The Hurt

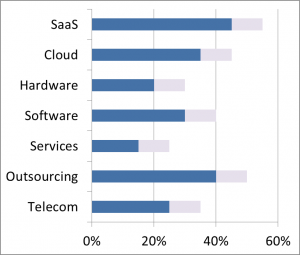

Suspend disbelief for just a moment and hear me when I say that most clients wildly overpay for technology. Not you, you say? Well, allow me to add meat to this alleged bone of contention between us, by further quantifying that statement. In a recently completed 36-month study of field results in actual client dealings, we empirically demonstrated that clients significantly overpaid in IT investments, by averaging 40% achieved savings in over 504 managed field engagements. These were not the top 504 savings examples, rather a comprehensive selection of field opportunities ensuring a representative and varied sample with no improper weighting. Here are the top 7 IT spend categories, and the resulting average overpayments.

NET(net) study of 504 client opportunities conducted from Jan 2010 – Dec 2012

NET(net) study of 504 client opportunities conducted from Jan 2010 – Dec 2012

Dark Blue: 51% of results Light Blue: 33% of results

Offensive, isn’t it?

But is it surprising?

There are many reasons why clients significantly overpay: (i) monopolistic supplier controls, (ii) the prevailing duopoly in enterprise applications, (iii) oligopolistic sector behaviors, (iv) predatory supplier pricing activities, (v) strong misalignment between client and supplier goals and incentives, (vi) obfuscated supplier configuration options, (vii) convoluted supplier policies, and (viii) unintelligible supplier contractual terms and conditions are all key contributors to this pervasive industry problem. Clearly suppliers are not the only problem. In fact, clients cause many of the problems for themselves. Refer to an earlier blog post outlining the top 7 things clients can do to Reduce Maintenance Costs on Enterprise Software.

Certainly this is a huge issue, as a 40% systemic overpayment can cripple any organization, but as difficult is this is to believe, and as hard as this may be to understand, the problem is actually not a “big” one. In fact, it’s a very small problem. How small? Well, it could all boil down to a 5% performance improvement. What I will demonstrate in this article is How a 5% Performance Improvement Can Result in a 50% Savings.

I’m sure you may be able to find an exception to this rule, but I think most people understand that most suppliers aren’t going to actively participate in your success if your goal is to figure out how to pay them far less for as much (or more) value. In fact, quite often suppliers go to great lengths to prevent you from doing just that.

One supplier, with mass market adoption of one of their most well-known and used products, offers different licensing options as, ‘a sign of good faith flexibility’ to its customers. Although most clients only know of a handful of these options, we have found over 3,000 different published ways you can license this technology. What’s more, once we evaluate all the client-side variables like organizational requirements, infrastructure, usage patterns, and user demographics, among other issues, a client’s custom situation mapped against these supplier options creates a labyrinth of deal permutations which poses an economic disparity between the most optimized and least optimized methods of deal structuring of an astounding 9,225.6%. This means that Client 1 – who is completely optimized - could pay $100,000 for the exact same source code for which Client 3,000 – who is completely sub-optimized, would pay $9.2 million. And remember, this is just one example of one product from one supplier. When you consider that many large suppliers have hundreds of products, it may boggle your mind to think about how complex this issue can become.

When we ask the IT and financial executives of our clientele how confident they are that their internal teams have the tools and capabilities they need to completely cull this value off the bargaining table, they generally say “not very”… but we say, give your team the benefit of the doubt, and assume for a moment that they can cull 90% of the value off the bargaining table in a technology optimization and supplier negotiation effort. This means that for every $1 of value you get, you only pay 10 cents to get that $1.

The Rescue

Now consider adding NET(net) to the mix; a consultancy firm that specializes in IT Investment Optimization and one that brings with it the experience you want, the expertise you need, and the performance you demand. Further consider the ability to simply make a 5% performance improvement through the cross-functional collaboration with IT, Legal, Finance, Procurement, Operations, and Supplier Management, among other groups – making the combined team’s work 95% effective at culling value. The result is only a 5% performance improvement, but you now pay 5 cents on the $1 of value (down from 10 cents), resulting in a 50% reduction in costs.

So when can a 5% performance improvement result in a 50% reduction of costs? Well, we believe it’s when you have your team of very skilled resources, work with our team of very skilled resources. We see this example nearly every day as iron indeed sharpens iron.

Stay Tuned Next Month

Keep your eyes open for February’s blog article entitled “The Rise of the Disruptive Supplier” where we will detail the true implications of the disruptive supplier business model, which we believe is already accelerating industry transformation. When Cloud and XaaS solutions are done right, they can cost a fraction of legacy applications, and the pending wave of supplier malfeasance and client malcontent is adding enormous mass and velocity to this wave, resulting in a rapid mass exodus away from monolithic controlling suppliers and towards suppliers that offer high value, low cost, and maximum agility. Buyers beware: do NOT assume that transformational options are always the best – either economically and/or strategically. The challenges in some of these agreements, investments, and relationships makes the traditional supplier evaluation, selection, contracting and management process look tame by comparison. Do however; consider working with experts in these areas who can help you turn this into the buyer’s market it’s supposed to be, enabling you to capture the value that’s rightfully yours.

NET(net)’s Website/Blogs/Articles and other content is subject to NET(net)’s legal terms offered for general information purposes only, and while NET(net) may offer views and opinions regarding the subject matter, such views and opinions are not intended to malign or disparage any other company or other individual or group.

About NET(net)

Celebrating 10 years, NET(net) is the world’s leading IT Investment Optimization firm, helping clients find, get and keep more economic and strategic value. With over 1,500 clients around the world in nearly all industries and geographies, and with the experience of over 15,000 field engagements with over 250 technology suppliers in XaaS, Cloud, Hardware, Software, Services, Healthcare, Outsourcing, Infrastructure, Telecommunications, and other areas of IT spend, resulting in incremental client value captured in excess of $100 billion since 2002, NET(net) has the expertise you need, the experience you want, and the performance you demand. Contact your NET(net) representative, email us today at info@netnetweb.com, visit us online at www.netnetweb.com, or call us at +1-866-2-NET-net to see if we can help you capture more value in your IT investments, agreements, and supplier relationships.