As a global company, NET(net) works with many clients in virtually all geographies and industries. In the process, we have the ability to see and federate market intelligence that no one company could possibly see on its own. This federated market intelligence becomes extremely valuable as we see trends in industries or geographies, or with particular suppliers or even with particular technologies. When NET(net) sees these changing market conditions, we leverage this market currency to provide our clients with market leading strategies to unlock and harness more value.

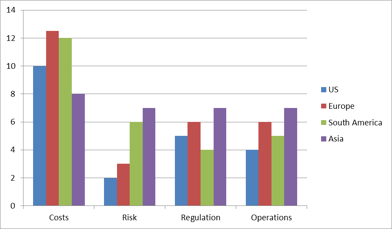

One of the emerging opportunities for market arbitrage is to leverage some of the benefits (and frankly some of the drawbacks) of doing business in Asia as you globalize your organization’s technology supplier agreements, investments, and relationships. Like we do with any good client, the first step in our process is to benchmark our situation. We will do that with a highly oversimplified view of the US market.

USA as the benchmark

- Low Costs

- Low Risk

- Low Regulations

- Low Operational Complexities

The similarities with Europe exist in risk, but there are more operational complexities (language, culture, currencies, etc). In addition, the EU is a little more prone to take regulatory action, than is the DOJ in the US. As such, the regulatory requirements are slightly higher. Most of the regulation seemingly exists to prevent monopolistic actions by suppliers, which aims to keep markets fair and competitive. These regulations and operational complexities may have backfired, however, as costs in European markets generally average 20-25% higher than what we see in the US. It seems as though suppliers have more than passed on the higher costs of regulations and operational complexities to their customers, protecting themselves from the inflated risk and cost of doing business.

European Markets:

- Higher Costs

- Low Risk

- Higher Regulations

- Higher Operational Complexities

In comparison to the Europe markets, the trend in Latin America continues. Even though the markets aren’t as heavily regulated, the Latin American markets generally have higher risk for suppliers, mostly due to higher levels of software compliancy problems, and higher levels of operational complexities. Similar to Europe, we commonly see market premiums of 25% or more when compared to US markets. Again, it seems as though suppliers have more than passed on the higher costs of risk due to software compliancy problems and operational complexities to their customers.

Latin American Markets:

- Higher Costs

- Higher Risk

- Lower Regulations

- Higher Operational Complexities

The interesting part of this story comes when you evaluate the Asian markets. In comparison to the USA markets, the trend of higher customer costs to offset increased regulation, operational complexities, and risk backfires. Asian clients pay considerably less for technology than do US clients (about 20% less on average), yet the environment in Asia is more regulated, has higher operational complexities, and contains a much higher risk for things like software compliance. As such, it is almost inexplicable that Asian clients are paying considerably less for even commonly available technologies than are US customers. Those clients that can leverage this condition effectively can engage in market arbitrage, and significantly improve the value of their technology investments.

- Lower Costs

- Much Higher Risk

- Higher Regulations

- Higher Operational Complexities

With a much higher risk profile, a more regulated environment, and higher levels of operational complexities, how can technology providers sell for considerably less in Asia than they can in other developed economies like the USA? It seems we have all been sold a bill of goods. It seems like the appropriate argument would be to equalize the monetary value with all other elements accordingly, and negotiate improved pricing conditions for an environment that offers less risk, less regulation, and less operational complexity. Alternatively, if we can’t get the economic value of improved pricing for a more favorable environment, perhaps we should aim to centralize our agreements in Asia where we can conceivably not only get better economics, but we can also get the suppliers to accept a higher risk profile for doing business with us.

Either way, the Asian markets are the anomaly, and they offer a glimpse into a potential future where contracts and investments are centralized and managed in Asia, while relationships are managed locally. This split of functions could be easily accomplished within any organization that has a global business, with significant operations in Asia, and/or any Asia based firm with significant global operations. Many times, we find that agreements and investments are based in the USA or in Europe, even when relationships are managed locally in Asia, which almost always leads to a higher cost, lower value situation. In this way, Asia May Be The Key To Unlocking Market Inequities.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.

About NET(net)

Celebrating 10 years, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 1500 clients around the world in nearly all industries and geographies, and with the experience of over 15,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value of nearly $100 billion since 2002, NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.