Since 2002, we have been helping clients optimize technology spend and have maintained a continuously updated list of suppliers where we know we can extract value with a high yield. VMware has been and seems destined to remain at or near the top of this list for the foreseeable future.

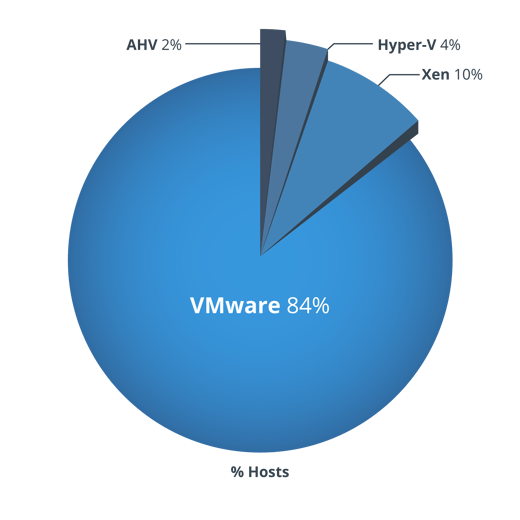

VMware is credited with commercializing compute virtualization technologies with their popular vSphere product, enabling multiple virtual applications to run concurrently on a single physical host. This increased utilization of IT resources has dramatically improved the economics of enterprise datacenter infrastructure, vaulting VMware to a market dominant position in the hypervisor/virtual machine category with more than an 80% share.

