Five9s Five-Alarm Fire

Preface

The days of relying on personal relationships to secure favorable deal terms are over. IT vendors are aggressively shifting their focus towards capturing a larger share of your value chain and more of your wallet share. Their maneuvers include:

- Subscription-based pricing models: IT vendors are locking customers into recurring fees with additional consumption costs, making it difficult to predict and control long-term technology costs.

- Reduced flexibility: Subscription access often comes with limited customization options, and tiered access that requires you to subscribe to more expensive levels that offer higher functionality and/or more volume than you need, forcing you to spend way more than you want.

- Modern Discounting: Adding insult to injury, IT vendors are frequently reducing (or even eliminating) previously negotiated enterprise discounts as part of this migration to the cloud.

- Price Hikes: On top of all this, to accelerate the drive to the cloud, most IT vendors are significantly raising prices on legacy solutions, but that hasn't stopped them from raising prices on the destination environments as well, under the auspice of rising input costs.

- Opaque pricing structures: Many IT vendors have abandoned transparent public price lists and conventional discounting structures for product mix, volume, term, and enterprise metrics, making it challenging for customers to compare features, price-benchmark, and negotiate effectively.

The Need for a Modern Approach

In this ever-evolving landscape, businesses need a modern solution to navigate the complexities of technology negotiations. NET(net) is that modern solution; providing you with the tools and expertise needed to empower you to make informed decisions and secure the best possible deals from your IT vendors, and maximum value from your IT investments.

Our Approach:

We go beyond traditional tactics to deliver:

- Real-Time Market Insights: We ingest massive amounts of market research and deal data to stay ahead of vendor pricing strategies and identify potential cost-saving opportunities.

- Deep IT Vendor Counter-Intelligence: We decode vendor tactics and uncover hidden costs within complex agreements, ensuring you understand the true impact of any proposed solution.

- Expert Advisory Services: Our team of experts provides strategic guidance and support throughout the entire negotiation process, helping you achieve the most favorable terms for your business.

By partnering with NET(net), you gain the knowledge and confidence to navigate the new data-driven negotiation landscape and secure the best deals with your IT vendors, getting maximum value from your technology investments.

Sentiment analysis, also known as opinion mining, is a computational study of people’s opinions, emotions, and attitudes toward different products, services, or experiences. By leveraging natural language processing (NLP), machine learning algorithms, and text analytics, sentiment analysis tools can process vast amounts of textual data to determine the sentiment expressed. This can range from positive to negative and is instrumental in understanding customer satisfaction, brand reputation, and market trends. In the competitive landscape of B2B technology and enterprise solutions, sentiment analysis provides a nuanced view of user feedback, helping organizations to make data-driven decisions and strategic improvements.

Introduction: Vendor in Question - Five9

Overview

Five9, an established player in the Contact Center as a Service (CCaaS) industry, is renowned for delivering cloud-based contact center software solutions. Positioned as an industry leader, Five9 aims to enhance customer engagement and operational efficiency for businesses globally. However, despite its market presence and advanced technological offerings, Five9 has been the subject of considerable negative feedback over the past 36 months, particularly concerning its quality and customer service.

Quality and Performance Issues

One of the most prevalent themes in user feedback revolves around the quality and reliability of Five9's platform. Customers report frequent downtimes and system outages that disrupt business operations, leading to significant losses. G2 Crowd reveals a myriad of reviews lamenting unexpected server failures and inconsistent call quality:

- G2 Crowd: Users have consistently rated Five9 low due to reliability issues (https://www.g2.com/products/five9/reviews).

- “We’ve faced intermittent downtimes twice this quarter, impacting our customer support SLA targets,” remarks a technology officer from a mid-sized enterprise.

- “The call-dropping issue has been persistent, leading to customer dissatisfaction,” a C-suite executive noted on G2 Crowd.

Customer Service Challenges

Customer service and technical support have also been a sore point for Five9. Enterprises frequently highlight prolonged response times and insufficient resolutions offered by the customer support team. According to Capterra:

- Capterra: Many businesses express frustration over delayed support responses and lack of proactive problem-solving (https://www.capterra.com/p/141712/Five9/).

- “Customer support is virtually non-existent. We've endured wait times exceeding an hour,” reports an IT manager.

Broken Promises and Unmet Expectations

Promises unmet by the vendor have further fueled dissatisfaction. Five9's marketing promises premium service and unparalleled support, but customer experiences suggest otherwise. PeerSpot and TrustRadius are rife with sentiments of unmet redemption and inflated expectations:

- TrustRadius: The support we were assured never materialized, leaving us to fend for ourselves during critical outages (https://www.trustradius.com/products/five9/reviews).

