The Reality Check:

Why the $11B acquisition is less about synergy and more about value extraction, and how to protect your own estate.

Let’s dispense with the pleasantries. IBM’s definitive agreement to acquire Confluent for roughly $11 billion is not a "strategic partnership" to accelerate hybrid cloud innovation. It is a textbook consolidation move by a legacy giant eyeing a critical data streaming asset to shore up its portfolio.

At NET(net), we aren’t buying the "kumbaya" narrative of synergy. We are bracing our clients for impact.

In the high-stakes arena of IT cost and value optimization, the old playbook of handshake deals is ancient history. Vendors are doubling down on sophisticated tactics to dominate your tech stack, leveraging AI and market consolidation to extract maximum wallet share. IBM’s move is the latest, loudest signal that the era of "open innovation" is ceding ground to "closed extraction."

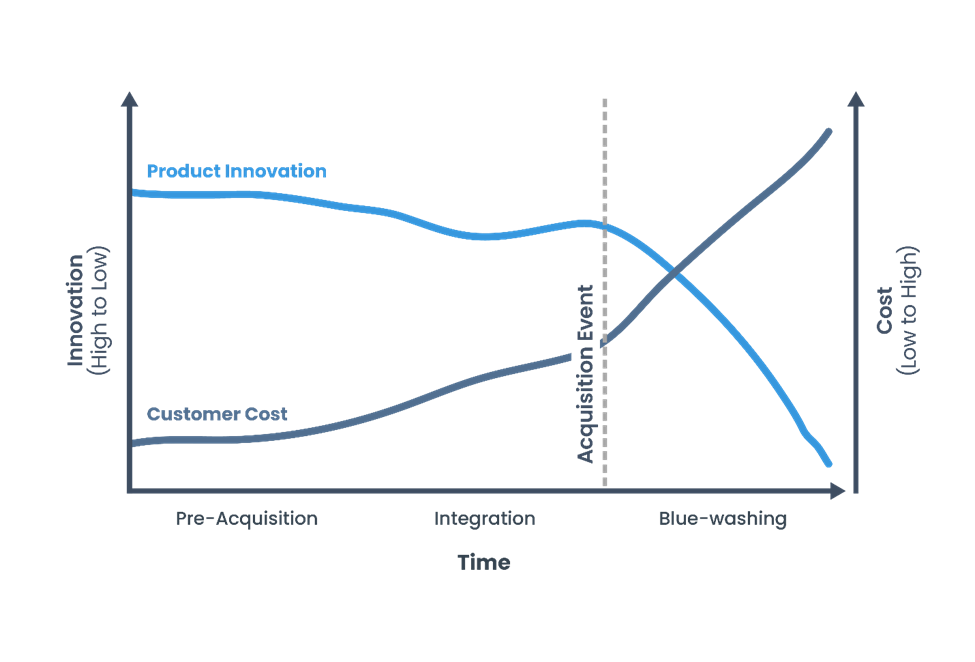

The Pattern: A Graveyard of Open-Source Speed

History, and our proprietary Cost Benchmarking Database, tells a very clear story: IBM acquisitions rarely end well for the acquired company’s customers.

- Remember HashiCorp? (Read our analysis) The open-source spirit and rapid innovation were slowly strangled by layers of bureaucracy and a relentless pursuit of "Blue-washing."

- Remember DataStax? (Read our analysis) A once-promising star that dimmed considerably under the IBM shadow.

- And then there’s Red Hat. The $34 billion crown jewel. IBM promised "independence," but the community got the death of CentOS (a forced march to paid RHEL subscriptions) and source code paywalls. It serves as the ultimate blueprint for how IBM monetizes open source: by closing the doors and locking the windows.

Confluent is next on the chopping block. The nimble, community-driven culture that made Kafka the standard for real-time data is about to collide with the glacial decision-making processes of Big Blue.