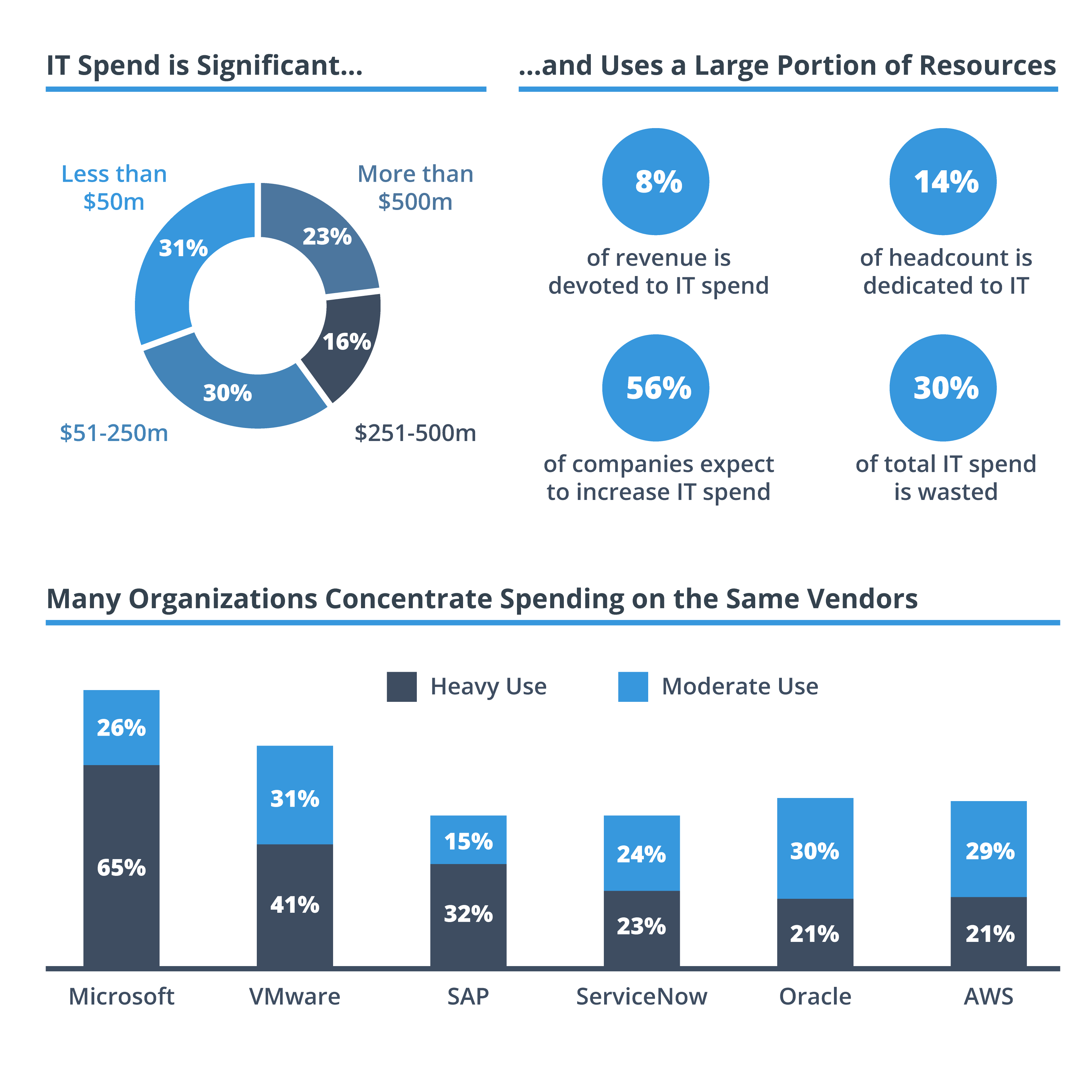

This complete market dominance translates to some impressive results, as virtualization has been the hottest investment category over the last 10 years, making VMware one of the largest enterprise IT budget line-item suppliers. In fact, in 2020, VMware ranked 2nd among all technology suppliers when it comes to concentration of enterprise IT spend. Only Microsoft ranked higher.

This complete market dominance translates to some impressive results, as virtualization has been the hottest investment category over the last 10 years, making VMware one of the largest enterprise IT budget line-item suppliers. In fact, in 2020, VMware ranked 2nd among all technology suppliers when it comes to concentration of enterprise IT spend. Only Microsoft ranked higher.

Like many companies that have enjoyed such wide adoption over a long period of time, VMware may have gotten a little over-confident. While Modern Enterprises are increasing their velocity towards open multi-cloud environments, VMware’s focus remains on increasing customer dependency on vSphere virtualization technologies and driving long-term lock-in to VMware products.

VMware has a strong view of how their customer relationships should work. VMware wants to grow, and they are relying on their customers to buy more and more of their product to assist them with their growth ambitions. Even when customers have sizeable legacy estates and/or have been long term Enterprise Licensing Agreement (ELA) customers, if there is no customer growth, VMware will still raise prices, often by 200% or more. This creates a real dilemma for VMware customers; continue to grow with VMware or run afoul of their growth ambitions and face their wrath.

Clients that have been struggling with VMware have felt like they have been held hostage and had to pay that ransom, primarily because they never considered the competition all that viable.

However, that all changed in 2020. For the first time in a long time, we have been seeing strong competition with VMware in the enterprise and in cloud. For example, VMware has been facing fierce competition in Hyper-converged infrastructure (HCI) (a software-defined IT infrastructure that virtualizes all the elements of conventional "hardware-defined" systems). HCI includes, at a minimum, virtualized computing, software-defined storage, and virtualized networking. HCI typically runs on commercial off-the-shelf servers. True HCI (by my definition) is hardware independent. VMware is now facing stiff competition in key markets, including hyperconverged infrastructure (HCI), virtualization, IT automation, hybrid cloud management, multi-cloud management, software-defined file storage, and network-based micro segmentation.

Recent upheaval in the executive ranks at VMware indicates that the competition is extremely serious, and our field experience shows VMware is competing on price and even losing deals at pricing levels thought nearly unattainable even a year ago.

Former VMware COO of products and cloud services Rajiv Ramaswami has been caught up in litigation from his former employer, which alleges that he breached contractual obligations after jumping ship to Nutanix as its newCEO (Jan 11, 2021).

Competition is also intense in the cloud. As more customers switch applications from VMs to Kubernetes and containers, VMware’s Tanzu is facing strong competition in a cloud-native future, as clients push for more cloud automation, optimization, and analytics.

VMware is billing themselves as a foundation for hybrid and/or multi-cloud management, yet their solution is still very much rooted in the culture of their legacy Foundation suite. Not surprisingly VMware’s ‘modern’ solutions are significantly more expensive than the equivalent solutions from their chief competitors. For our clients, having viable choices in this space, and competitiveness on pricing, is music to their ears after years of suffering under VMware’s rule.

VMware was the darling of the data center 20 years ago when they sold virtualization software. Although as enterprises continue to modernize, viable alternatives have emerged with high value, low-cost solutions that are every bit as good as VMware both in enterprise computing and multi and hybrid cloud management. This results in a new market dynamic that creates a significant opportunity to extract value from VMware.

We are not here to sell you a solution. Our aim is to simply help you determine how best to meet your needs for the lowest possible cost, both in your legacy and cloud environments.

