structures: Many IT vendors have abandoned transparent public price lists and conventional discounting structures for product mix, volume, term, and enterprise metrics, making it challenging for customers to compare features, price-benchmark, and negotiate effectively.

The Need for a Modern Approach

In this ever-evolving landscape, businesses need a modern solution to navigate the complexities of technology negotiations. NET(net) is that modern solution; providing you with the tools and expertise needed to empower you to make informed decisions and secure the best possible deals from your IT vendors, and maximum value from your IT investments.

Our Approach:

We go beyond traditional tactics to deliver:

- Real-Time Market Insights: We ingest massive amounts of market research and deal data to stay ahead of vendor pricing strategies and identify potential cost-saving opportunities.

- Deep IT Vendor Counter-Intelligence: We decode vendor tactics and uncover hidden costs within complex agreements, ensuring you understand the true impact of any proposed solution.

- Expert Advisory Services: Our team of experts provides strategic guidance and support throughout the entire negotiation process, helping you achieve the most favorable terms for your business.

By partnering with NET(net), you gain the knowledge and confidence to navigate the new data-driven negotiation landscape and secure the best deals with your IT vendors, getting maximum value from your technology investments.

Background

Sentiment analysis, often referred to as 'opinion mining', is a branch of natural language processing (NLP) that analyzes human sentiments, opinions, and emotions expressed in text. By processing data from various sources, sentiment analysis aims to classify the polarity of a given text at the document, sentence, or feature/aspect level. The resulting insights can be invaluable for businesses, providing a deeper understanding of their customer base and identifying areas for improvement. This analysis specifically targets the feedback and reviews for Teradata and its top four competitors over the past 36 months, leveraging data from multiple industry and customer review platforms.

Sentiment Analysis Report: Teradata

Introduction

Teradata, a prominent name in data warehousing and analytics, has been under the spotlight for various reasons — not all of them positive. While the company boasts an extensive repertoire of enterprise solutions, numerous customer feedback and reviews reveal concerning issues, particularly around quality and customer service. This report delves into negative feedback sourced from key platforms like G2 Crowd, Capterra, PeerSpot, TrustRadius, and Software Advice, supplemented with firsthand customer testimonials from FeaturedCustomer and user sentiment from forums like SpiceWorks, Reddit, Quora, Hacker News, and Stack Overflow. A comparative sentiment analysis against Teradata's top four competitors is also provided.

Customer Feedback Overview

URL: G2Crowd: Teradata

- Numerous users state that Teradata's product integration capabilities are subpar.

- Frequent complaints about the lack of timely and effective customer support.

URL: Capterra: Teradata

- Common dissatisfaction includes a high cost of implementation and steep learning curve.

- Users frequently mention performance issues during peak data traffic times.

URL: PeerSpot: Teradata

- Critical reviews focus on the high Total Cost of Ownership (TCO).

- Customers express frustration over complex licensing models.

- Negative feedback highlights the outdated user interface.

- Many note slower query responses compared to modern solutions.

URL: Software Advice: Teradata

- Reviews criticize the inconsistent performance metrics.

- Chronic issues with system unavailability are frequently reported.

Supplementary Sentiment:

URL: FeaturedCustomer: Teradata

- While some customers are satisfied, negative anecdotes dominate, focusing largely on implementation woes and subpar customer service.

Community Forums Sentiment

SpiceWorks

- Discussions frequently cite Teradata’s high costs and difficulty in deployment.

- Users often advise against Teradata, recommending competitor solutions instead.

- Criticism on Reddit forums revolves around the complexities and inefficiencies in Teradata's architecture.

- Several threads mention poor scalability as a critical flaw.

Quora

- Many professionals on Quora caution potential users about Teradata's outdated technology.

- Comments consistently mention the steep learning curve as a major deterrent.

Hacker News

- Threads on Hacker News frequently highlight the high maintenance costs and poor support structure.

- Comparisons with competitors often show Teradata in a less favorable light.

Stack Overflow

- Users often post issues about troubleshooting and the lack of comprehensive support materials.

- Numerous unanswered queries suggest a lack of active community engagement.

