Salesforce has led the market for years. We have pointed to Salesforce as the culprit who broke the early promise of software as a service as (SaaS). SaaS was supposed to be elastic with demand allowing costs to go both up and down. Historically, we know that Salesforce is supportive of increases in their customers' cost but it has been punitive to reductions. With Salesforce’s fiscal year-end coming at the end of January 2023, now is a great time to re-evaluate your deployment and at the very least benchmark to see how your spend compares to the market. But first, more on Salesforce themselves….

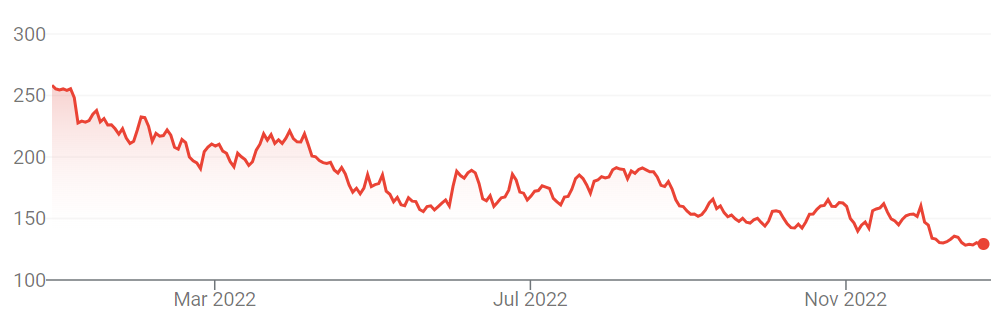

Things 'they are a changin' in Salesforce.com’s world. Be it Marc Benioff’s about face from being the spokesperson for woke in the pandemic, only then returning back to traditional view, that pandemic era policies at least correlate with eroded productivity and the company’s stock performance - which has gone down by 50% this year.

Is the stock price a trailing or leading indicator of confidence in management? Our view is maybe both. Salesforce’s leadership drain seems to be gaining momentum with these key losses in the past months alone:

- Bret Taylor (co-CEO)

- Gavin Patterson (Chief Strategy Officer)

- Stewart Butterfield (Slack co-founder and CEO)

- Mark Nelson (Tableau CEO)

- Mark Carter (EVP, Security)

- Tamar Yehoshua (Chief Product Officer)

- Jonathan Price (SVP of Marketing, Brand & Communications)

As the old/new sole leader (no surprise here), co-Founder Marc Benioff was said to be unhappy with the lack of focus. According to Wall Street Journal reporting:

“Mr. Benioff…became frustrated about how Mr. Taylor was spending his time, the people said. Among his concerns were whether Mr. Taylor was spending too much time in a new role as Twitter Inc.’s chairman, too much time with other CEOs and customers and not enough time on Salesforce product and engineering, the people said.”

For those keeping score, this is the second CEO working with Marc that has departed in two years. Not a lot of stability for one of the world’s largest software companies. This is especially telling given how most Salesforce executives are paid, which is heavily weighted to stock options. With most of the above executives having option strike prices above the current value, most of them probably are leaving with very little in terms of value from those options.

While all of this leadership turmoil has been playing out, we have been noticing (and commenting) on how Salesforce has become responsive to competition and customer dissatisfaction with the return on the premiums being invested in Salesforce solutions. Salesforce is still trying to keep customer investments with each of its acquired companies (Mulesoft, Tableau, Slack etc.) separate but with customers belts being tightened and value being delivered scrutinized, Salesforce is being forced to adopt a more client centric stance or risk customer defections joining in the downward momentum.

Opportunity is Knocking

For the first time in years, Salesforce is looking to staunch the flood of bad news. To do this, Salesforce is willing to buy the peace with customers to create an unprecedented win-win. With all these changes happening at Salesforce as an obvious reaction to poor performance, executive departures, and staffing uncertainty there is opportunity for its current and potential customers. As their fiscal year quickly ends at the end of January, they will be chasing revenue at a feverish pace! When companies start chasing revenue and executives get hungrier, there are better deals to be had. For many years we have been saying that 95% of Salesforce customers are overpaying and we stand by that based on our own performance in helping them negotiate better deals. With these economic and market conditions take their hits on Salesforce, now is the time to take advantage where you can. Now is the time to grow deals with disproportionate gains and causing potentially desperate reactions from Sales organizations too afraid to now be around after January. We have been helping Salesforce Clients optimize their deals for 20 years and have the Subject Matter Expertise, the FMI (Federated Market Intelligence) and most importantly the will to make a positive difference in your bottom line.

Contact us to learn more, and in the meantime here are additional tools to help:

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get, and keep more economic and strategic value in their technology supply chains. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, NET(net) has the expertise you need, the experience you want, and delivers the performance you demand, resulting in incremental client captured value in excess of $250 billion since 2002. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-616-546-3100 to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.