The "Value Extraction" Playbook: What to Expect

If you are a Confluent customer, the clock is ticking. Here is the roadmap of risks you face in the coming 12-24 months:

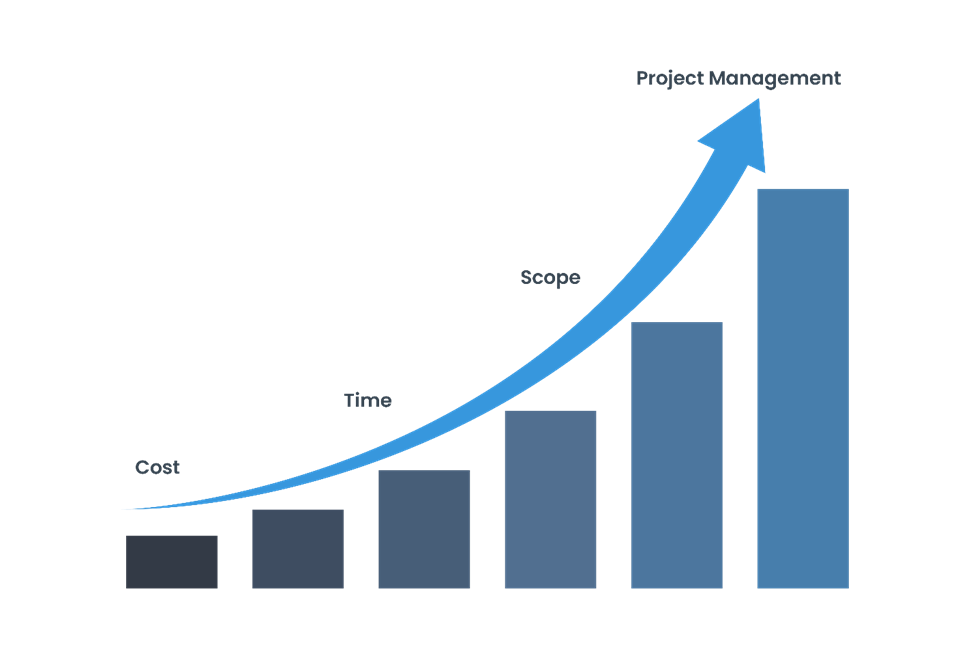

1. The Integration Tax (Chaos & Cost)

IBM’s track record with integrations is notoriously complex. Expect a protracted, expensive, and frustrating migration of support and licensing structures.

2. The Inevitable Price Hike

Let’s be blunt: IBM did not spend $11B to lower your prices. They acquired Confluent to extract value. Expect a gradual, then accelerating, increase in licensing fees. The "dynamic pricing" models we see emerging across the industry, often powered by AI, will be weaponized here to optimize their margins at your expense.

3. The Death of Innovation

Confluent thrived because it was agile. IBM is... IBM. Expect a stifling of innovation as Confluent’s engineers are forced to prioritize features that align with IBM’s legacy stack (Mainframe, Red Hat, DB2) rather than pure market needs.

4. The "Golden Handcuffs" of Lock-In

This deal is designed to increase your switching costs. IBM will aggressively push you deeper into their ecosystem, bundling Confluent with Red Hat OpenShift and Watsonx. While this looks like a discount today, it is a dependency trap for tomorrow.

Tactical Opportunities: The "Exploit, Then Escape" Strategy

Is it all doom and gloom? No, but only if you act with vigilance bordering on paranoia.

- Short-Term Bundling: IBM will likely dangle aggressive bundled pricing to lock you in early. If you are already entrenched in IBM and need Kafka, there may be a fleeting cost advantage. If you take the deal, be sure to protect the exit. Negotiate the shortest possible contract terms with the most stringent performance SLAs.

- Leverage the Chaos: The messy integration period creates an opening. Competitors (Amazon Kinesis, Azure Event Hubs, Aiven) will be hungry to poach dissatisfied Confluent customers. Use this threat to drive leverage in your renewal discussions.