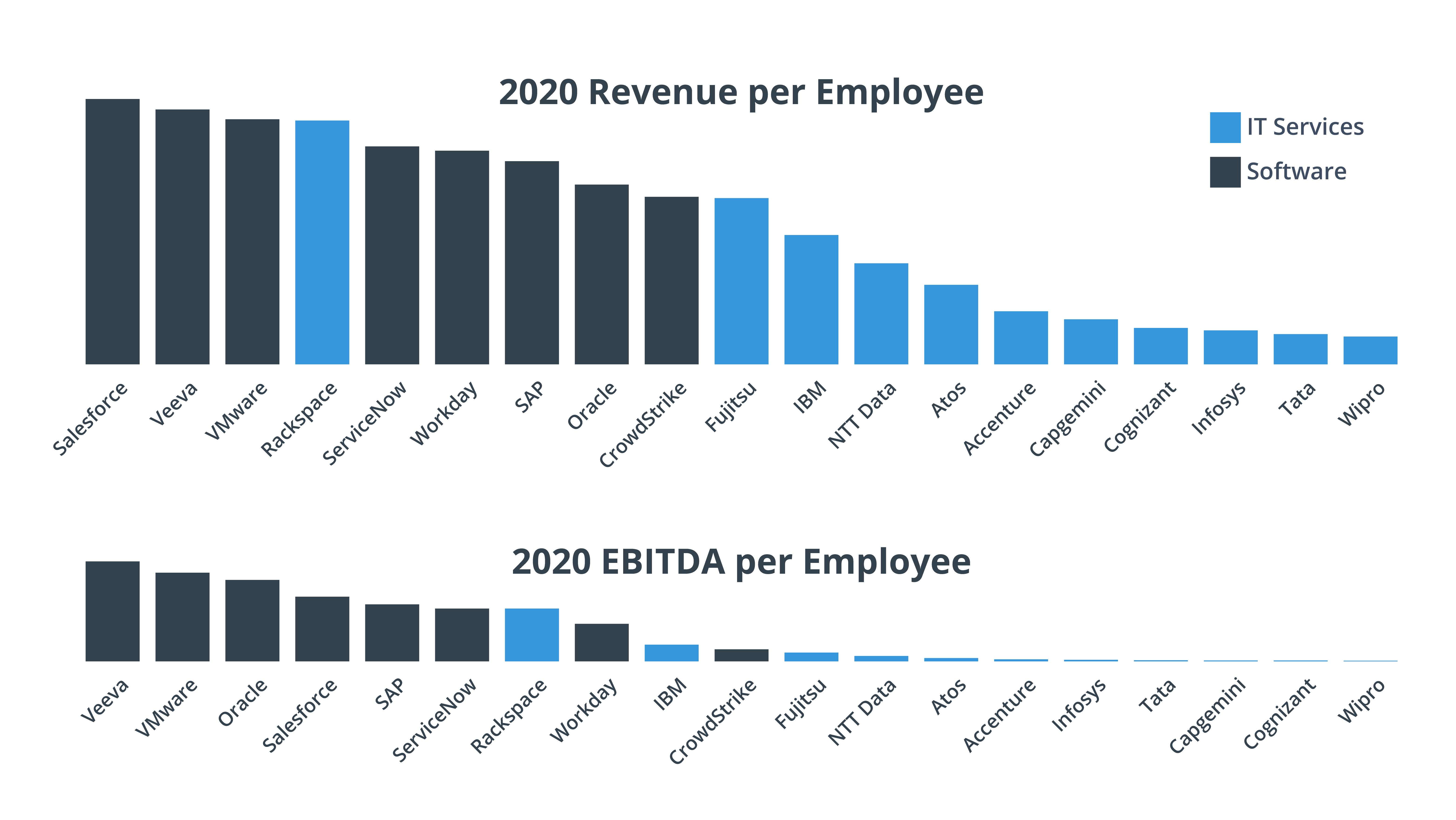

VMware sells at extremely high margins, and their customers pay 39-70% more for VMware solutions when compared to viable market alternatives. VMware earned more in revenue (per employee) than all but Salesforce.com and Veeva in 2020 and earned more EBITDA than any other technology company (with the exception of Veeva), making them experts at giving the least amount of value to get the most amount of your money.

As the chart above illustrates, in 2020, 40 cents of every dollar you spent with VMware went straight to their bottom line; so, the best you could have done was to get 60 cents of value on every dollar you spent. In 2021, you have the chance to recast your VMware investment.

Given the realities of today’s market, where VMware is facing stiff competition in the enterprise and facing viable alternatives in cloud, there is no reason you should not get VMware’s absolute best pricing if you are to stay a VMware customer.

If you want to see the opportunity you have to save, price-benchmark your deal with us here. With just a few details about your commercial arrangement, we can benchmark your deal in seconds, and show you what kind of opportunity you must save.

In addition, do not forget that VMware is one of the most audit-crazy suppliers in existence, so if you don’t get proactive now to get your house in order, they may be asking for a big fee to do it for you. In our latest survey from 2019, VMware ranked 7th on our list.

If you choose to work with NET(net) to extract value with VMware, we can help you maximize your savings and further enable your organization with the tools you need as you synthesize your cloud migration strategy. Contact us today to find out how we can help you.

About NET(net)

Founded in 2002, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 2,500 clients around the world in nearly all industries and geographies, and with the experience of over 25,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client captured value in excess of $250 billion since 2002. NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and relationships.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.