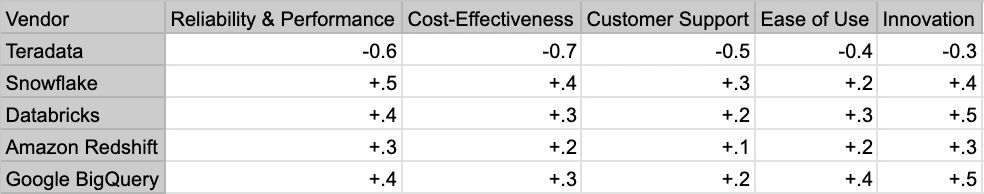

Sentiment Analysis Comparison Chart: Teradata vs. Competitors

Overview

This chart compares Teradata's sentiment scores to its primary competitors in the data warehousing and analytics space: Snowflake, Databricks, Amazon Redshift, and Google BigQuery. Sentiment scores are derived from user feedback across various platforms and range from -1 (very negative) to +1 (very positive).

Comparison Criteria

- Reliability and Performance

- Cost-Effectiveness

- Customer Support

- Ease of Use

- Innovation

Sentiment Scores

Key Takeaways

- Teradata consistently scores lower across all categories, indicating significant challenges in meeting customer expectations.

- Snowflake, Databricks, Google BigQuery demonstrate strong performance, particularly in innovation and cost-effectiveness.

- Amazon Redshift presents a balanced profile with moderate scores across all categories.

Conclusion

The sentiment analysis highlights Teradata's position as a laggard in the data warehousing and analytics market. Customers perceive Teradata as offering lower value, higher costs, and subpar support compared to competitors. To regain market share, Teradata must prioritize improving reliability, reducing costs, enhancing customer support, and accelerating innovation.

Sentiment Analysis and Competitive Benchmarking

The sentiment analysis algorithm shows that Teradata lags behind its competitors in several key areas:

Top 5 Vendors (Scores out of a possible 10 points)

- Teradata - 3.8

- Snowflake - 8.5

- Databricks - 7.9

- Amazon Redshift - 7.2

- Google BigQuery - 8.1

Summary

Overall, Teradata has garnered significant negative feedback over the past 36 months, with major dissatisfaction stemming from issues related to quality, performance, and customer service. While it remains a critical player in data warehousing, competitors like Snowflake, Databricks, Amazon Redshift, and Google BigQuery seem to be surpassing Teradata in terms of customer satisfaction and technological innovation. Therefore, enterprises must weigh these insights carefully when making strategic decisions concerning their data management and analytics infrastructure.

Call to Action

The relentless pursuit of profit by IT vendors, often at the expense of product quality and customer service, has created a chasm between the value delivered and the costs incurred by enterprise customers. This unsustainable imbalance not only erodes customer profit margins but also stifles innovation and competitive advantage. It's a moral imperative to break free from this cycle of exploitation, reclaiming control over IT expenses and redirecting those funds into strategic initiatives that drive growth and success. The financial rewards of disrupting this status quo are immense. By demanding better terms, exploring alternative solutions, or even severing ties with underperforming vendors, enterprises can unlock significant cost savings, enhance operational efficiency, and gain a competitive edge. The time for complacency is over. It's time to take charge, challenge the norm, and reshape the vendor-customer relationship. Are you ready to seize this opportunity?

NET(net) can help you achieve success, so Act Now.

About the Author

Steven C. Zolman is a leading expert in technology investment optimization and the founder, owner, and executive chairman of NET(net), Inc., the world's leading technology investment optimization firm. With over 30 years of industry experience, Mr. Zolman has helped client organizations of all sizes maximize the value of their technology investments by minimizing cost and risk and maximizing the realization of value and benefit.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get, and keep more economic and strategic value in their technology supply chains. Over the last 20 years, NET(net) has influenced trillions of investment, captured hundreds of billions of value, and has helped clients cost and value optimize all major areas of IT Spend, including XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, and Telecommunications, among others. NET(net) has the experience you want, demonstrates the expertise that you need, and delivers the performance you demand and deserve. Contact us at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1 (616) 546-3100 to see if we can help you capture more value in your IT investments, agreements, deployments, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms, offered for general information purposes only, and does not constitute legal advice. While NET(net) may offer views and opinions regarding the subject matter, such views and opinions are those of the content authors, are not necessarily reflective of the views of the company and are not intended to malign or disparage any other company or other individual or group.