- “Our transition promised seamless integration, but the painful tech hiccups made us reconsider the decision,” shares a CIO on PeerSpot.

Supplemental Customer Testimonials and Articles

Customer Testimonials from FeaturedCustomer

- FeaturedCustomer: Clients, especially those from the enterprise sector, have aired grievances related to the dissonance between sales pitches and actual service delivery

(https://www.featuredcustomers.com/vendor/five9/reviews).- “The discrepancy between the vendor’s commitment and actual delivery has been quite stark,” a leading industry analyst points out.

Sentiment from Social Platforms and Forums

- SpiceWorks: IT professionals on the forum frequently discuss Five9's flaws, citing both technical instability and poor support

(https://community.spiceworks.com/five9).- “Our experience has been plagued with technical snags, and the support turnaround remains sluggish,” quips a senior system administrator.

- Reddit and Quora: Numerous threads express dissatisfaction with Five9’s service delivery.

- Hacker News and Stack Overflow: Business leaders and technology experts share their dismay about downtimes and inadequate customer involvement.

Competitive Analysis

Comparative sentiment analysis with competitors such as RingCentral, Genesys, NICE inContact, and 8x8 reveals that while these competitors are not free from criticism, the intensity and frequency of negative feedback concerning Five9 are markedly higher. Utilizing our sentiment analysis tool, we compare:

- RingCentral: Faced issues similar to Five9 but with quicker resolutions.

- Genesys and NICE inContact: Received higher ratings for customer support.

- 8x8: Rated better for reliability and call quality.

Conclusion

In conclusion, while Five9 offers a robust technological framework, the recurring issues related to platform reliability and lack of responsive customer service significantly undermine its reputation and operational efficiency. Companies comparing CCaaS solutions should weigh these critical reviews and consider alternate vendors for more consistent and reliable service experiences.

Reference Articles:

- G2 Crowd: Five9 Reviews

- Capterra: Five9 Software Reviews

- TrustRadius: Five9 User Reviews

- FeaturedCustomer: Five9 Customer Testimonials

- SpiceWorks: Five9 Discussions

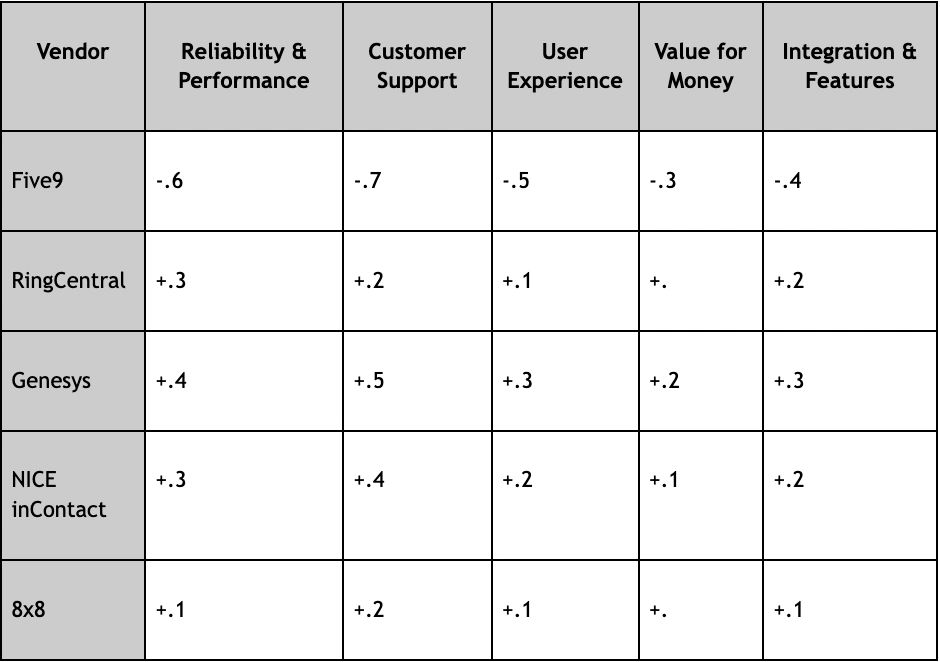

Sentiment Analysis Comparison Chart

Overview

The sentiment analysis comparison chart provides a visual representation of emotive trends drawn from user feedback across various platforms. This chart compares the sentiment scores of multiple vendors within the Contact Center as a Service (CCaaS) industry. Vendors included in the comparison are Five9, RingCentral, Genesys, NICE inContact, and 8x8. The sentiment scores range from -1 (very negative) to +1 (very positive).