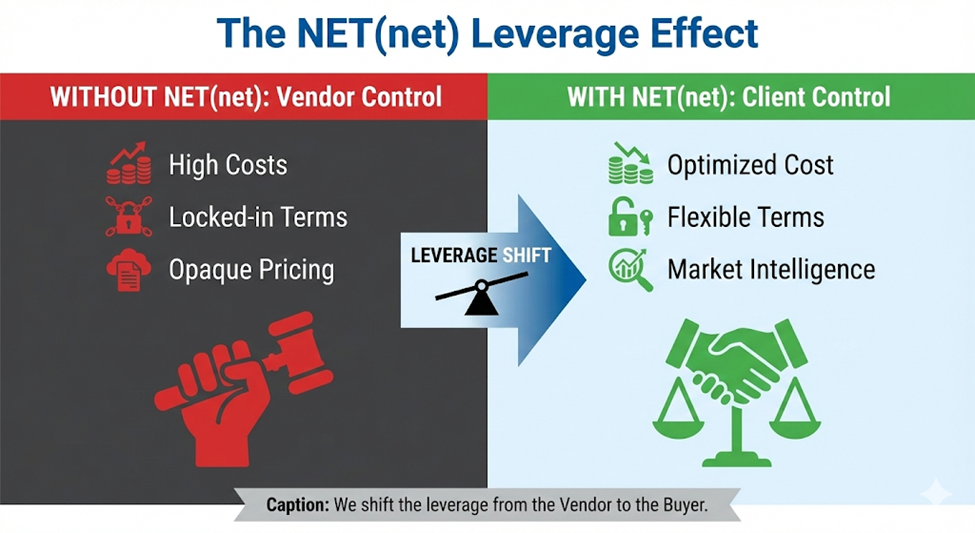

NET(net)’s Mandate: Your Survival Guide

In this turbulent landscape, where AI hype meets consolidation grit, enterprises cannot afford to go it alone. NET(net) delivers unfiltered intelligence and strategic firepower to outmaneuver vendors.

Your Battle Plan:

- Diversify Relentlessly: Do not put all your Kafka eggs in the IBM basket. Embrace a multi-cloud or open-source strategy where possible.

- Contractual Fortification: Demand price protection guarantees and "escape hatch" clauses for performance degradation.

- Monitor the Roadmap: Watch Confluent’s product updates like a hawk. At the first sign of stagnation, trigger your migration plan.

Final Thoughts…

This $11 billion acquisition is a clear signal that the era of open data streaming is shifting toward a model of vendor lock-in and value extraction. Don't wait for the inevitable price hikes or roadmap stagnation to impact your bottom line - the time to secure your commercial leverage is now.

How We Help:

- Federated Market Intelligence: We harness vast datasets and 23+ years of proprietary deal data to decode vendor pricing tactics, forecast trajectories, and price-benchmark.

- Outcome-Driven Negotiation: We don't just give advice; we sit on your side of the table. Our optimization analysis and professional vendor negotiations assistance ensures your deal is tied to measurable value, not vendor whims.

Call to Action

The relentless pursuit of profit by IT mega-vendors has created a chasm between the cost you pay and the value you receive. This imbalance erodes your margins and stifles your innovation. It is a financial imperative to break free from this cycle.

Don't wait for your next renewal cycle to feel the impact of this $11 billion consolidation. The shift in leverage is already happening!

Contact NET(net) today. We will help you assess your exposure, quantify the risks, and negotiate terms that protect your future, locking in favorable terms before the integration window closes. Let’s redefine the rules of the game together.

About NET(net)

At NET(net), we don't just optimize IT investments, we weaponize them for competitive advantage. As the world's leading technology investment optimization firm, we've spent over two decades perfecting the art and science of extracting maximum value from technology supply chains while neutralizing vendor pricing manipulation.

Our battle - hardened methodology has influenced trillions of dollars in technology investments, captured hundreds of billions in documented value, and transformed how enterprises approach every facet of IT spend - from emerging technology such as AI, ML, IoT, RPA, Quantum, and Blockchain, to IaaS, PaaS, and SaaS, to enterprise hardware and software solutions, and professional services arrangements including strategic outsourcing relationships.

We're not consultants who theorize about optimization, we're the specialists who help you devise and execute your strategy. Our proven frameworks turn vendor pricing chaos into strategic opportunity, licensing complexity into competitive advantage, and cost centers into value engines. Whether you're facing an aggressive vendor audit, navigating a forced migration, or simply refusing to accept runaway IT costs, NET(net) delivers the expertise, experience, and execution you need to dominate rather than merely survive.

Founded in 2002, NET(net) has established itself as the essential strategic partner for enterprises and technology providers who demand performance, not promises. We've mastered every major area of IT optimization because we understand that in today's vendor-hostile environment, half-measures guarantee defeat.

Experience the NET(net) advantage. Contact us at info@netnetweb.com, visit www.netnetweb.com, or call +1 (616) 546-3100 to discover how we can transform your technology investments from cost burden to strategic weapon.

Legal Disclaimer: NET(net)'s website, blogs, articles, and other content are subject to NET(net)'s legal terms and are offered for general information purposes only, and do not constitute legal advice. While NET(net) may offer views and opinions regarding the subject matter, such views and opinions are those of the content authors, are not necessarily reflective of the views of the company, and are not intended to malign or disparage any other company or other individual or group. Visit our legal notice page for more information.