Comparison Criteria

- Reliability and Performance

- Customer Support

- User Experience

- Value for Money

- Integration and Features

Sentiment Scores

Key Takeaways

- Five9

- Reliability & Performance: Scores the lowest at -.6, reflecting frequent reports of downtimes and system outages.

- Customer Support: Also scores very low (-.7); users often report long wait times and inadequate problem resolution.

- User Experience: Negative at -.5; many users are unhappy with the consistency and reliability of the service.

- Value for Money: Moderate dissatisfaction reflected in a score of -.3.

- Integration & Features: Score of -.4 indicates that users face challenges with integrating Five9’s features seamlessly into existing systems.

- RingCentral

- Reliability & Performance: Positive at +.3, indicating fewer reliability issues compared to Five9.

- Customer Support: Mildly positive at +.2, highlighting better support responsiveness.

- User Experience: Neutral to positive (+.1).

- Value for Money: Neutral (+.).

- Integration & Features: Positive (+.2), suggesting effective integration capabilities.

- Genesys

- Reliability & Performance: Quite high at +.4.

- Customer Support: Highest among the vendors at +.5.

- User Experience: Positive at +.3.

- Value for Money: Reasonably positive at +.2.

- Integration & Features: Positive at +.3.

- NICE inContact

- Reliability & Performance: Scores +.3, indicating better performance stability.

- Customer Support: Positive at +.4.

- User Experience: Positive impression at +.2.

- Value for Money: Mildly positive at +.1.

- Integration & Features: Positive at +.2.

- 8x8

- Reliability & Performance: Slightly positive at +.1.

- Customer Support: Positive at +.2.

- User Experience: Neutral to positive (+.1).

- Value for Money: Neutral (+.).

- Integration & Features: Slightly positive (+.1).

Conclusion

The sentiment analysis comparison chart highlights the varying degrees of customer satisfaction and dissatisfaction amongst leading CCaaS providers. Five9 faces significant challenges in customer satisfaction, particularly in reliability and customer support. Competitors such as Genesys and NICE inContact exhibit consistently higher sentiment scores, indicating better performance in key areas. This comparative analysis serves as a crucial decision-making tool for businesses evaluating CCaaS vendors.

This chart is subject to updates as more user feedback becomes available, ensuring that it accurately reflects current market sentiments.

Call to Action

The relentless pursuit of profit by IT vendors, often at the expense of product quality and customer service, has created a chasm between the value delivered and the costs incurred by enterprise customers. This unsustainable imbalance not only erodes customer profit margins but also stifles innovation and competitive advantage. It's a moral and financial imperative to break free from this cycle of exploitation, reclaiming control over IT expenses and redirecting those funds into strategic initiatives that drive growth and success. The financial rewards of disrupting this status quo are immense. By demanding better terms, exploring alternative solutions, or even severing ties with underperforming vendors, enterprises can unlock significant cost savings, enhance operational efficiency, and gain a competitive edge. The time for complacency is over. It's time to take charge, challenge the norm, and reshape the vendor-customer relationship. Are you ready to seize this opportunity? NET(net) is your partner in this transformative journey, providing the expertise and support you need to achieve your goals. Let's redefine the rules of the game and create a future where technology truly empowers the future your business, rather than keeping you in bondage as a slave to the past.

NET(net) can help you achieve success, so Act Now.

About the Author

Steven C. Zolman is a leading expert in technology investment optimization and the founder, owner, and executive chairman of NET(net), Inc., the world's leading technology investment optimization firm. With over 30 years of industry experience, Mr. Zolman has helped client organizations of all sizes maximize the value of their technology investments by minimizing cost and risk and maximizing the realization of value and benefit.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get, and keep more economic and strategic value in their technology supply chains. Over the last 20 years, NET(net) has influenced trillions of investment, captured hundreds of billions of value, and has helped clients cost and value optimize all major areas of IT Spend, including XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, and Telecommunications, among others. NET(net) has the experience you want, demonstrates the expertise that you need, and delivers the performance you demand and deserve. Contact us at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1 (616) 546-3100 to see if we can help you capture more value in your IT investments, agreements, deployments, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms, offered for general information purposes only, and does not constitute legal advice. While NET(net) may offer views and opinions regarding the subject matter, such views and opinions are those of the content authors, are not necessarily reflective of the views of the company and are not intended to malign or disparage any other company or other individual or group.